Answered step by step

Verified Expert Solution

Question

1 Approved Answer

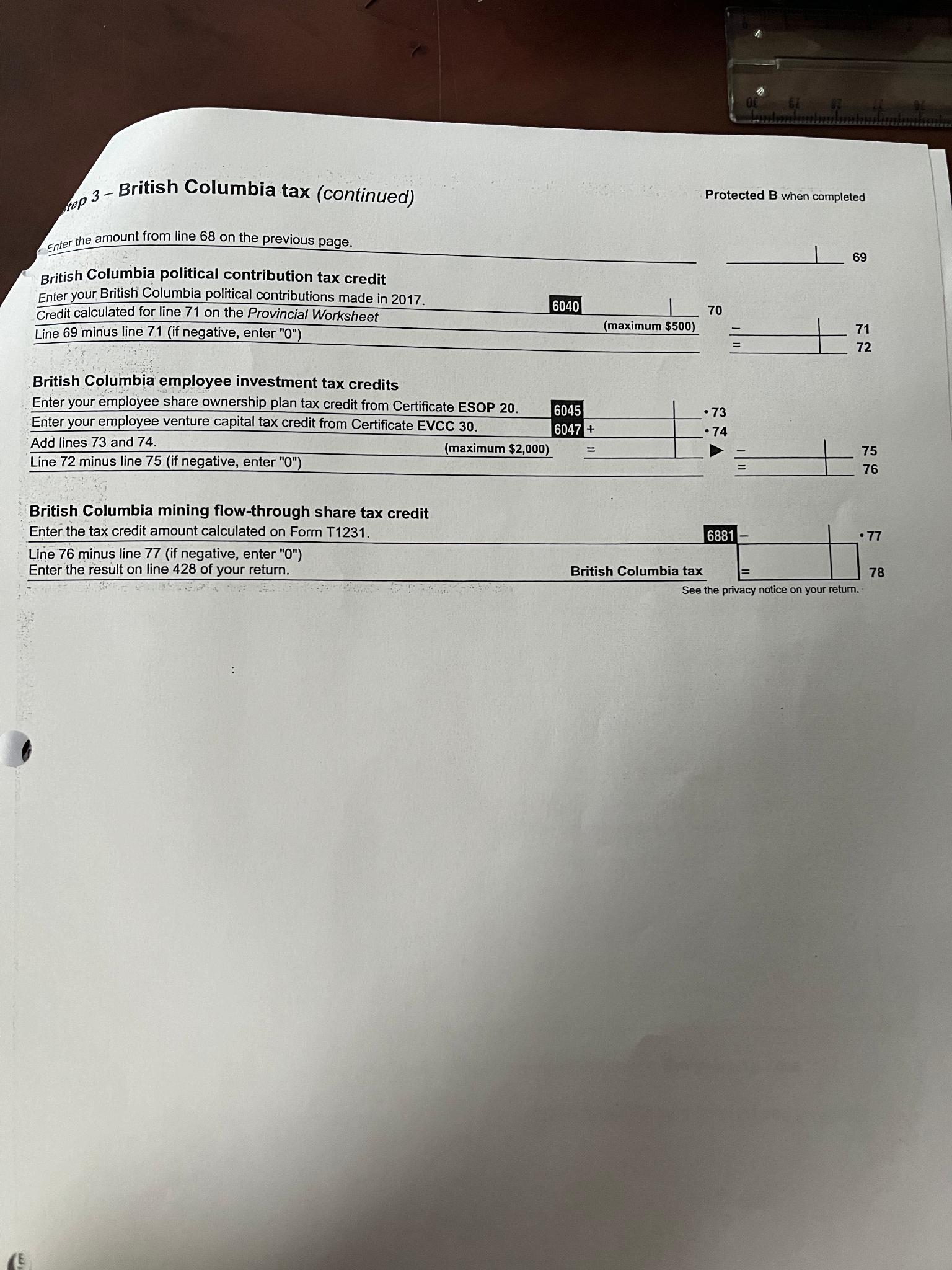

1 . 2 3 - British Columbia tax ( continued ) Protected B when completed Enter the amount from line 6 8 on the previous

British Columbia tax continued

Protected B when completed

Enter the amount from line on the previous page.

British Columbia political contribution tax credit

Enter your British Columbia political contributions made in

Credit calculated for line on the Provincial Worksheet

Line minus line if negative, enter

British Columbia employee investment tax credits

tableEnter your employee share ownership plan tax credit from Certificate ESOP Enter your employee venture capital tax credit from Certificate EVCC Add lines and maximum $Line minus line if negative, enter

British Columbia mining flowthrough share tax credit

Enter the tax credit amount calculated on Form T

Line minus line if negative, enter

Enter the result on line of your return.

British Columbia tax

See the privacy notice on your return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started