1

2

3

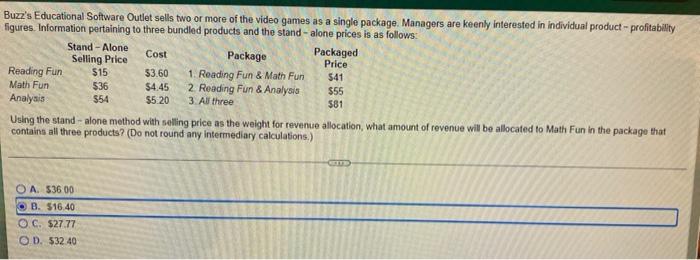

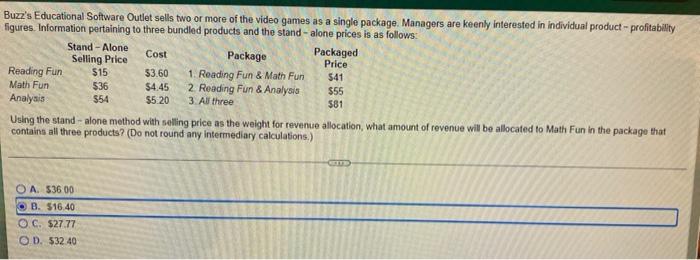

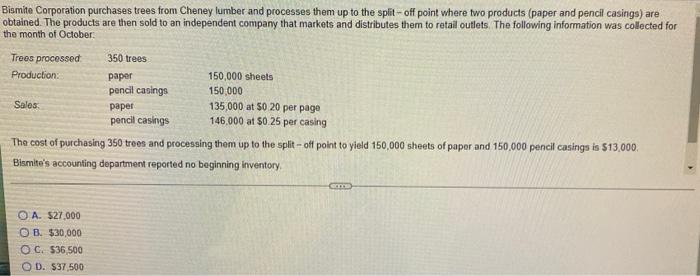

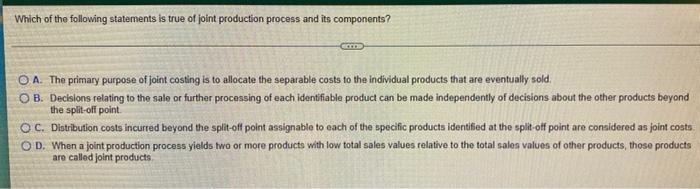

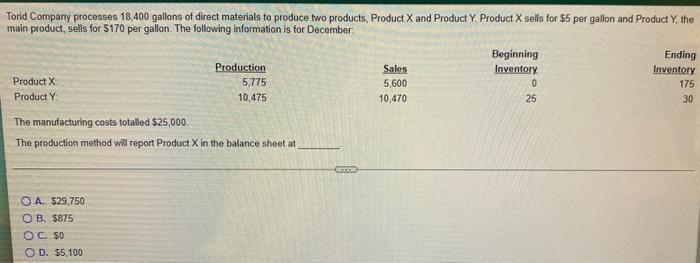

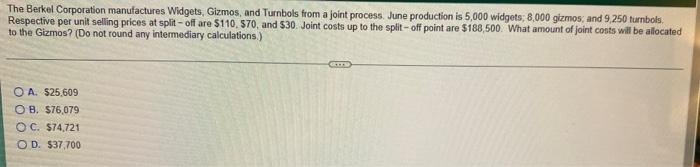

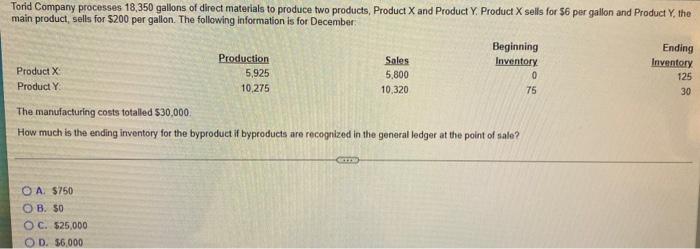

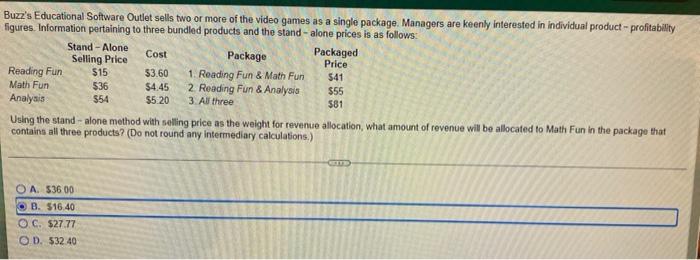

Buzz's Educational Software Outlet sells two or more of the video games as a single package. Managers are keenly interested in individual product-profitability figures. Information pertaining to three bundled products and the stand-alone prices is as follows: Cost Package Packaged Stand Alone Selling Price $15 Price Reading Fun $3.60 1. Reading Fun & Math Fun $41 Math Fun $36 $4.45 2. Reading Fun & Analysis 3. All three $55 Analysis $54 $5.20 $81 Using the stand-alone method with selling price as the weight for revenue allocation, what amount of revenue will be allocated to Math Fun in the package that contains all three products? (Do not round any intermediary calculations.) OA. $36.00 B. $16.40 O.C. $27.77 OD. $32.40- Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October 350 trees Trees processed Production: 150,000 sheets paper pencil casings paper 150,000 Sales 135,000 at $0 20 per page 146,000 at $0.25 per casing pencil casings The cost of purchasing 350 trees and processing them up to the split-off point to yield 150,000 sheets of paper and 150,000 pencil casings is $13,000. Bismite's accounting department reported no beginning inventory. Come OA. $27,000 OB. $30,000 OC. $36,500 OD. $37,500 Which of the following statements is true of joint production process and its components? Comme A. The primary purpose of joint costing is to allocate the separable costs to the individual products that are eventually sold. OB. Decisions relating to the sale or further processing of each identifiable product can be made independently of decisions about the other products beyond the split-off point. OC. Distribution costs incurred beyond the split-off point assignable to each of the specific products identified at the split-off point are considered as joint costs OD. When a joint production process yields two or more products with low total sales values relative to the total sales values of other products, those products are called joint products. Torid Company processes 18,400 gallons of direct materials to produce two products, Product X and Product Y. Product X sells for $5 per gallon and Product Y, the main product, sells for $170 per gallon. The following information is for December: Beginning Inventory Ending Inventory Production 5,775 10,475 Sales 5,600 Product X 0 175 Product Y 10,470 25 30 The manufacturing costs totalled $25,000. The production method will report Product X in the balance sheet at OA. $29,750 OB. $875 OC. SO OD. $5,100 Grene The Berkel Corporation manufactures Widgets, Gizmos, and Turnbols from a joint process. June production is 5,000 widgets; 8,000 gizmos; and 9,250 tumbols. Respective per unit selling prices at split-off are $110, $70, and $30. Joint costs up to the split-off point are $188,500. What amount of joint costs will be allocated to the Gizmos? (Do not round any intermediary calculations.) GITS OA. $25,609 OB. $76,079 OC. $74,721 OD. $37,700 Torid Company processes 18,350 gallons of direct materials to produce two products, Product X and Product Y. Product X sells for $6 per gallon and Product Y, the main product, sells for $200 per gallon. The following information is for December Beginning Ending Inventory Production 5,925 10,275 Sales 5,800 Inventory 0 Product X 125 Product Y 10,320 75 30 The manufacturing costs totalled $30,000. How much is the ending inventory for the byproduct if byproducts are recognized in the general ledger at the point of sale? CITS OA. $750 OB. $0 OC. $25,000 OD. $6,000