1

2.

3.

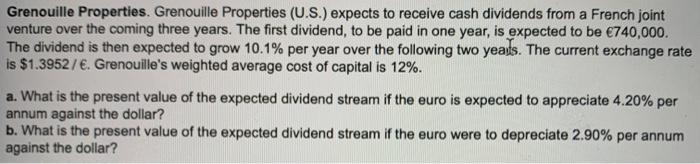

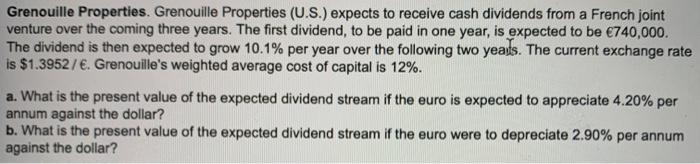

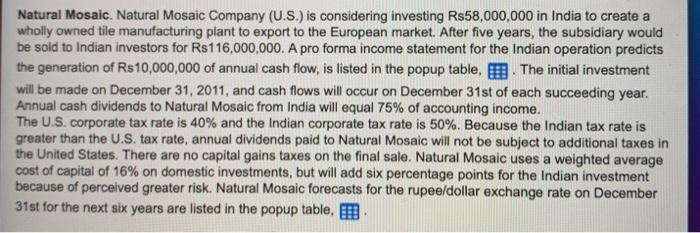

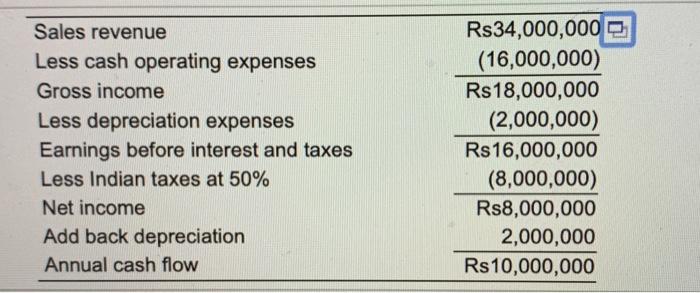

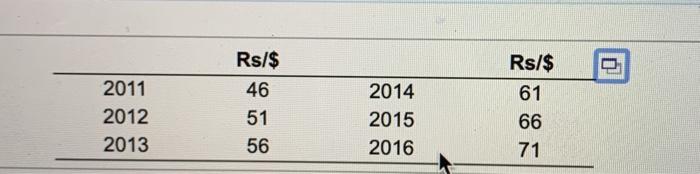

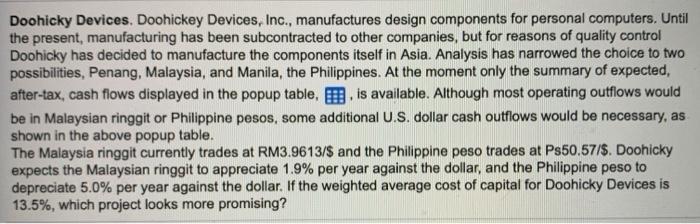

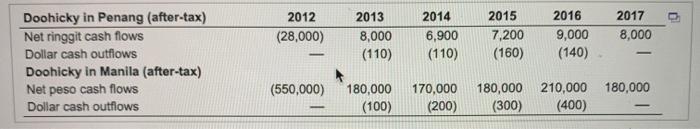

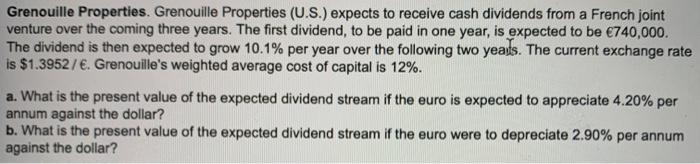

Grenouille Properties. Grenouille Properties (U.S.) expects to receive cash dividends from a French joint venture over the coming three years. The first dividend, to be paid in one year, is expected to be 740,000. The dividend is then expected to grow 10.1% per year over the following two yeats. The current exchange rate is $1.39527. Grenouille's weighted average cost of capital is 12%. a. What is the present value of the expected dividend stream if the euro is expected to appreciate 4.20% per annum against the dollar? b. What is the present value of the expected dividend stream if the euro were to depreciate 2.90% per annum against the dollar? Natural Mosaic. Natural Mosaic Company (U.S.) is considering investing Rs58,000,000 in India to create a wholly owned tile manufacturing plant to export to the European market. After five years, the subsidiary would be sold to Indian investors for Rs116,000,000. A pro forma income statement for the Indian operation predicts the generation of Rs 10,000,000 of annual cash flow, is listed in the popup table, P. The initial investment will be made on December 31, 2011, and cash flows will occur on December 31st of each succeeding year. Annual cash dividends to Natural Mosaic from India will equal 75% of accounting income. The U.S. corporate tax rate is 40% and the Indian corporate tax rate is 50%. Because the Indian tax rate is greater than the U.S. tax rate, annual dividends paid to Natural Mosaic will not be subject to additional taxes in the United States. There are no capital gains taxes on the final sale. Natural Mosaic uses a weighted average cost of capital of 16% on domestic investments, but will add six percentage points for the Indian investment because of perceived greater risk. Natural Mosaic forecasts for the rupee/dollar exchange rate on December 31st for the next six years are listed in the popup table, Sales revenue Less cash operating expenses Gross income Less depreciation expenses Earnings before interest and taxes Less Indian taxes at 50% Net income Add back depreciation Annual cash flow Rs34,000,000 (16,000,000) Rs 18,000,000 (2,000,000) Rs 16,000,000 (8,000,000) R$8,000,000 2,000,000 Rs 10,000,000 2011 2012 2013 Rs/$ 46 51 56 2014 2015 2016 Rs/$ 61 66 71 Doohicky Devices. Doohickey Devices, Inc., manufactures design components for personal computers. Until the present, manufacturing has been subcontracted to other companies, but for reasons of quality control Doohicky has decided to manufacture the components itself in Asia. Analysis has narrowed the choice to two possibilities, Penang, Malaysia, and Manila, the Philippines. At the moment only the summary of expected, after-tax, cash flows displayed in the popup table, is available. Although most operating outflows would be in Malaysian ringgit or Philippine pesos, some additional U.S. dollar cash outflows would be necessary, as shown in the above popup table. The Malaysia ringgit currently trades at RM3.9613/$ and the Philippine peso trades at Ps50.57/$. Doohicky expects the Malaysian ringgit to appreciate 1.9% per year against the dollar, and the Philippine peso to depreciate 5.0% per year against the dollar. If the weighted average cost of capital for Doohicky Devices is 13.5%, which project looks more promising? 2012 (28,000) Doohicky in Penang (after-tax) Net ringgit cash flows Dollar cash outflows Doohicky in Manila (after-tax) Net peso cash flows Dollar cash outflows 2013 8,000 (110) 2014 6,900 (110) 2015 7,200 (160) 2016 9,000 (140) 2017 8,000 (550,000) 170,000 180,000 180,000 (100) 180,000 210,000 (300) (400) (200)