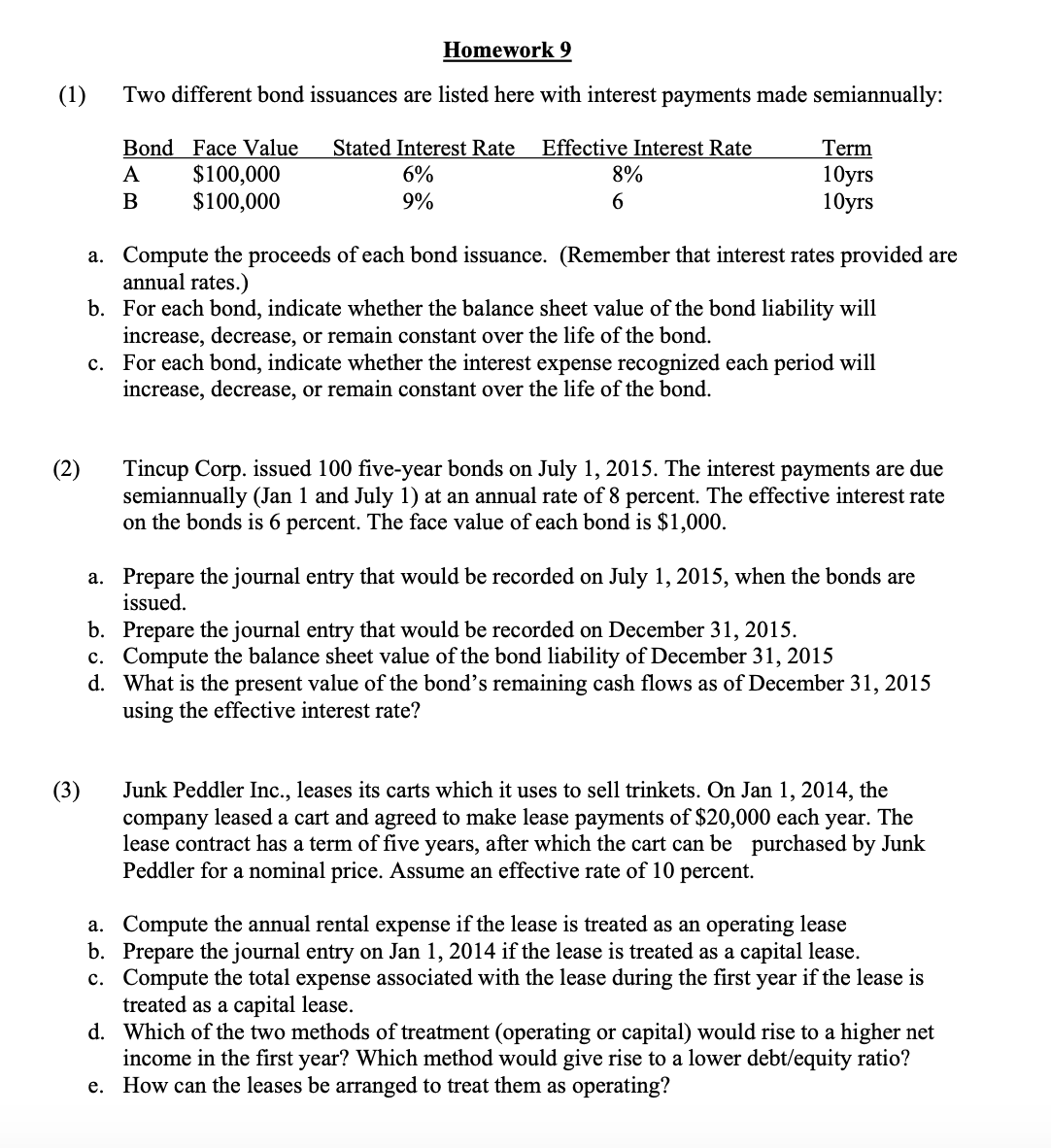

(1) (2) (3) or: 99".\" Homework 9 Two different bond issuances are listed here with interest payments made semiannually: Bond Face Value Stated Interest Rate Effective Interest Rate Term A $100,000 6% 8% 10yrs B $100,000 9% 6 10yrs Compute the proceeds of each b0nd issuance. (Remember that interest rates provided are annual rates.) For each bond, indicate whether the balance sheet value of the bond liability will increase, decrease, or remain constant over the life of the bond. For each bond, indicate whether the interest expense recognized each period will increase, decrease, or remain constant over the life of the bond. Tincup Corp. issued 100 ve-year bonds on July 1, 2015. The interest payments are due semiannually (Jan 1 and July 1) at an annual rate of 8 percent. The effective interest rate on the bonds is 6 percent. The face value of each bond is $1,000. Prepare the journal entry that would be recorded on July 1, 2015, when the bonds are issued. Prepare the journal entry that would be recorded on December 31, 2015. Compute the balance sheet value of the bond liability of December 31, 2015 What is the present value of the b0nd's remaining cash ows as of December 31, 2015 using the effective interest rate? Junk Peddler Inc., leases its carts which it uses to sell trinkets. On Jan 1, 2014, the company leased a cart and agreed to make lease payments of $20,000 each year. The lease contract has a term of ve years, after which the cart can be purchased by Junk Peddler for a nominal price. Assume an effective rate of 10 percent. Compute the annual rental expense if the lease is treated as an operating lease Prepare the journal entry on Jan 1, 2014 if the lease is treated as a capital lease. Compute the total expense associated with the lease during the rst year if the lease is treated as a capital lease. Which of the two methods of treatment (operating or capital) would rise to a higher net income in the rst year? Which method would give rise to a lower debtfequity ratio? How can the leases be arranged to treat them as operating