1 2

2 3

3

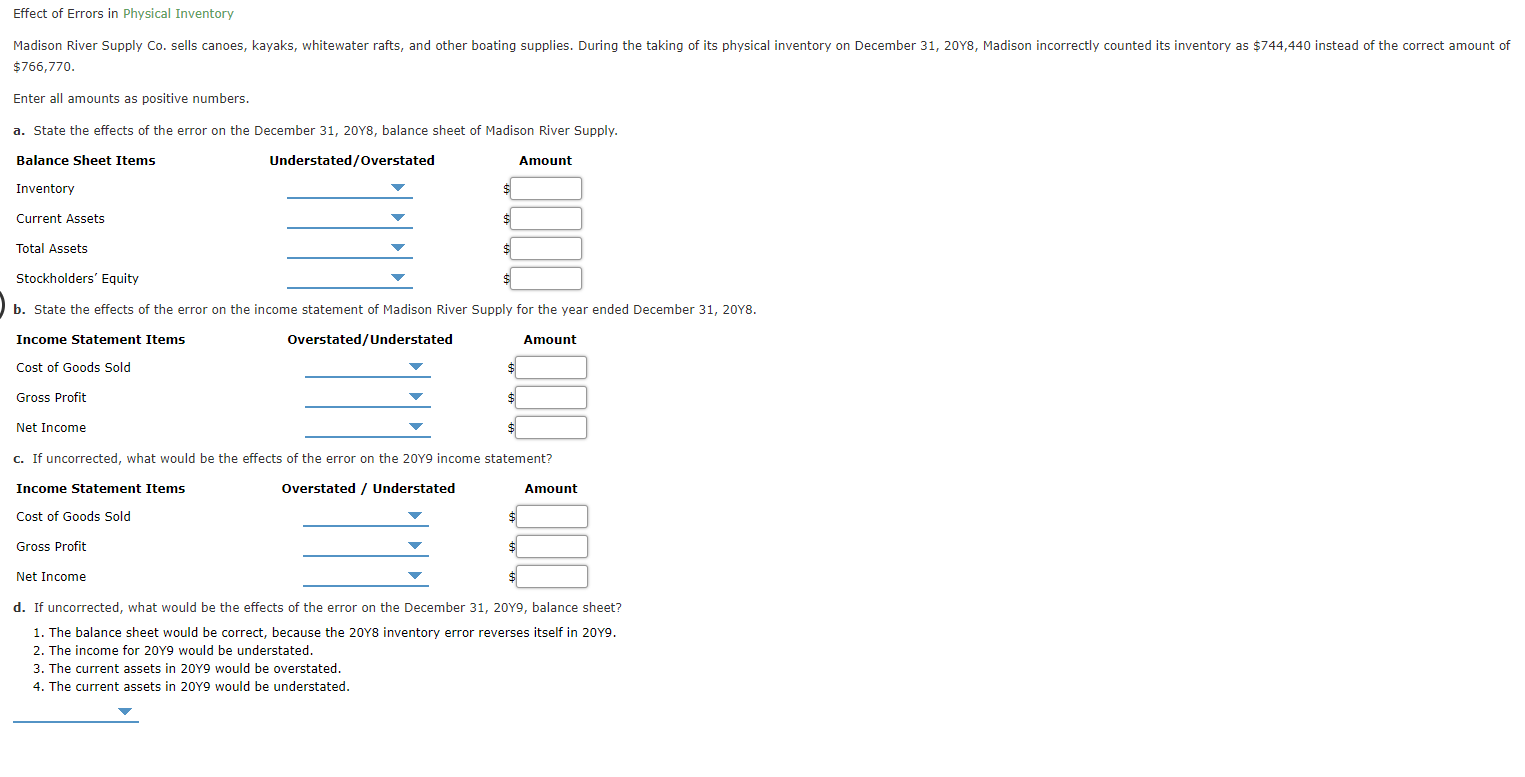

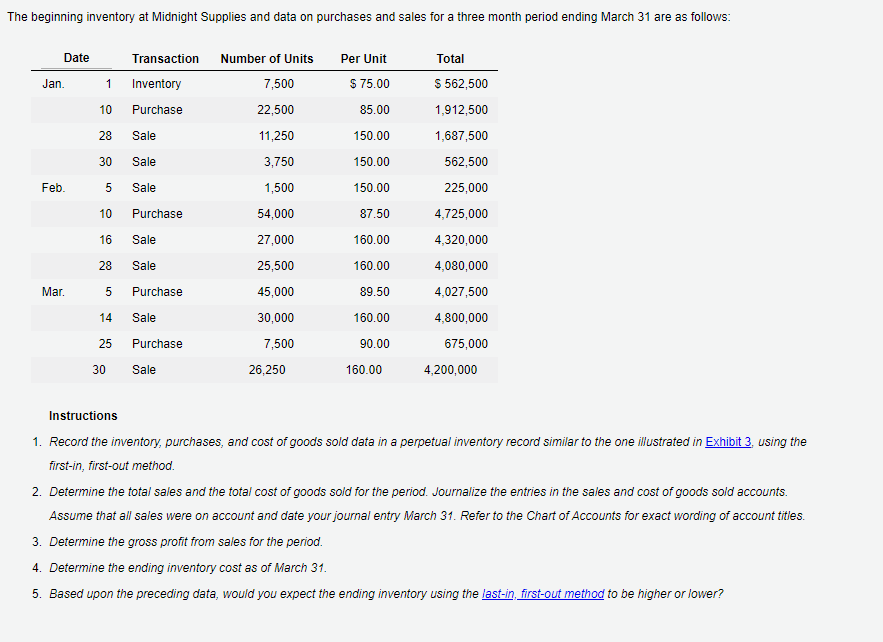

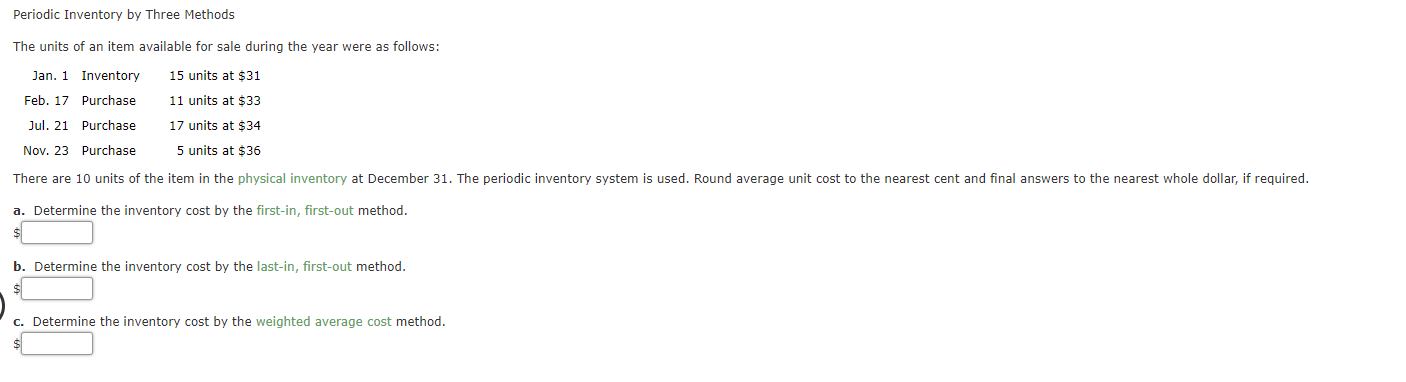

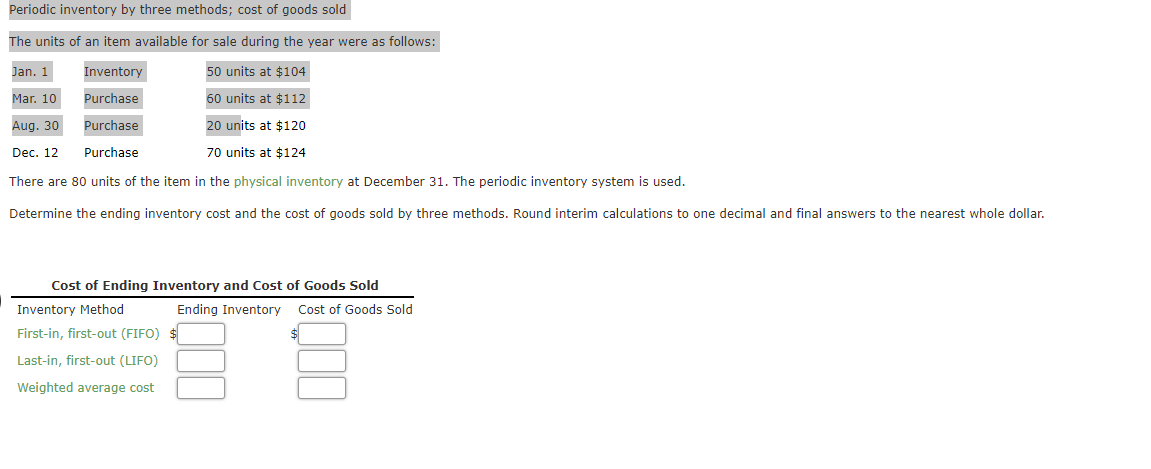

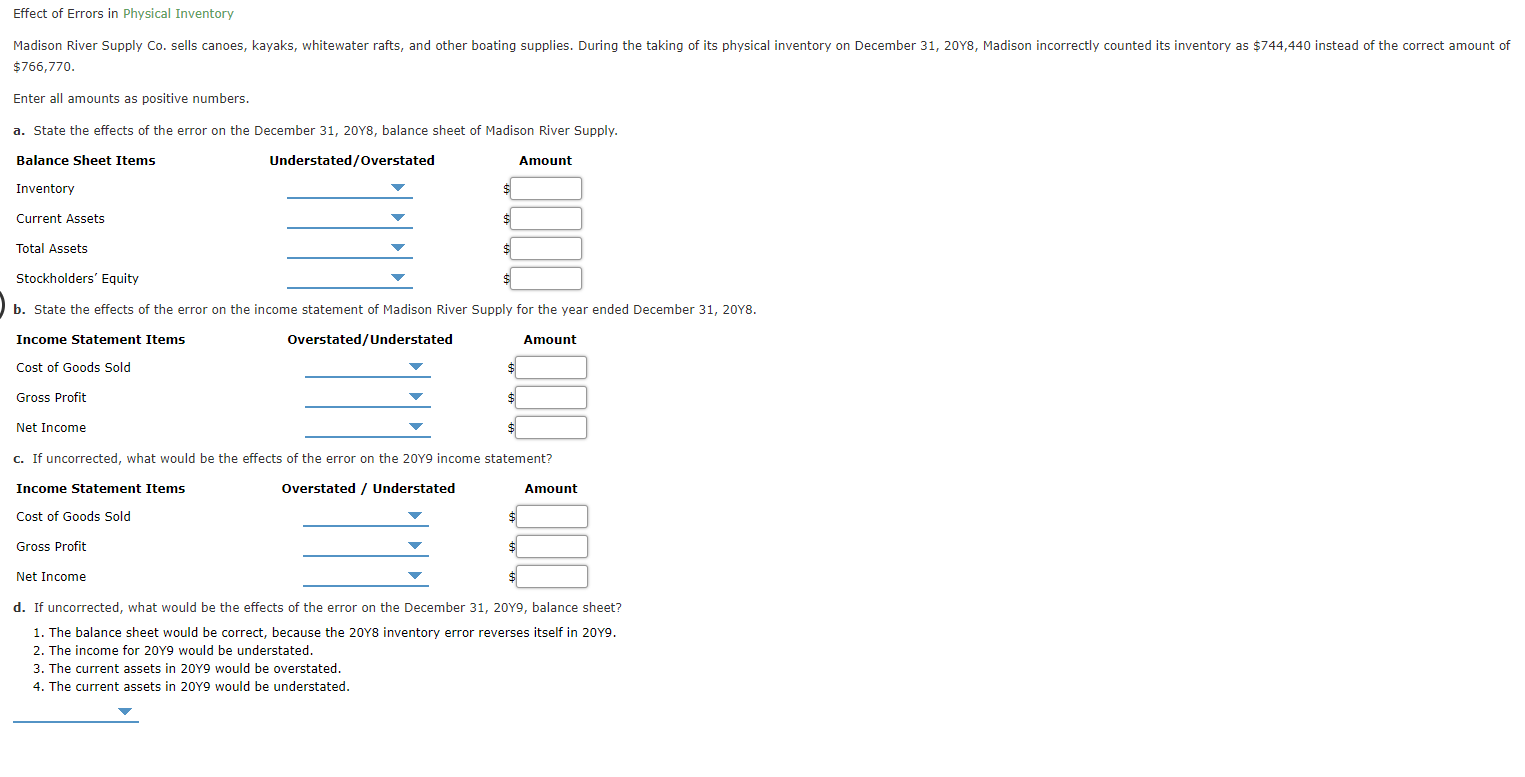

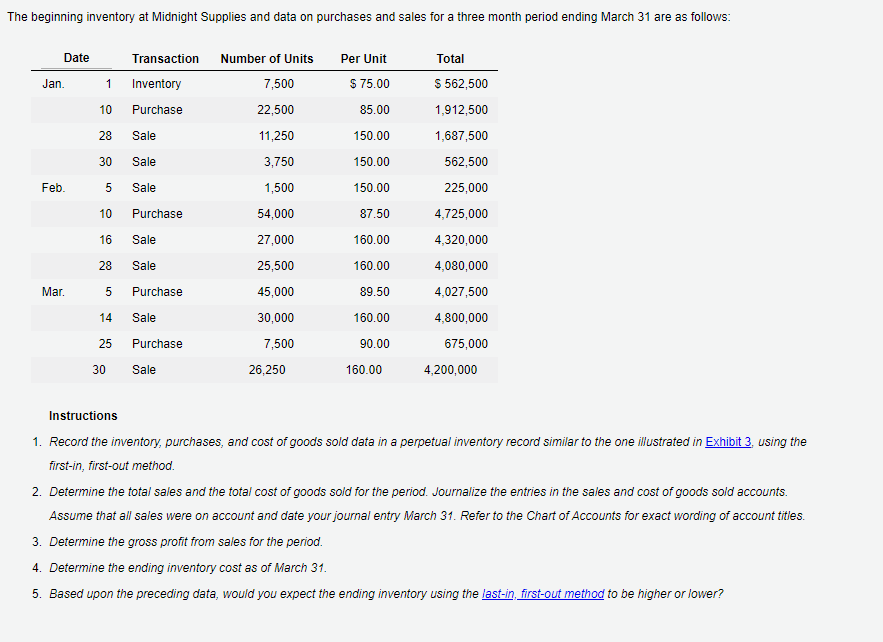

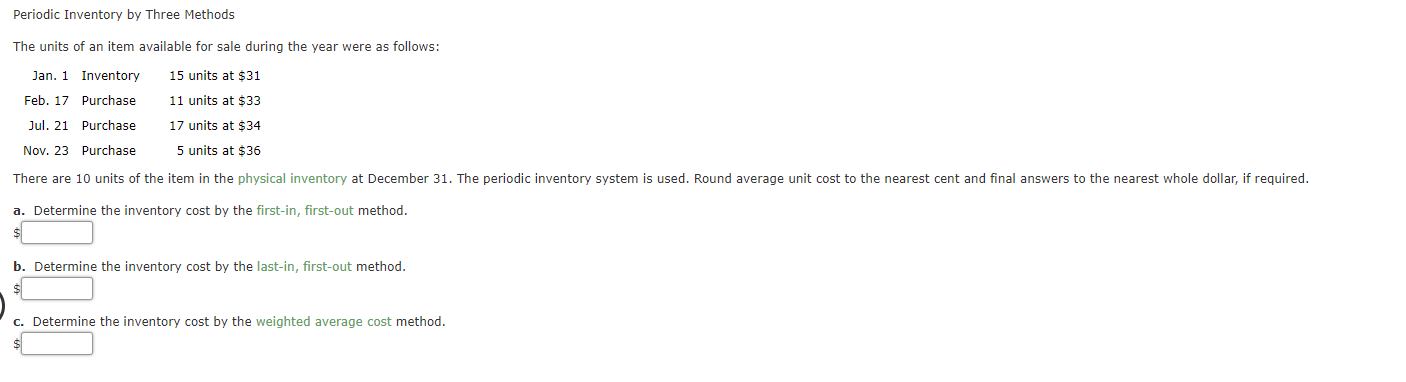

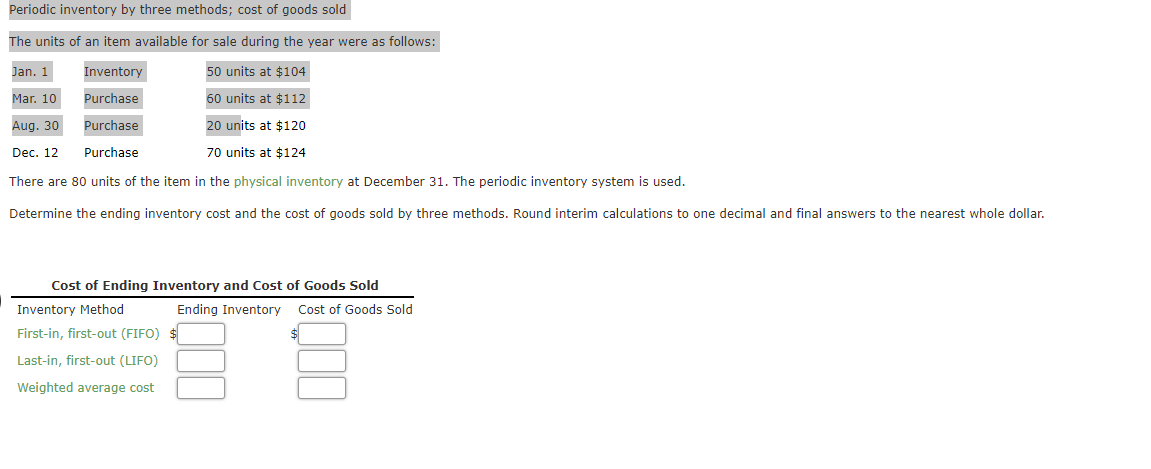

Periodic Inventory by Three Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 15 units at $31 Feb. 17 Purchase 11 units at $33 Jul. 21 Purchase 17 units at $34 Nov. 23 Purchase 5 units at $36 There are 10 units of the item in the physical inventory at December 31. The periodic inventory system is used. Round average unit cost to the nearest cent and final answers to the nearest whole dollar, if required. a. Determine the inventory cost by the first-in, first-out method. b. Determine the inventory cost by the last-in, first-out method. C. Determine the inventory cost by the weighted average cost method. Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory 50 units at $104 Mar. 10 Purchase 60 units at $112 Aug. 30 Purchase 20 units at $120 Dec. 12 Purchase 70 units at $124 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by three methods. Round interim calculations to one decimal and final answers to the nearest whole dollar. Cost of Ending Inventory and Cost of Goods Sold Inventory Method Ending Inventory Cost of Goods Sold First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost Effect of Errors in Physical Inventory Madison River Supply Co. sells canoes, kayaks, whitewater rafts, and other boating supplies. During the taking of its physical inventory on December 31, 20Y8, Madison incorrectly counted its inventory as $744,440 instead of the correct amount of $766,770. Enter all amounts as positive numbers. a. State the effects of the error on the December 31, 20Y8, balance sheet of Madison River Supply. Balance Sheet Items Understated/Overstated Amount Inventory Current Assets Total Assets Stockholders' Equity $ b. State the effects of the error on the income statement of Madison River Supply for the year ended December 31, 20Y8. Income Statement Items Overstated/Understated Amount Cost of Goods Sold Gross Profit $ Net Income C. If uncorrected, what would be the effects of the error on the 2049 income statement? Income Statement Items Overstated / Understated Amount Cost of Goods Sold Gross Profit Net Income d. If uncorrected, what would be the effects of the error on the December 31, 2019, balance sheet? 1. The balance sheet would be correct, because the 2048 inventory error reverses itself in 2019. 2. The income for 2049 would be understated. 3. The current assets in 2019 would be overstated. 4. The current assets in 2019 would be understated. The beginning inventory at Midnight Supplies and data on purchases and sales for a three month period ending March 31 are as follows: Date Transaction Inventory Per Unit $ 75.00 Jan. Number of Units 7,500 22,500 1 10 Purchase 85.00 28 Sale 150.00 11,250 3,750 30 Sale 150.00 Feb. 5 Sale 1,500 150.00 10 Purchase 54,000 87.50 Total S 562,500 1,912,500 1,687,500 562,500 225,000 4,725,000 4,320,000 4,080,000 4,027,500 4.800,000 675,000 4,200,000 16 Sale 160.00 28 Sale 27,000 25,500 45,000 160.00 Mar. 5 Purchase 89.50 160.00 14 Sale 30,000 7,500 25 Purchase 90.00 30 Sale 26,250 160.00 Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3. using the first-in, first-out method. 2. Determine the total sales and the total cost of goods sold for the period. Journalize the entries in the sales and cost of goods sold accounts. Assume that all sales were on account and date your journal entry March 31. Refer to the Chart of Accounts for exact wording of account titles. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost as of March 31. 5. Based upon the preceding data, would you expect the ending inventory using the last-in, first-out method to be higher or lower? Periodic Inventory by Three Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 15 units at $31 Feb. 17 Purchase 11 units at $33 Jul. 21 Purchase 17 units at $34 Nov. 23 Purchase 5 units at $36 There are 10 units of the item in the physical inventory at December 31. The periodic inventory system is used. Round average unit cost to the nearest cent and final answers to the nearest whole dollar, if required. a. Determine the inventory cost by the first-in, first-out method. b. Determine the inventory cost by the last-in, first-out method. C. Determine the inventory cost by the weighted average cost method. Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory 50 units at $104 Mar. 10 Purchase 60 units at $112 Aug. 30 Purchase 20 units at $120 Dec. 12 Purchase 70 units at $124 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by three methods. Round interim calculations to one decimal and final answers to the nearest whole dollar. Cost of Ending Inventory and Cost of Goods Sold Inventory Method Ending Inventory Cost of Goods Sold First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost Effect of Errors in Physical Inventory Madison River Supply Co. sells canoes, kayaks, whitewater rafts, and other boating supplies. During the taking of its physical inventory on December 31, 20Y8, Madison incorrectly counted its inventory as $744,440 instead of the correct amount of $766,770. Enter all amounts as positive numbers. a. State the effects of the error on the December 31, 20Y8, balance sheet of Madison River Supply. Balance Sheet Items Understated/Overstated Amount Inventory Current Assets Total Assets Stockholders' Equity $ b. State the effects of the error on the income statement of Madison River Supply for the year ended December 31, 20Y8. Income Statement Items Overstated/Understated Amount Cost of Goods Sold Gross Profit $ Net Income C. If uncorrected, what would be the effects of the error on the 2049 income statement? Income Statement Items Overstated / Understated Amount Cost of Goods Sold Gross Profit Net Income d. If uncorrected, what would be the effects of the error on the December 31, 2019, balance sheet? 1. The balance sheet would be correct, because the 2048 inventory error reverses itself in 2019. 2. The income for 2049 would be understated. 3. The current assets in 2019 would be overstated. 4. The current assets in 2019 would be understated. The beginning inventory at Midnight Supplies and data on purchases and sales for a three month period ending March 31 are as follows: Date Transaction Inventory Per Unit $ 75.00 Jan. Number of Units 7,500 22,500 1 10 Purchase 85.00 28 Sale 150.00 11,250 3,750 30 Sale 150.00 Feb. 5 Sale 1,500 150.00 10 Purchase 54,000 87.50 Total S 562,500 1,912,500 1,687,500 562,500 225,000 4,725,000 4,320,000 4,080,000 4,027,500 4.800,000 675,000 4,200,000 16 Sale 160.00 28 Sale 27,000 25,500 45,000 160.00 Mar. 5 Purchase 89.50 160.00 14 Sale 30,000 7,500 25 Purchase 90.00 30 Sale 26,250 160.00 Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3. using the first-in, first-out method. 2. Determine the total sales and the total cost of goods sold for the period. Journalize the entries in the sales and cost of goods sold accounts. Assume that all sales were on account and date your journal entry March 31. Refer to the Chart of Accounts for exact wording of account titles. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost as of March 31. 5. Based upon the preceding data, would you expect the ending inventory using the last-in, first-out method to be higher or lower

2

2 3

3