Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. received in: a. Year 10 (at a discount rate of 1%)? b. Year 10 (at a discount rate of 13%)? Year

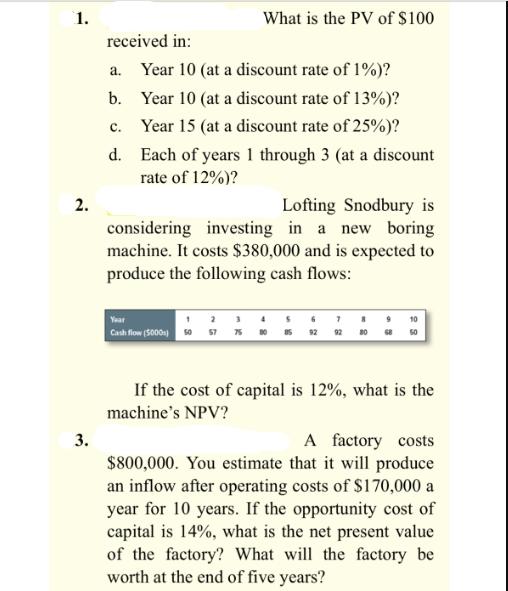

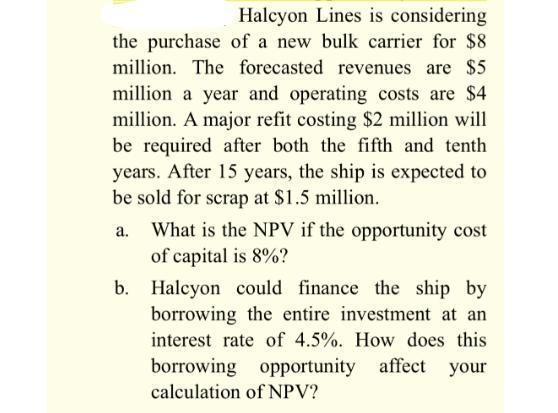

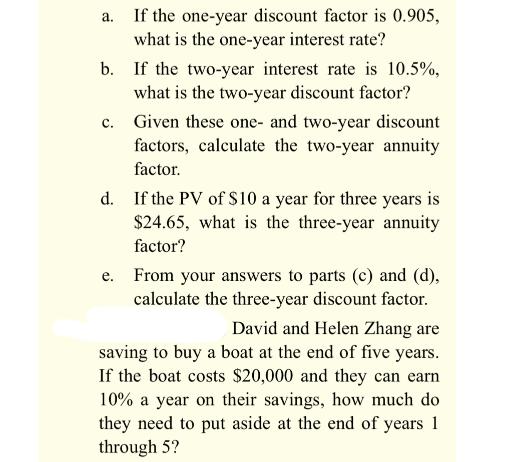

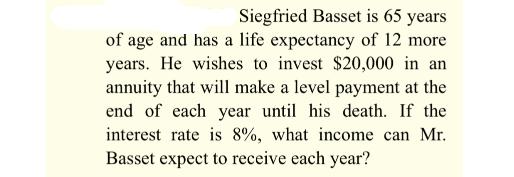

1. 2. 3. received in: a. Year 10 (at a discount rate of 1%)? b. Year 10 (at a discount rate of 13%)? Year 15 (at a discount rate of 25%)? C. d. Each of years 1 through 3 (at a discount rate of 12%)? What is the PV of $100 Lofting Snodbury is considering investing in a new boring machine. It costs $380,000 and is expected to produce the following cash flows: Year Cash flow (5000s) 50 57 3 92 92 If the cost of capital is 12%, what is the machine's NPV? A factory costs $800,000. You estimate that it will produce an inflow after operating costs of $170,000 a year for 10 years. If the opportunity cost of capital is 14%, what is the net present value of the factory? What will the factory be worth at the end of five years? 4. 5. A 10-year German government bond (bund) has a face value of 100 and a coupon rate of 5% paid annually. Assume that the interest rate (in euros) is equal to 6% per year. What is the bond's PV? `In December 2020, Treasury 4/4s of 2040 offered a semiannually compounded yield to maturity of 1.32%. Recognizing that coupons are paid semiannually, calculate the bond's price. 6. ) A 10-year U.S. Treasury bond with a face value of $1,000 pays a coupon of 5.5% (2.75% of face value every six months). The reported yield to maturity is 5.2% (a six-month discount rate of 5.2/2 = 2.6%). a. What is the present value of the bond? b. Generate a graph or table showing how the bond's present value changes for semiannually compounded interest rates between 1% and 15%. A six-year government bond makes annual coupon payments of 5% and offers a yield of 3% annually compounded. Suppose that one year later the bond still yields 3%. What return has the bondholder earned over the 12-month period? Now suppose that the bond yields 2% at the end of the year. What return did the bondholder earn in this case? Halcyon Lines is considering the purchase of a new bulk carrier for $8 million. The forecasted revenues are $5 million a year and operating costs are $4 million. A major refit costing $2 million will be required after both the fifth and tenth years. After 15 years, the ship is expected to be sold for scrap at $1.5 million. a. What is the NPV if the opportunity cost of capital is 8%? b. Halcyon could finance the ship by borrowing the entire investment at an interest rate of 4.5%. How does this borrowing opportunity affect your calculation of NPV? a. If the one-year discount factor is 0.905, what is the one-year interest rate? b. If the two-year interest rate is 10.5%, what is the two-year discount factor? Given these one- and two-year discount factors, calculate the two-year annuity factor. C. d. If the PV of $10 a year for three years is $24.65, what is the three-year annuity factor? e. From your answers to parts (c) and (d), calculate the three-year discount factor. David and Helen Zhang are saving to buy a boat at the end of five years. If the boat costs $20,000 and they can earn 10% a year on their savings, how much do they need to put aside at the end of years 1 through 5? Siegfried Basset is 65 years of age and has a life expectancy of 12 more years. He wishes to invest $20,000 in an annuity that will make a level payment at the end of each year until his death. If the interest rate is 8%, what income can Mr. Basset expect to receive each year?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

PV FV 1Discount rateYear a PV 100 1110 905287 9053 b PV 100 11310 294588 2946 c PV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started