1.

2. 3.

3.

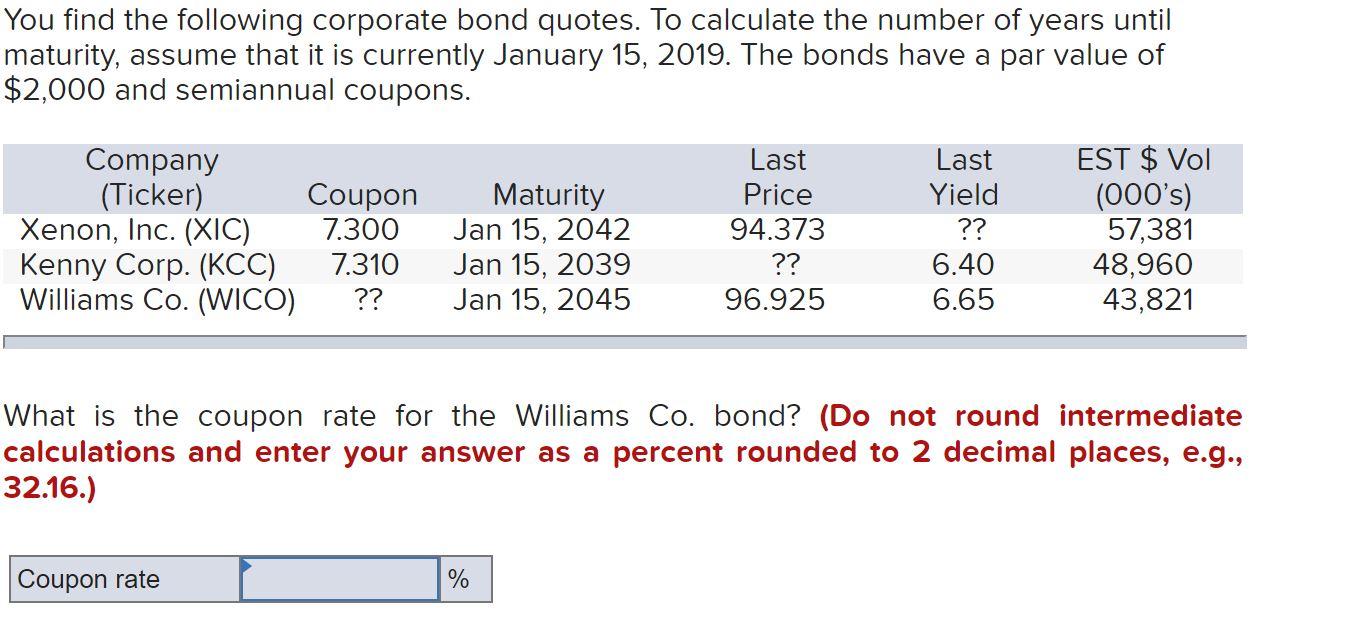

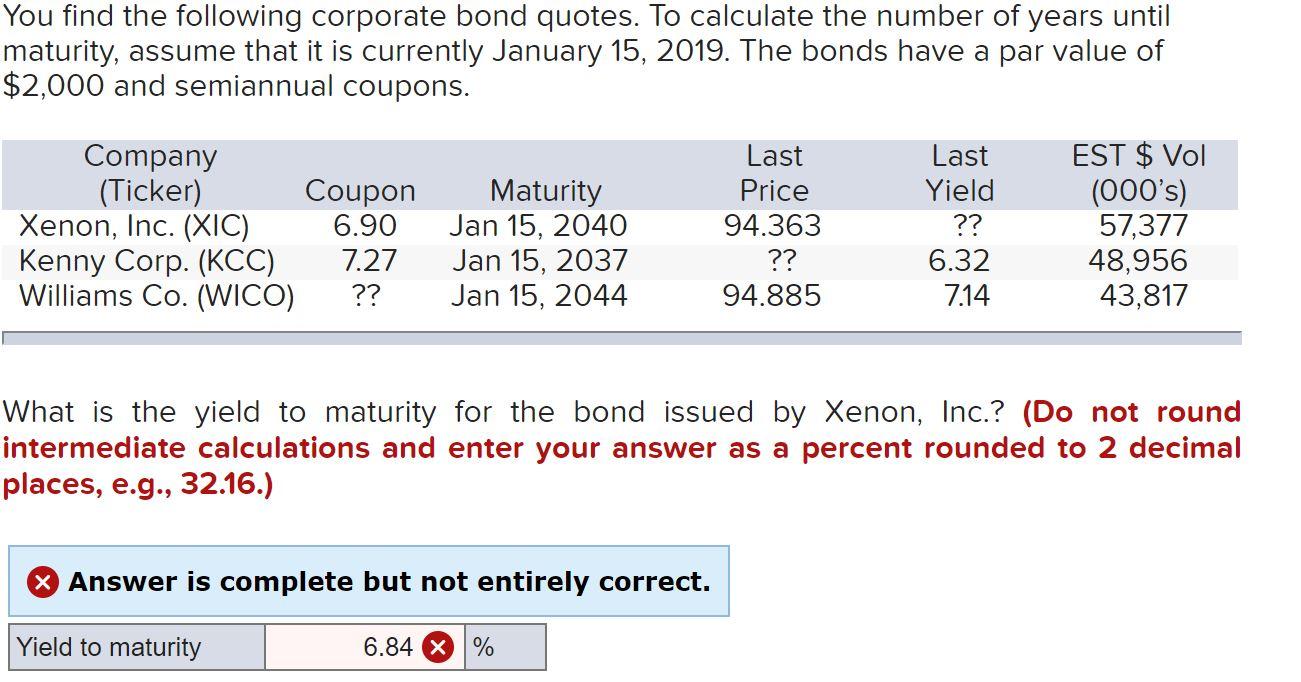

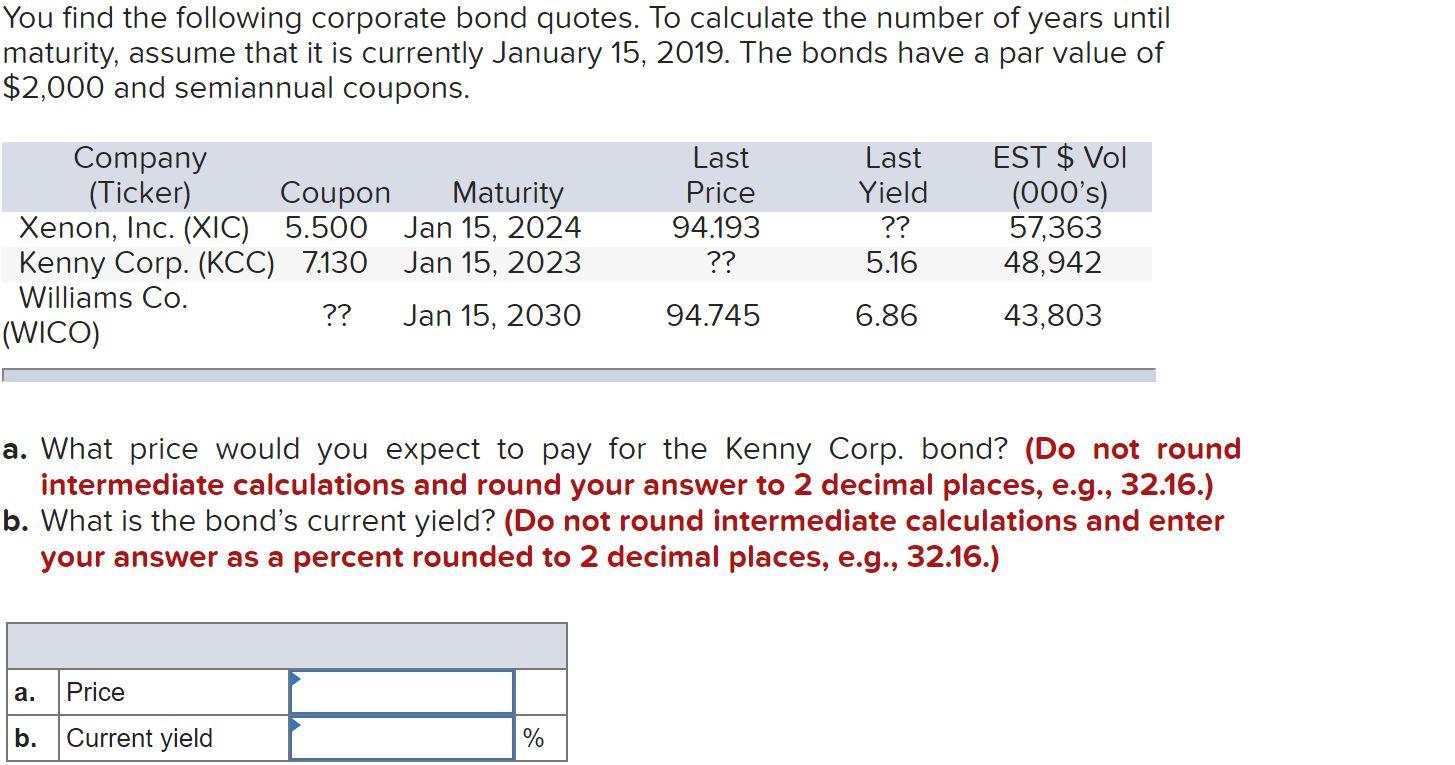

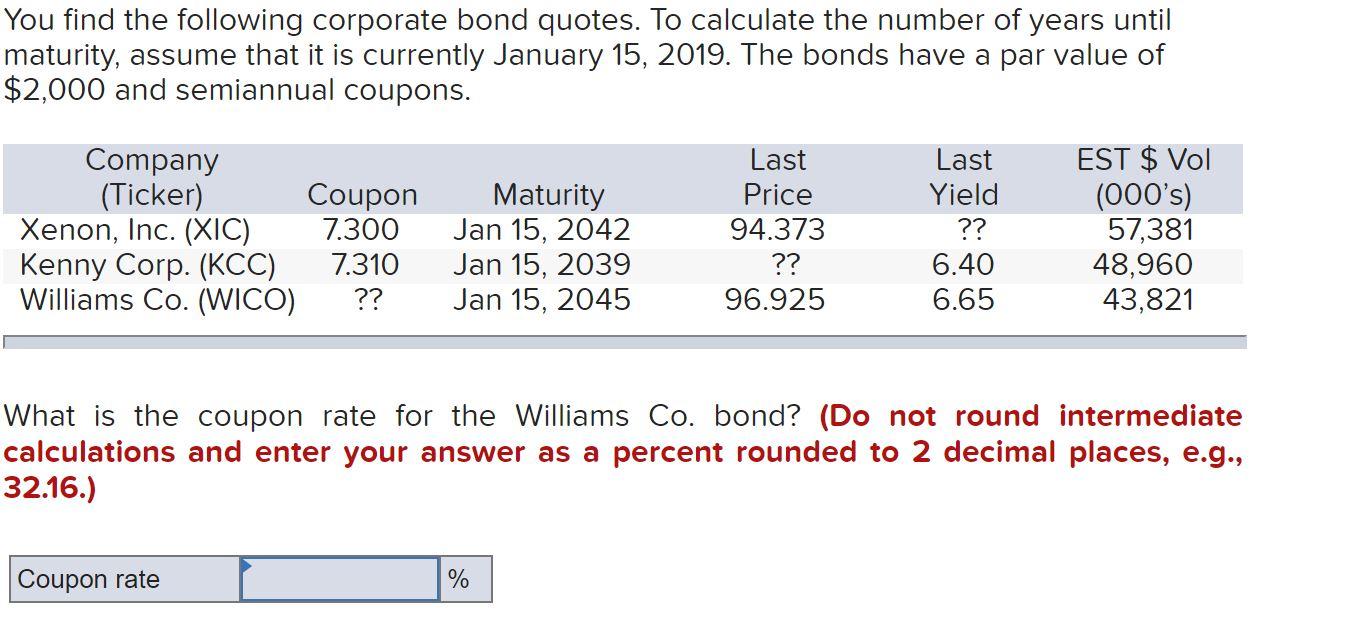

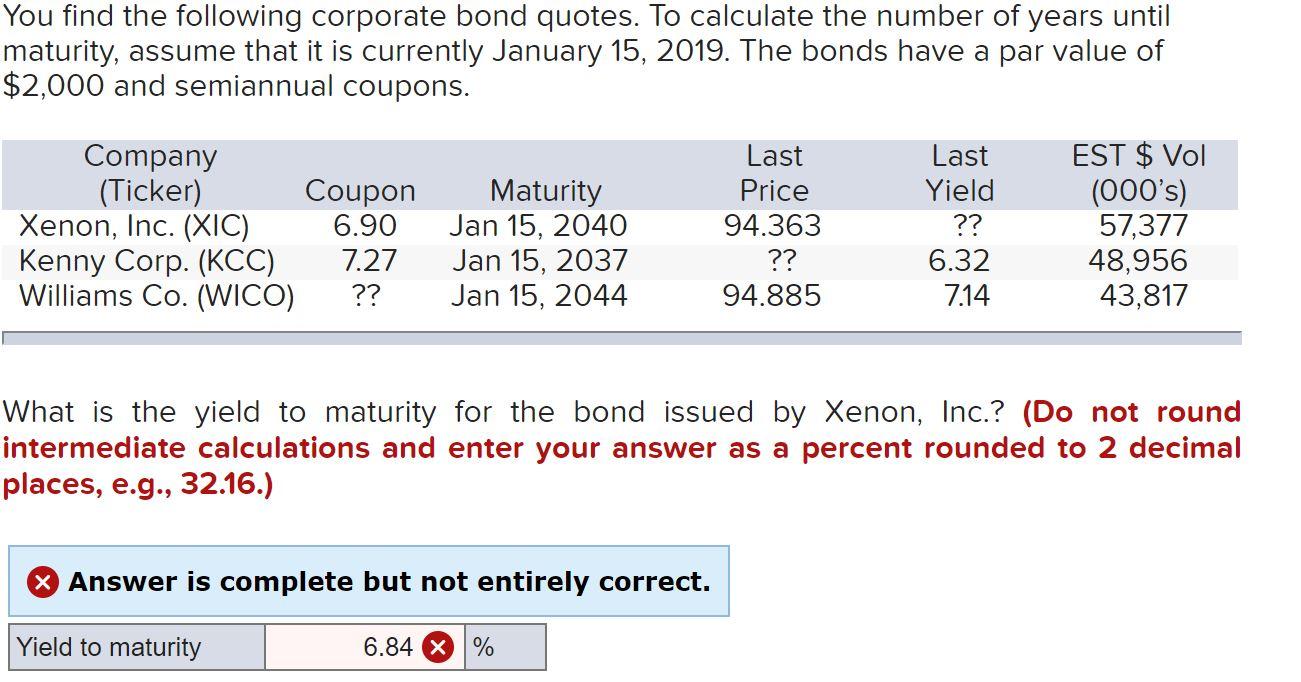

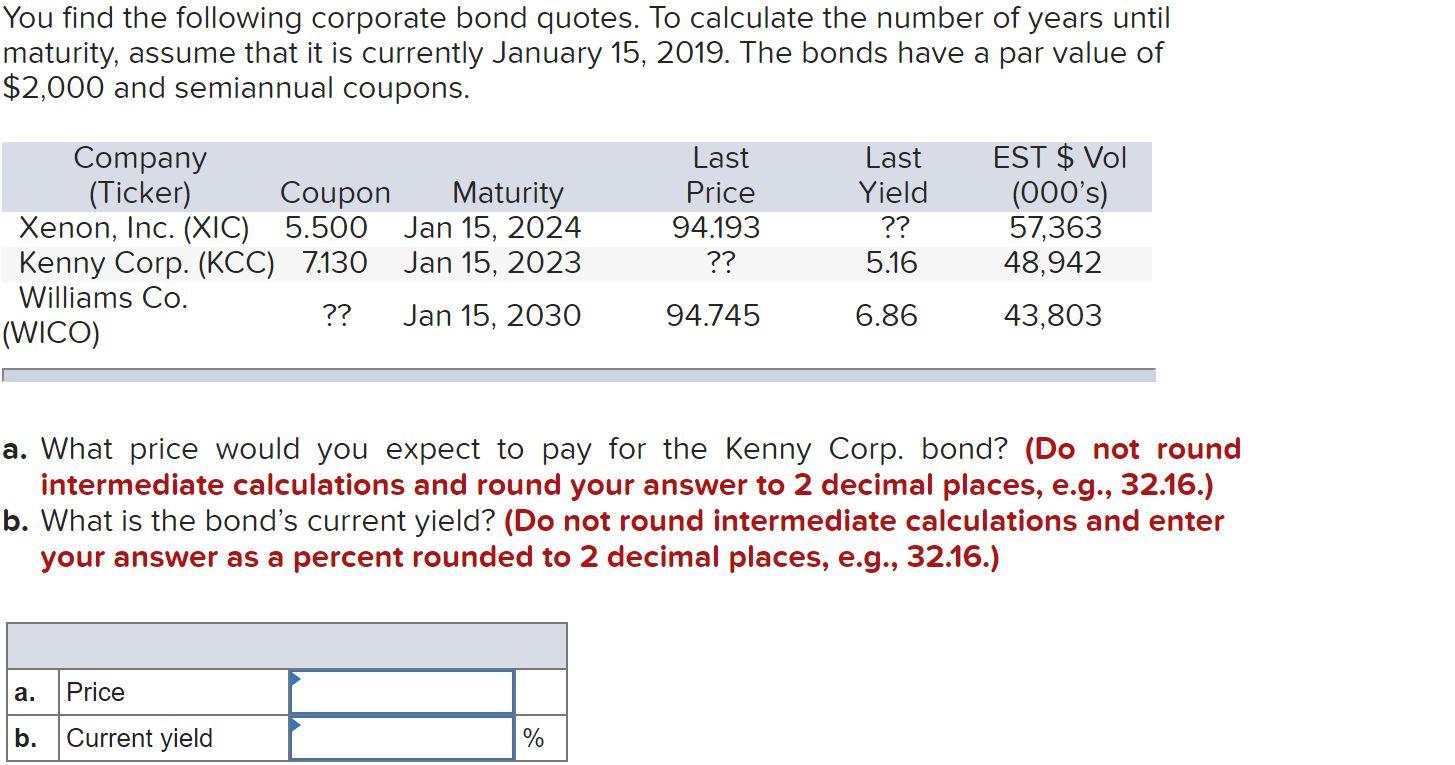

You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2019. The bonds have a par value of $2,000 and semiannual coupons. Company (Ticker) Coupon Xenon, Inc. (XIC) 6.90 Kenny Corp. (KCC) 7.27 Williams Co. (WICO) ?? Maturity Jan 15, 2040 Jan 15, 2037 Jan 15, 2044 Last Price 94.363 ?? 94.885 Last Yield ?? 6.32 7.14 EST $ Vol (000's) 57,377 48,956 43,817 What is the yield to maturity for the bond issued by Xenon, Inc.? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) X Answer is complete but not entirely correct. Yield to maturity 6.84 X % You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2019. The bonds have a par value of $2,000 and semiannual coupons. Company (Ticker) Coupon Maturity Xenon, Inc. (XIC) 5.500 Jan 15, 2024 Kenny Corp. (KCC) 7.130 Jan 15, 2023 Williams Co. ?? Jan 15, 2030 (WICO) Last Price 94.193 ?? Last Yield ?? 5.16 EST $ Vol (000's) 57,363 48,942 94.745 6.86 43,803 a. What price would you expect to pay for the Kenny Corp. bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the bond's current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Price b. Current yield % You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2019. The bonds have a par value of $2,000 and semiannual coupons. Company (Ticker) Coupon Xenon, Inc. (XIC) 7.300 Kenny Corp. (KCC) 7.310 Williams Co. (WICO) ?? Maturity Jan 15, 2042 Jan 15, 2039 Jan 15, 2045 Last Price 94.373 ?? 96.925 Last Yield ?? 6.40 6.65 EST $ Vol (000's) 57,381 48,960 43,821 What is the coupon rate for the Williams Co. bond? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate %

3.

3.