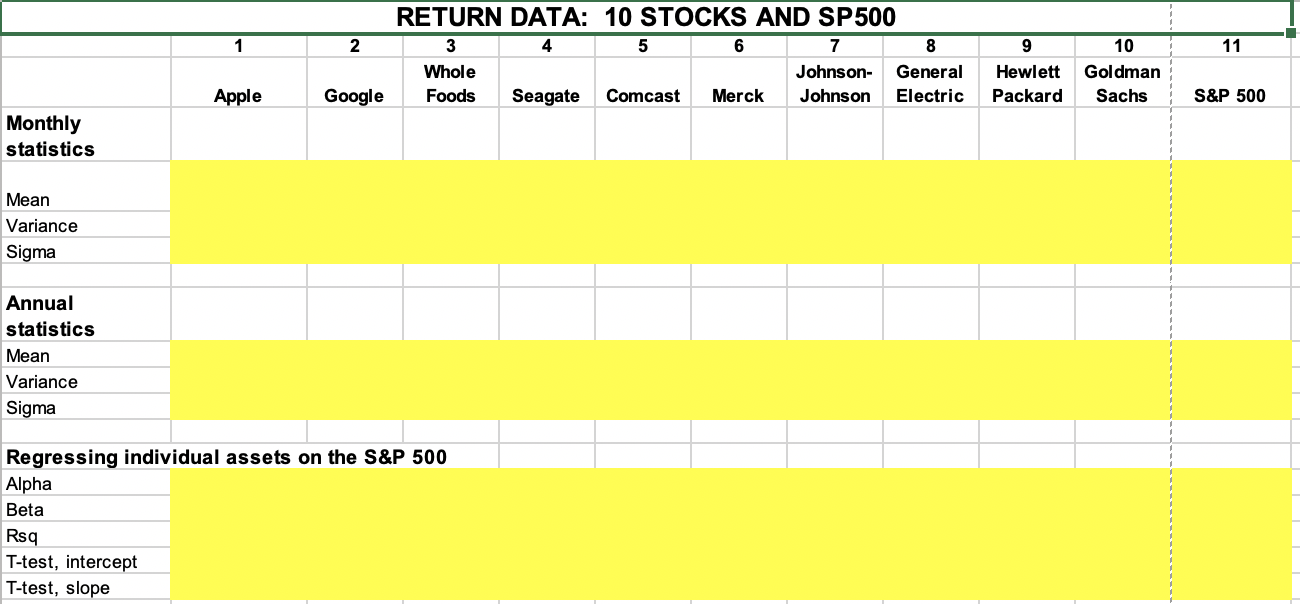

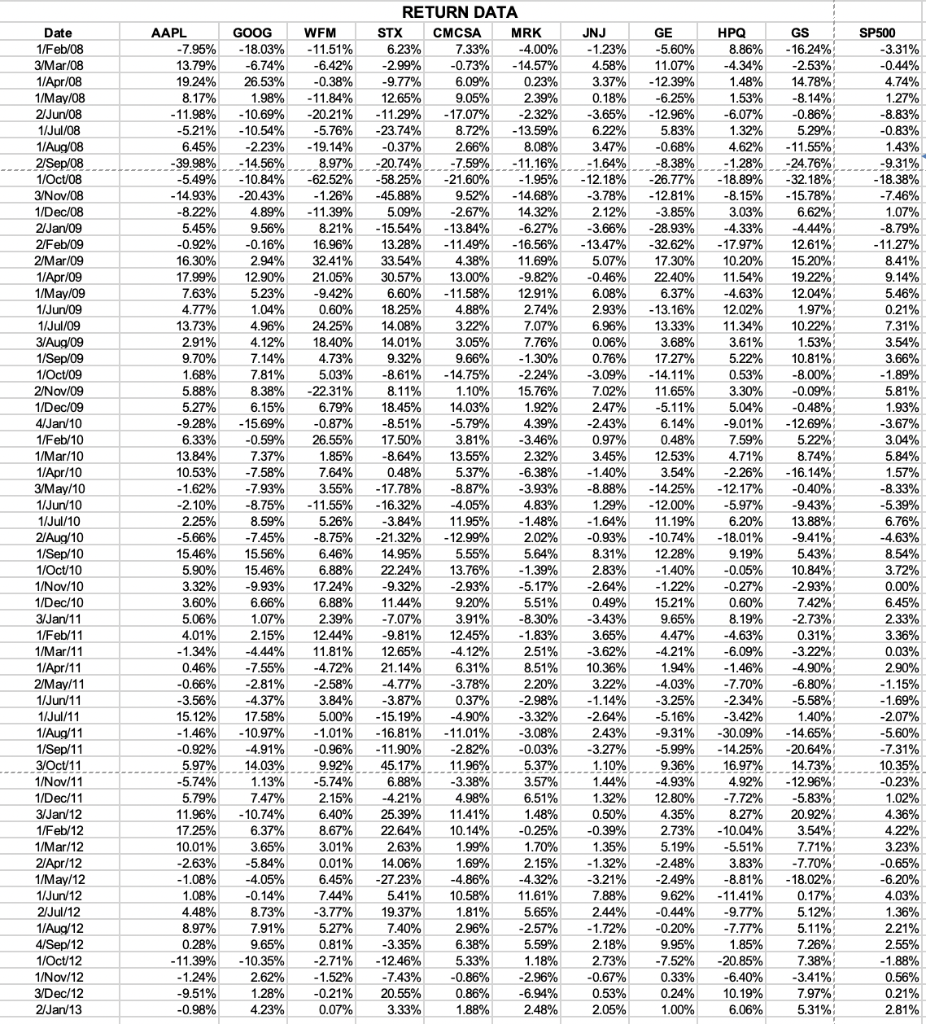

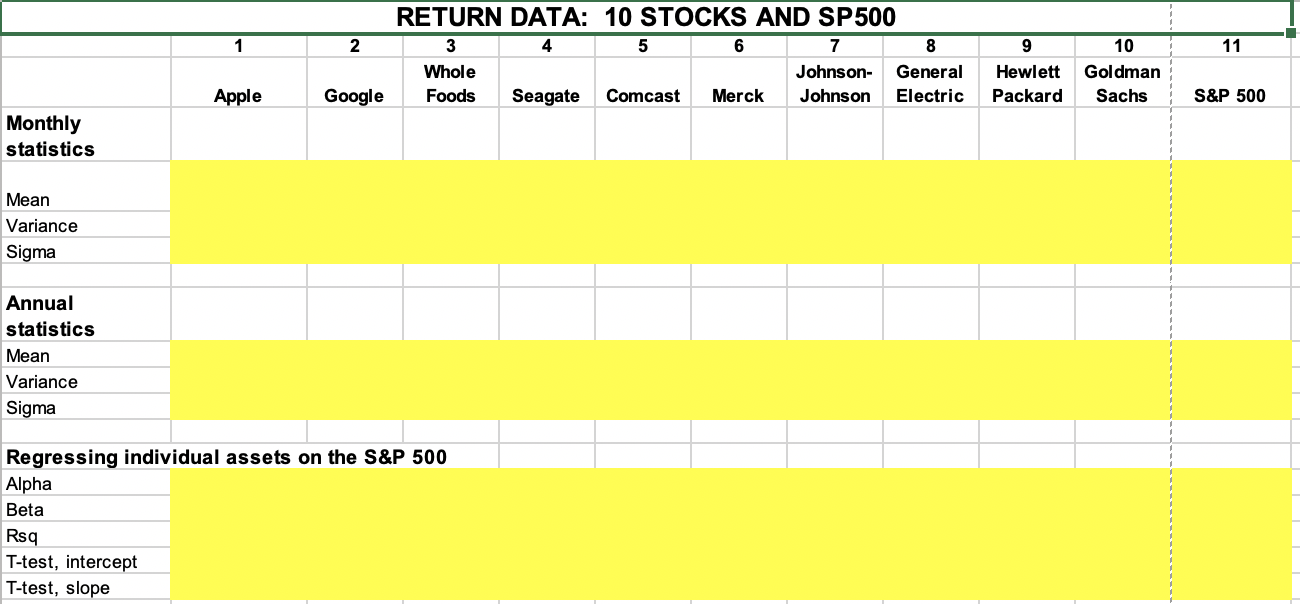

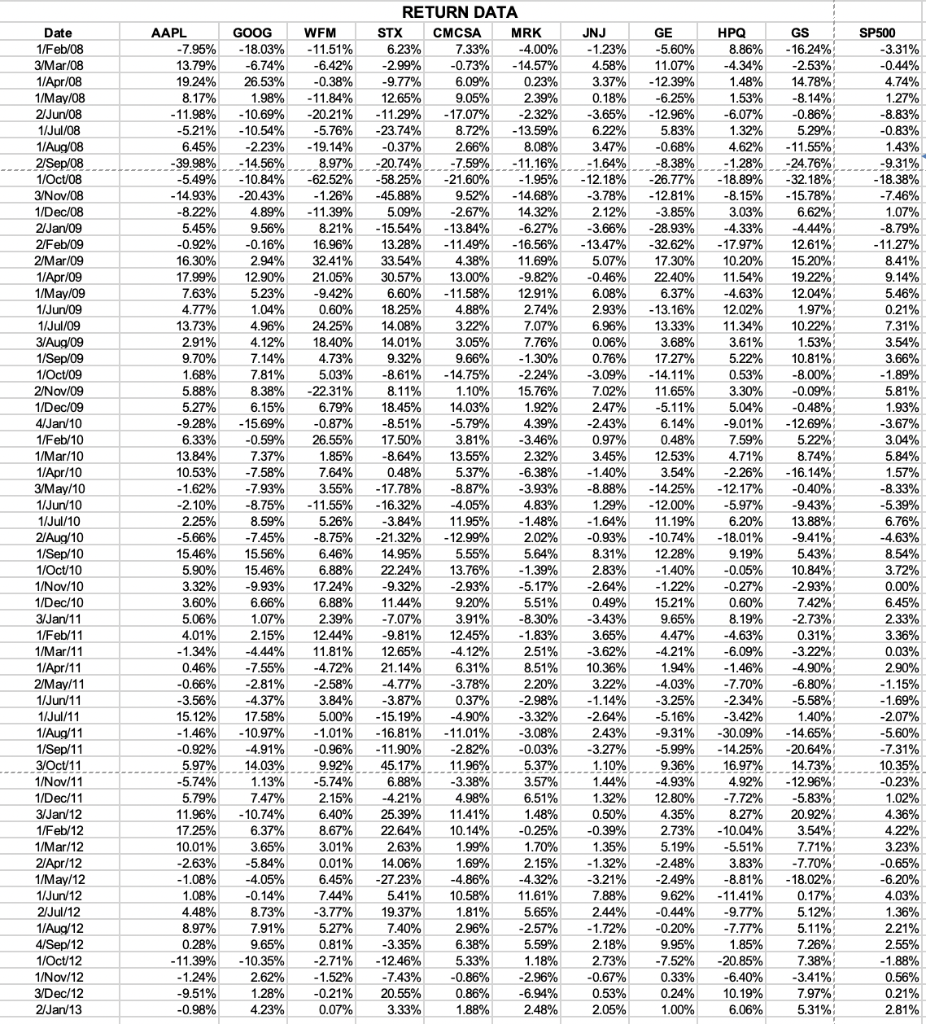

1 2 9 10 11 RETURN DATA: 10 STOCKS AND SP500 3 4 5 6 7 8 Whole Johnson General Foods Seagate Comcast Merck Johnson Electric Hewlett Packard Goldman Sachs Apple Google S&P 500 Monthly statistics Mean Variance Sigma Annual statistics Mean Variance Sigma Regressing individual assets on the S&P 500 Alpha Beta Rsq T-test, intercept T-test, slope WFM MRK -7.95% SP500 -3.31% -6.42% GS -16.24% -2.53% 14.78% -0.44% 19.24% 4.74% - 11.84% 9.05% 2.39% -6.25% 1.53% -8.14% 6.45% -39.98% OCO -0.86% 2001 5.29% -11.55% 44 CEO 100% -24.76% Nung -12.81% 1.27% 201 -8.83% -0.83% 44001 1.43% -9.31% - 18.38% -7.46% 1.07% -8.79% woor ico - 11.27% 112 8.41% 7100 9.14% 5.46% 0.21% 7.31% 3.54% 2010 3.66% - 1.89% 5.81% 1.93% -3.67% 3.04% 1/May/09 - 11.58% - 15.69% -0.87% 14.03% -5.79% 4.39% -2.43% 6.33% 0.48% 5.84% - 11 DO 1.68% -22.31% 12.45% -4.72% 0.37% -5 16% -3.42% 1/Aug/11 .10.97% -2.82% 14.25% 10.58% 11.61% RETURN DATA Date AAPL GOOG STX CMCSA JNJ GE HPQ 1/Feb/08 - 18.03% - 11.51% 6.23% 7.33% -4.00% -1.23% 3/Mar/08 -5.60% 8.86% 13.79% -6.74% -2.99% -0.73% - 14.57% 4.58% 11.07% 1/Apr/08 -4.34% 26.53% -0.38% -9.77% 6.09% 0.23% 3.37% 1/May/08 - 12.39% 1.48% 8.17% 1.98% 12.65% 0.18% 2/Jun/08 -10.69% -20.21% 202402 - 11.29% 170707 2290 - 17.07% 2850 -2.32% 4200 -3.65% 2401 0702 12.96% 1/Jul/08 -6.07% -5.21% 2002 - 10.54% -5.76% 19 20 Uong -23.74% 8.72% -13.59% 52907 6.22% 420 40440 5.83% 270 1/Aug/08 -2.23% 1.32% - 19.14% COM -0.37% 2.66% 8.08% 3.47% -0.68% 2/Sep/08 4.62% - 14.56% Wix.com 8.97% . -20.74% -7.59% -- 11.16% -1.64% 1/Oct/08 -8.38% -5.49% 21.01.29 -62.52% - 10.84% -58.25% -21.60% -1.95% -1.28% - 12.18% -26.77% -18.89% 3/Nov/08 - 14.93% -20.43% - 1.26% wo -45.88% 2.00 9.52% 10.00 - 14.68% -3.78% we -8.15% 1/Dec/08 -8.22% 4.89% - 11.39% 5.09% -2.67% 14.32% 2.12% -3.85% 3.03% 0 2/Jan/09 5.45% 9.56% 8.21% - 15.54% 20:00 -13.84% co -6.27% xo -3.66% 2/Feb/09 -28.93% -0.92% -4.33% -0.16% 20:46 16.96% 13.28% - 11.49% 20.00 -16.56% -13.47% 2/Mar/09 -32.62% - 17.97% Shares 16.30% 2.94% 32.41% 4.38% 33.54% 11.69% 6:00 5.07% 1/Apr/09 17.30% 17.99% 10.20% 120 12.90% 21.05% 30.57% 13.00% -9.82% -0.46% 22.40% 11.54% om 7.63% 5.23% -9.42% Wien 420 6.60% XX 2.100 1/Jun/09 12.91% 1.00 6.08% 6.37% -4.63% 4.77% 1.04% 0.60% 18.25% 4.88% 2.74% 2.93% -13.16% 24 25 12.02% 1/Jul/09 13.73% 4.96% 24.25% 14.08% 3.22% 7.07% 6.96% 13.33% DC 11.34% 1:06 2.91% 3/Aug/09 4.12% 18.40% 14.01% 3.05% 7.76% 0.06% 06 3.68% 1/Sep/09 3.61% 9.70% 7.14% 4.73% 9.32% 9.66% -1.30% . 1/Oct/09 0.76% 17.27% 5.22% 7.81% 5.03% -8.61% - 14.75% -2.24% -3.09% co 2/Nov/09 - 14.11% 0.53% 5.88% 8.38% 8.11% 1.117 15.76% 1.10% 7.02% 1/Dec/09 3.30% 5.27% 6.15% 11.65% 6.79% 0.79% 18.45% 10.45% 1.92% 4/Jan/10 1.8270 -9.28% 2.47% 5.04% -5.11% 9.28% -8.51% 1/Feb/10 -0.59% 26.55% 17.50% 6.14% -9.01% 3.81% -3.46% 1/Mar/10 0.97% 13.84% 7.37% 7.59% 1.85% -8.64% 13.55% 2.32% 3.45% 12.53% 4.71% 1/Apr/10 10.53% -7.58% 7.64% 0.48% 5.37% -6.38% -1.40% 3.54% 3/May/10 -2.26% 1.62% -7.93% 3.55% - 17.78% -8.87% -3.93% -8.88% -12.17% - 14.25% 1/Jun/10 -2.10% -8.75% - 11.55% Droo - 16.32% -4.05% 4.83% 1.29% -12.00% -5.97% 1/Jul/10 2.25% 8.59% 5.26% -3.84% 11.95% -1.48% -1.64% 11.19% 11:20 6.20% 2/Aug/10 -5.66% -7.45% -8.75% -21.32% 100 - 12.99% 0:00 2.02% 0.93% 1/Sep/10 -10.74% - 18.01% 15.46% 15.56% 6.46% 12:20 14.95% 5.55% 5.64% 8.31% 2.000 12.28% 1/Oct/10 9.19% 5.90% 15.46% 6.88% 22.24% 13.76% 140 3.100 -1.39% 2.83% 1/Nov/10 -1.40% -0.05% 3.32% -9.93% 17.24% 2.00 -9.32% -2.93% -5.17% -2.64% 19.20 1/Dec/10 -1.22% -0.27% 3.60% 6.66% Soul 6.88% 11.44% 0.000 9.20% 0.0070 5.51% 3/Jan/11 0.49% 15.21% JO170 5.06% 1.07% 0.60% 2.39% 400 . -7.07% loro 3.91% 2.000 20 1.0 1/Feb/11 -8.30% -3.43% 2017 9.65% 4.01% -0.49% 8.19% 2.15% 12.44% 0.18% -9.81% -1.83% 12.44% 3,65% 1/Mar/11 4.47% -1.03% -1.34% -4.44% 4.47% -1.54% -4.63% 4.44% % -4.12% 12.00% 1/Apr/11 2.51% -4.12% -3.62% 0.46% -4.21% -6.09% 2.02% 0.46% -7.55% 21.14% 8.51% 21.14% 10.36% 1.94% 2/May/11 -1.46% -0.66% -2.81% 0.31% 10.30% -2.81% -4.77% -2.58% -4.17% -3.78% -3.78% 2.20% 3.22% -4.03% -7.70% 1/Jun/11 -4.03% -3.56% -4.37% -3.87% -7.70% -3.87% -2.98% -3.25% 17.58% 1/Jul/11 5.00% 5.00% -2.34% -15.19% -490% -3.32% -4.90% -1 46% -1.46% -1.01% - 16.81% -3.08% 2439 _0920 2.43% -9.31% -4.91% -0.92% 30.1146 -0.96% - 11.90% -0.03% 32704 110202 -3.27% -5.99% 5.97% 9.92% 11 969 45.17% 52702 TIN 4400 ago 5.37% 11.96% 1.10% 18 07 1/Nov/11 9.36% 16.97% 11/11 -5.74% 1.13% -5.74% 6.88% -3.38% 2460 3.57% 1.44% -4.93% 4.92% 5.79% 7.47% 2.15% -4.21% 12902 4.98% 44.COM 6.51% 1.32% 7720% 12.80% -7.72% 11.96% 25 2002 -10.74% 6.40% 444902 25.39% 11.41% 1.48% 72507 0270 0.50% 1/Feb/12 4.35% 2707 17.25% 8.27% 201 6.37% 8.67% 440 22.64% 10.14% MO2 2001 -0.25% -0.39% 100401 2002 2.73% - 10.04% 1/Mar/12 10.01% 00 3.65% 3.01% 2.63% 1.99% 1.70% acor 1.35% 5.19% -5.51% 2/Apr/12 -2.63% -5.84% 0.01% 14.06% 1.69% 2.15% - 1.32% -2.48% 3.83% 1/May/12 -1.08% -4.05% 6.45% -27.23% -4.86% -4.32% 1/Jun/12 -3.21% -2.49% -8.81% 1.041 1.08% -0.14% wor -0.01% 7.44% -0.14% 5.41% 1.44% 7.88% 9.62% 2/Jul/12 4.48% 4.48% 8.73% 19.37% 1/Aug/12 1.81% 5.65% 7.91% 2.44% -0.44% 5.27% 2.96% -2.57% 4/Sep/12 -1.72% 0.28% -0.20% 9.65% 0.81% -3.35% 6.38% 5.59% 1/Oct/12 - 11.39% 9.95% 1.85% - 10.35% -2.71% - 12.46% 5.33% 1.18% 2.73% 1/Nov/12 -7.52% -20.85% - 1.24% 2.62% -1.52% -7.43% -0.86% -2.96% -0.67% 0.33% -6.40% 3/Dec/12 -9.51% 1.28% -0.21% 20.55% 0.86% -6.94% 0.53% 0.24% 2/Jan/13 10.19% -0.98% 4.23% 0.07% 3.33% 2.48% 2.05% 6.06% -32.18% - 15.78% To 6.62% -4.44% 06 12.61% 100 15.20% 19.22% 10.04.10 12.04% 1.97% 00 10.22% 1.53% 10.81% 2010 -8.00% -0.09% 0.087 -0.48% - 12.69% 12.09% 5.22% 8.74% -16.14% -0.40% 0.1070 -9.43% 13.88% -9.41% 5.43% 10.84% -2.93% 7.42% 360 -2.73% 0.31% -3.22% -4.90% -4.90% -6.80% -5.58% 1.40% - 14.65% -20.64% 14 7201 14.73% 10 OCOR -12.96% -5.83% 20.92% BAO 3.54% 7.71% -7.70% - 18.02% TO 0.17% 5.12% 5.12% 5.11% 7.26% 7.38% -3.41% 7.97% 5.31% 1.57% -8.33% -5.39% 6.76% 4.63% 22 8.54% DU 3.72% 0.00% 6.45% 2.33% 2.00% 3.36% 11.81% 6.31% 3.84% - 1.14% 15.12% -2.64% - 11.01% -30.09% 1/Sep/11 3/Oct/11 14.09% 1/Dec/11 3/Jan/12 1142 0.03% 2.90% -1.15% - 1.15% -1.69% -1.69% -2.07% -5.60% -7.31% 2502 10.35% 02201 -0.23% 4100 1.02% 2001 4.36% 4.22% 2207 3.23% -0.65% -6.20% 4.03% 1.36% 2.21% 2.55% -1.88% 0.56% 0.21% 2.81% - 11.41% -9.77% -3.77% 8.97% 7.40% -7.77% 2.18% 1.88% 1.00% 1 2 9 10 11 RETURN DATA: 10 STOCKS AND SP500 3 4 5 6 7 8 Whole Johnson General Foods Seagate Comcast Merck Johnson Electric Hewlett Packard Goldman Sachs Apple Google S&P 500 Monthly statistics Mean Variance Sigma Annual statistics Mean Variance Sigma Regressing individual assets on the S&P 500 Alpha Beta Rsq T-test, intercept T-test, slope WFM MRK -7.95% SP500 -3.31% -6.42% GS -16.24% -2.53% 14.78% -0.44% 19.24% 4.74% - 11.84% 9.05% 2.39% -6.25% 1.53% -8.14% 6.45% -39.98% OCO -0.86% 2001 5.29% -11.55% 44 CEO 100% -24.76% Nung -12.81% 1.27% 201 -8.83% -0.83% 44001 1.43% -9.31% - 18.38% -7.46% 1.07% -8.79% woor ico - 11.27% 112 8.41% 7100 9.14% 5.46% 0.21% 7.31% 3.54% 2010 3.66% - 1.89% 5.81% 1.93% -3.67% 3.04% 1/May/09 - 11.58% - 15.69% -0.87% 14.03% -5.79% 4.39% -2.43% 6.33% 0.48% 5.84% - 11 DO 1.68% -22.31% 12.45% -4.72% 0.37% -5 16% -3.42% 1/Aug/11 .10.97% -2.82% 14.25% 10.58% 11.61% RETURN DATA Date AAPL GOOG STX CMCSA JNJ GE HPQ 1/Feb/08 - 18.03% - 11.51% 6.23% 7.33% -4.00% -1.23% 3/Mar/08 -5.60% 8.86% 13.79% -6.74% -2.99% -0.73% - 14.57% 4.58% 11.07% 1/Apr/08 -4.34% 26.53% -0.38% -9.77% 6.09% 0.23% 3.37% 1/May/08 - 12.39% 1.48% 8.17% 1.98% 12.65% 0.18% 2/Jun/08 -10.69% -20.21% 202402 - 11.29% 170707 2290 - 17.07% 2850 -2.32% 4200 -3.65% 2401 0702 12.96% 1/Jul/08 -6.07% -5.21% 2002 - 10.54% -5.76% 19 20 Uong -23.74% 8.72% -13.59% 52907 6.22% 420 40440 5.83% 270 1/Aug/08 -2.23% 1.32% - 19.14% COM -0.37% 2.66% 8.08% 3.47% -0.68% 2/Sep/08 4.62% - 14.56% Wix.com 8.97% . -20.74% -7.59% -- 11.16% -1.64% 1/Oct/08 -8.38% -5.49% 21.01.29 -62.52% - 10.84% -58.25% -21.60% -1.95% -1.28% - 12.18% -26.77% -18.89% 3/Nov/08 - 14.93% -20.43% - 1.26% wo -45.88% 2.00 9.52% 10.00 - 14.68% -3.78% we -8.15% 1/Dec/08 -8.22% 4.89% - 11.39% 5.09% -2.67% 14.32% 2.12% -3.85% 3.03% 0 2/Jan/09 5.45% 9.56% 8.21% - 15.54% 20:00 -13.84% co -6.27% xo -3.66% 2/Feb/09 -28.93% -0.92% -4.33% -0.16% 20:46 16.96% 13.28% - 11.49% 20.00 -16.56% -13.47% 2/Mar/09 -32.62% - 17.97% Shares 16.30% 2.94% 32.41% 4.38% 33.54% 11.69% 6:00 5.07% 1/Apr/09 17.30% 17.99% 10.20% 120 12.90% 21.05% 30.57% 13.00% -9.82% -0.46% 22.40% 11.54% om 7.63% 5.23% -9.42% Wien 420 6.60% XX 2.100 1/Jun/09 12.91% 1.00 6.08% 6.37% -4.63% 4.77% 1.04% 0.60% 18.25% 4.88% 2.74% 2.93% -13.16% 24 25 12.02% 1/Jul/09 13.73% 4.96% 24.25% 14.08% 3.22% 7.07% 6.96% 13.33% DC 11.34% 1:06 2.91% 3/Aug/09 4.12% 18.40% 14.01% 3.05% 7.76% 0.06% 06 3.68% 1/Sep/09 3.61% 9.70% 7.14% 4.73% 9.32% 9.66% -1.30% . 1/Oct/09 0.76% 17.27% 5.22% 7.81% 5.03% -8.61% - 14.75% -2.24% -3.09% co 2/Nov/09 - 14.11% 0.53% 5.88% 8.38% 8.11% 1.117 15.76% 1.10% 7.02% 1/Dec/09 3.30% 5.27% 6.15% 11.65% 6.79% 0.79% 18.45% 10.45% 1.92% 4/Jan/10 1.8270 -9.28% 2.47% 5.04% -5.11% 9.28% -8.51% 1/Feb/10 -0.59% 26.55% 17.50% 6.14% -9.01% 3.81% -3.46% 1/Mar/10 0.97% 13.84% 7.37% 7.59% 1.85% -8.64% 13.55% 2.32% 3.45% 12.53% 4.71% 1/Apr/10 10.53% -7.58% 7.64% 0.48% 5.37% -6.38% -1.40% 3.54% 3/May/10 -2.26% 1.62% -7.93% 3.55% - 17.78% -8.87% -3.93% -8.88% -12.17% - 14.25% 1/Jun/10 -2.10% -8.75% - 11.55% Droo - 16.32% -4.05% 4.83% 1.29% -12.00% -5.97% 1/Jul/10 2.25% 8.59% 5.26% -3.84% 11.95% -1.48% -1.64% 11.19% 11:20 6.20% 2/Aug/10 -5.66% -7.45% -8.75% -21.32% 100 - 12.99% 0:00 2.02% 0.93% 1/Sep/10 -10.74% - 18.01% 15.46% 15.56% 6.46% 12:20 14.95% 5.55% 5.64% 8.31% 2.000 12.28% 1/Oct/10 9.19% 5.90% 15.46% 6.88% 22.24% 13.76% 140 3.100 -1.39% 2.83% 1/Nov/10 -1.40% -0.05% 3.32% -9.93% 17.24% 2.00 -9.32% -2.93% -5.17% -2.64% 19.20 1/Dec/10 -1.22% -0.27% 3.60% 6.66% Soul 6.88% 11.44% 0.000 9.20% 0.0070 5.51% 3/Jan/11 0.49% 15.21% JO170 5.06% 1.07% 0.60% 2.39% 400 . -7.07% loro 3.91% 2.000 20 1.0 1/Feb/11 -8.30% -3.43% 2017 9.65% 4.01% -0.49% 8.19% 2.15% 12.44% 0.18% -9.81% -1.83% 12.44% 3,65% 1/Mar/11 4.47% -1.03% -1.34% -4.44% 4.47% -1.54% -4.63% 4.44% % -4.12% 12.00% 1/Apr/11 2.51% -4.12% -3.62% 0.46% -4.21% -6.09% 2.02% 0.46% -7.55% 21.14% 8.51% 21.14% 10.36% 1.94% 2/May/11 -1.46% -0.66% -2.81% 0.31% 10.30% -2.81% -4.77% -2.58% -4.17% -3.78% -3.78% 2.20% 3.22% -4.03% -7.70% 1/Jun/11 -4.03% -3.56% -4.37% -3.87% -7.70% -3.87% -2.98% -3.25% 17.58% 1/Jul/11 5.00% 5.00% -2.34% -15.19% -490% -3.32% -4.90% -1 46% -1.46% -1.01% - 16.81% -3.08% 2439 _0920 2.43% -9.31% -4.91% -0.92% 30.1146 -0.96% - 11.90% -0.03% 32704 110202 -3.27% -5.99% 5.97% 9.92% 11 969 45.17% 52702 TIN 4400 ago 5.37% 11.96% 1.10% 18 07 1/Nov/11 9.36% 16.97% 11/11 -5.74% 1.13% -5.74% 6.88% -3.38% 2460 3.57% 1.44% -4.93% 4.92% 5.79% 7.47% 2.15% -4.21% 12902 4.98% 44.COM 6.51% 1.32% 7720% 12.80% -7.72% 11.96% 25 2002 -10.74% 6.40% 444902 25.39% 11.41% 1.48% 72507 0270 0.50% 1/Feb/12 4.35% 2707 17.25% 8.27% 201 6.37% 8.67% 440 22.64% 10.14% MO2 2001 -0.25% -0.39% 100401 2002 2.73% - 10.04% 1/Mar/12 10.01% 00 3.65% 3.01% 2.63% 1.99% 1.70% acor 1.35% 5.19% -5.51% 2/Apr/12 -2.63% -5.84% 0.01% 14.06% 1.69% 2.15% - 1.32% -2.48% 3.83% 1/May/12 -1.08% -4.05% 6.45% -27.23% -4.86% -4.32% 1/Jun/12 -3.21% -2.49% -8.81% 1.041 1.08% -0.14% wor -0.01% 7.44% -0.14% 5.41% 1.44% 7.88% 9.62% 2/Jul/12 4.48% 4.48% 8.73% 19.37% 1/Aug/12 1.81% 5.65% 7.91% 2.44% -0.44% 5.27% 2.96% -2.57% 4/Sep/12 -1.72% 0.28% -0.20% 9.65% 0.81% -3.35% 6.38% 5.59% 1/Oct/12 - 11.39% 9.95% 1.85% - 10.35% -2.71% - 12.46% 5.33% 1.18% 2.73% 1/Nov/12 -7.52% -20.85% - 1.24% 2.62% -1.52% -7.43% -0.86% -2.96% -0.67% 0.33% -6.40% 3/Dec/12 -9.51% 1.28% -0.21% 20.55% 0.86% -6.94% 0.53% 0.24% 2/Jan/13 10.19% -0.98% 4.23% 0.07% 3.33% 2.48% 2.05% 6.06% -32.18% - 15.78% To 6.62% -4.44% 06 12.61% 100 15.20% 19.22% 10.04.10 12.04% 1.97% 00 10.22% 1.53% 10.81% 2010 -8.00% -0.09% 0.087 -0.48% - 12.69% 12.09% 5.22% 8.74% -16.14% -0.40% 0.1070 -9.43% 13.88% -9.41% 5.43% 10.84% -2.93% 7.42% 360 -2.73% 0.31% -3.22% -4.90% -4.90% -6.80% -5.58% 1.40% - 14.65% -20.64% 14 7201 14.73% 10 OCOR -12.96% -5.83% 20.92% BAO 3.54% 7.71% -7.70% - 18.02% TO 0.17% 5.12% 5.12% 5.11% 7.26% 7.38% -3.41% 7.97% 5.31% 1.57% -8.33% -5.39% 6.76% 4.63% 22 8.54% DU 3.72% 0.00% 6.45% 2.33% 2.00% 3.36% 11.81% 6.31% 3.84% - 1.14% 15.12% -2.64% - 11.01% -30.09% 1/Sep/11 3/Oct/11 14.09% 1/Dec/11 3/Jan/12 1142 0.03% 2.90% -1.15% - 1.15% -1.69% -1.69% -2.07% -5.60% -7.31% 2502 10.35% 02201 -0.23% 4100 1.02% 2001 4.36% 4.22% 2207 3.23% -0.65% -6.20% 4.03% 1.36% 2.21% 2.55% -1.88% 0.56% 0.21% 2.81% - 11.41% -9.77% -3.77% 8.97% 7.40% -7.77% 2.18% 1.88% 1.00%