Answered step by step

Verified Expert Solution

Question

1 Approved Answer

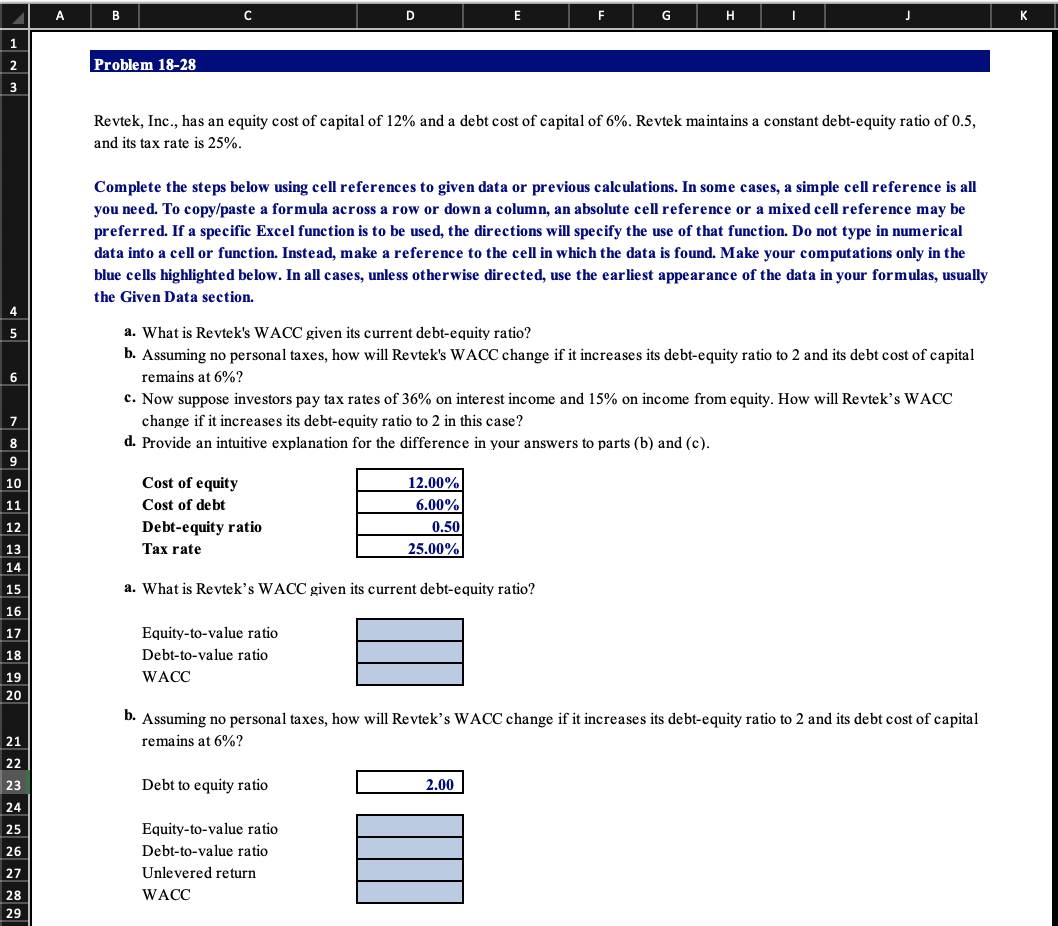

1 2 A 3 4 5 6 B Problem 18-28 C D E F G H J K Revtek, Inc., has an equity cost

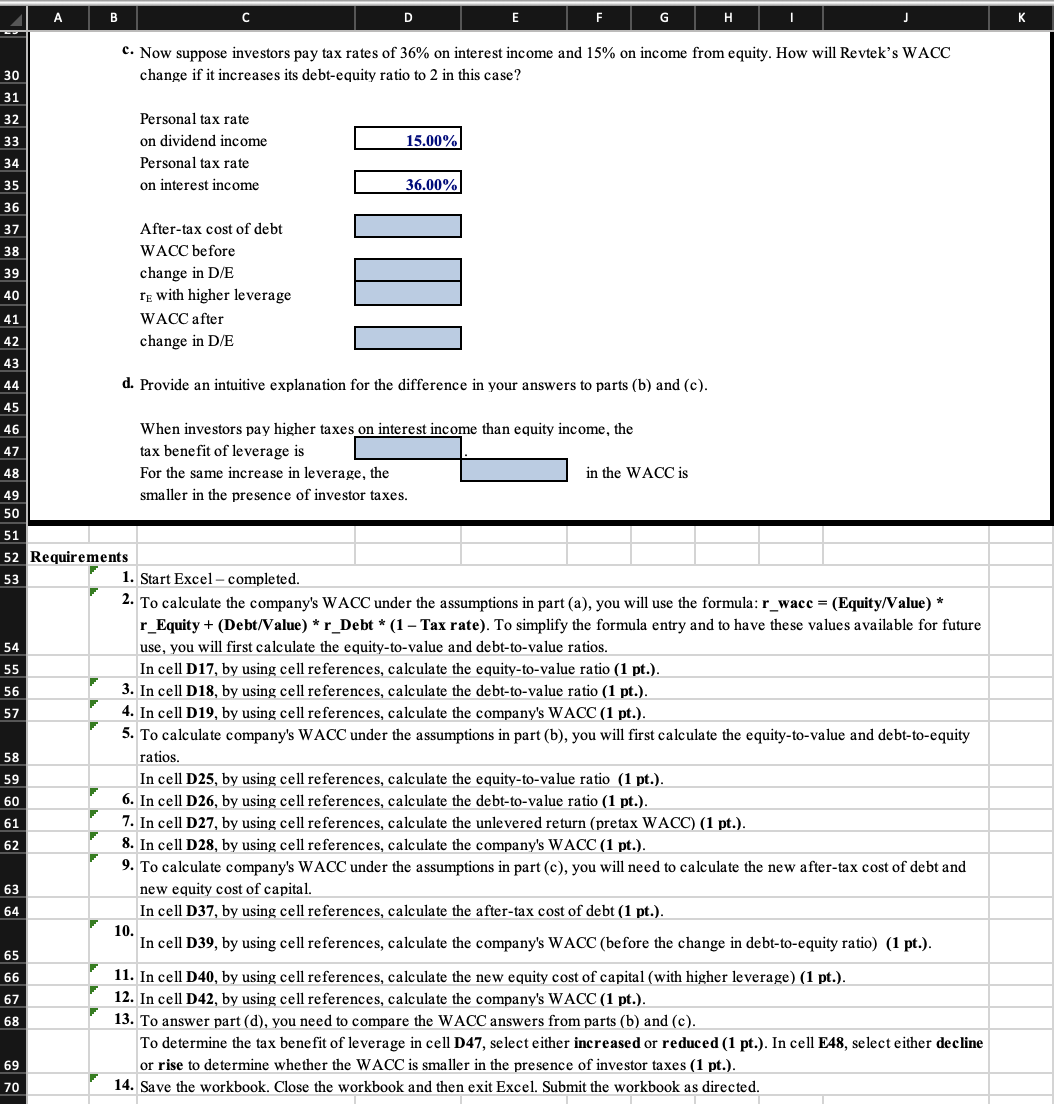

1 2 A 3 4 5 6 B Problem 18-28 C D E F G H J K Revtek, Inc., has an equity cost of capital of 12% and a debt cost of capital of 6%. Revtek maintains a constant debt-equity ratio of 0.5, and its tax rate is 25%. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. What is Revtek's WACC given its current debt-equity ratio? b. Assuming no personal taxes, how will Revtek's WACC change if it increases its debt-equity ratio to 2 and its debt cost of capital remains at 6%? c. Now suppose investors pay tax rates of 36% on interest income and 15% on income from equity. How will Revtek's WACC change if it increases its debt-equity ratio to 2 in this case? d. Provide an intuitive explanation for the difference in your answers to parts (b) and (c). 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 - - s - Cost of equity Cost of debt Debt-equity ratio Tax rate 12.00% 6.00% 0.50 25.00% a. What is Revtek's WACC given its current debt-equity ratio? Equity-to-value ratio Debt-to-value ratio WACC b. Assuming no personal taxes, how will Revtek's WACC change if it increases its debt-equity ratio to 2 and its debt cost of capital remains at 6%? Debt to equity ratio Equity-to-value ratio Debt-to-value ratio Unlevered return WACC 2.00 A B C D E F G H J 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 c. Now suppose investors pay tax rates of 36% on interest income and 15% on income from equity. How will Revtek's WACC change if it increases its debt-equity ratio to 2 in this case? Personal tax rate on dividend income Personal tax rate on interest income After-tax cost of debt WACC before change in D/E TE with higher leverage WACC after change in D/E 15.00% 36.00% d. Provide an intuitive explanation for the difference in your answers to parts (b) and (c). When investors pay higher taxes on interest income than equity income, the tax benefit of leverage is For the same increase in leverage, the smaller in the presence of investor taxes. in the WACC is 52 Requirements 53 54 55 56 57 1. Start Excel completed. 2. To calculate the company's WACC under the assumptions in part (a), you will use the formula: r_wacc = (Equity/Value) * r_Equity + (Debt/Value) * r_Debt * (1 - Tax rate). To simplify the formula entry and to have these values available for future use, you will first calculate the equity-to-value and debt-to-value ratios. In cell D17, by using cell references, calculate the equity-to-value ratio (1 pt.). 3. In cell D18, by using cell references, calculate the debt-to-value ratio (1 pt.). 4. In cell D19, by using cell references, calculate the company's WACC (1 pt.). 5. To calculate company's WACC under the assumptions in part (b), you will first calculate the equity-to-value and debt-to-equity ratios. In cell D25, by using cell references, calculate the equity-to-value ratio (1 pt.). 58 59 60 6. In cell D26, by using cell references, calculate the debt-to-value ratio (1 pt.). 61 62 63 64 7. In cell D27, by using cell references, calculate the unlevered return (pretax WACC) (1 pt.). 8. In cell D28, by using cell references, calculate the company's WACC (1 pt.). 9. To calculate company's WACC under the assumptions in part (c), you will need to calculate the new after-tax cost of debt and new equity cost of capital. 10. In cell D37, by using cell references, calculate the after-tax cost of debt (1 pt.). In cell D39, by using cell references, calculate the company's WACC (before the change in debt-to-equity ratio) (1 pt.). 11. In cell D40, by using cell references, calculate the new equity cost of capital (with higher leverage) (1 pt.). 65 66 67 12. In cell D42, by using cell references, calculate the company's WACC (1 pt.). 68 13. To answer part (d), you need to compare the WACC answers from parts (b) and (c). 69 70 To determine the tax benefit of leverage in cell D47, select either increased or reduced (1 pt.). In cell E48, select either decline or rise to determine whether the WACC is smaller in the presence of investor taxes (1 pt.). 14. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started