1.

2.

2.

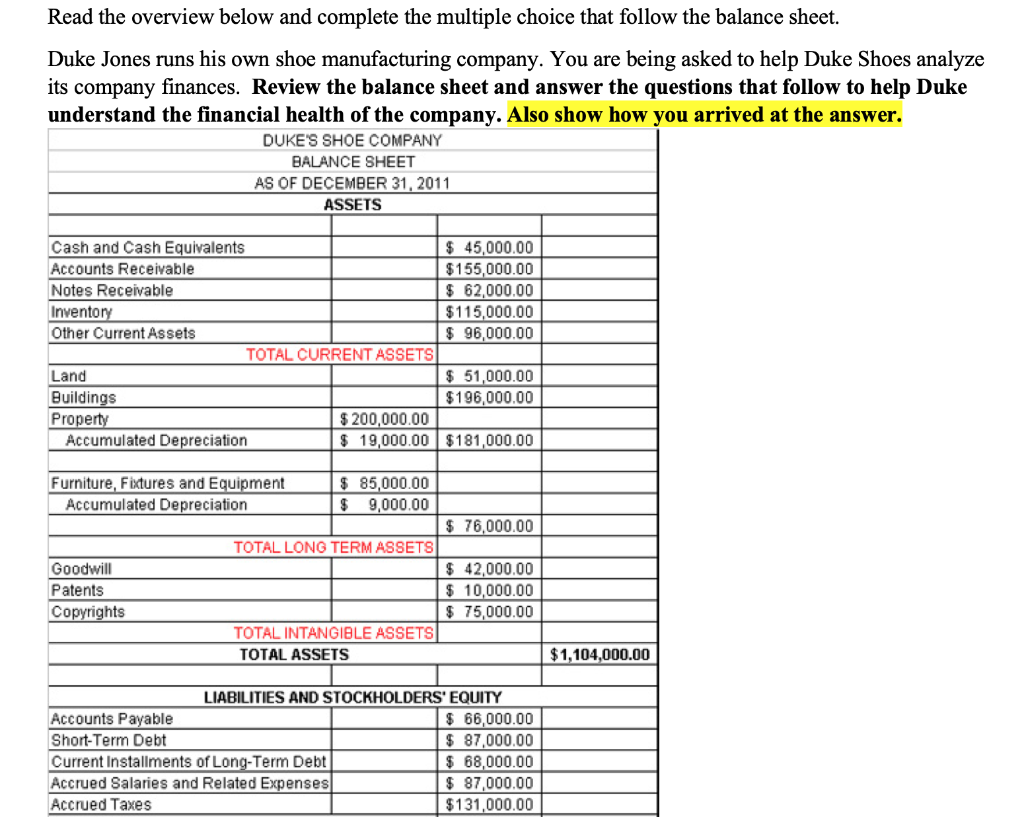

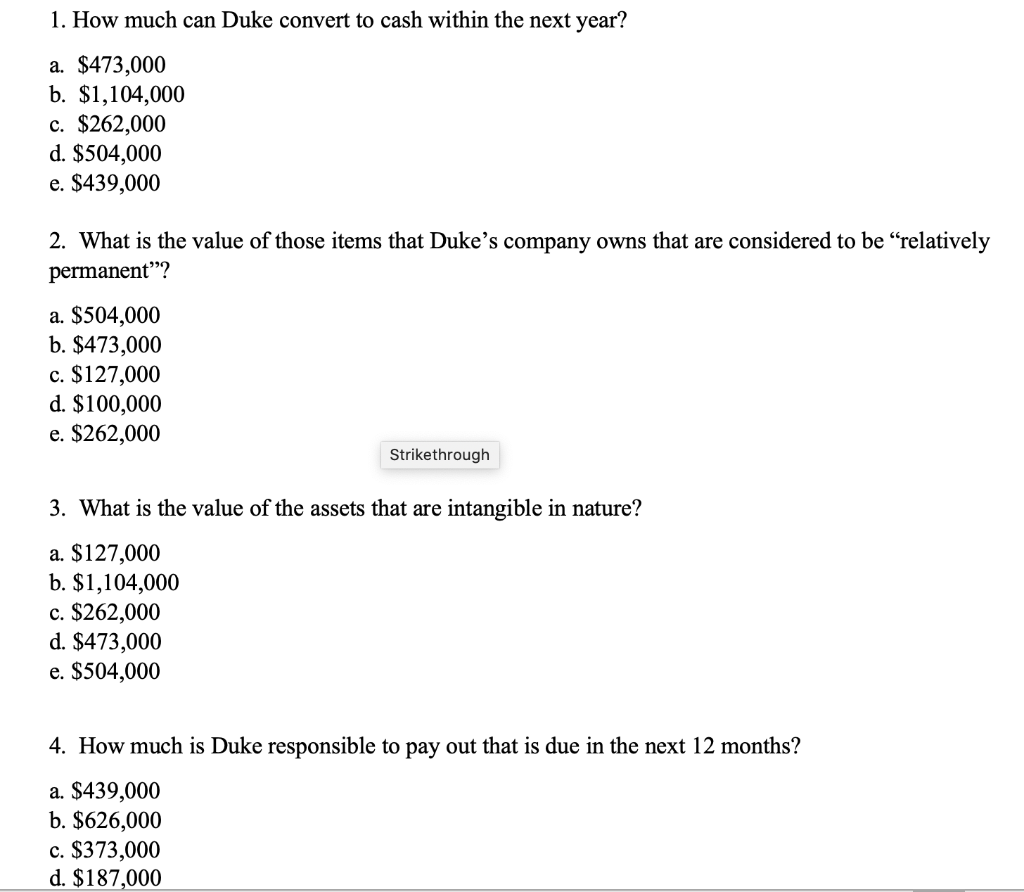

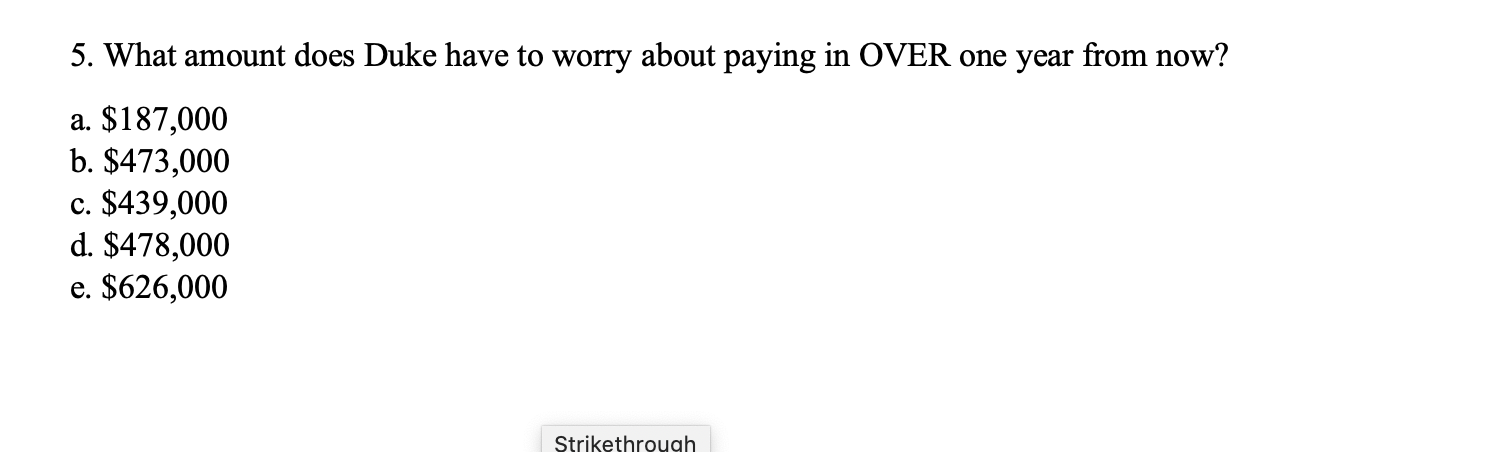

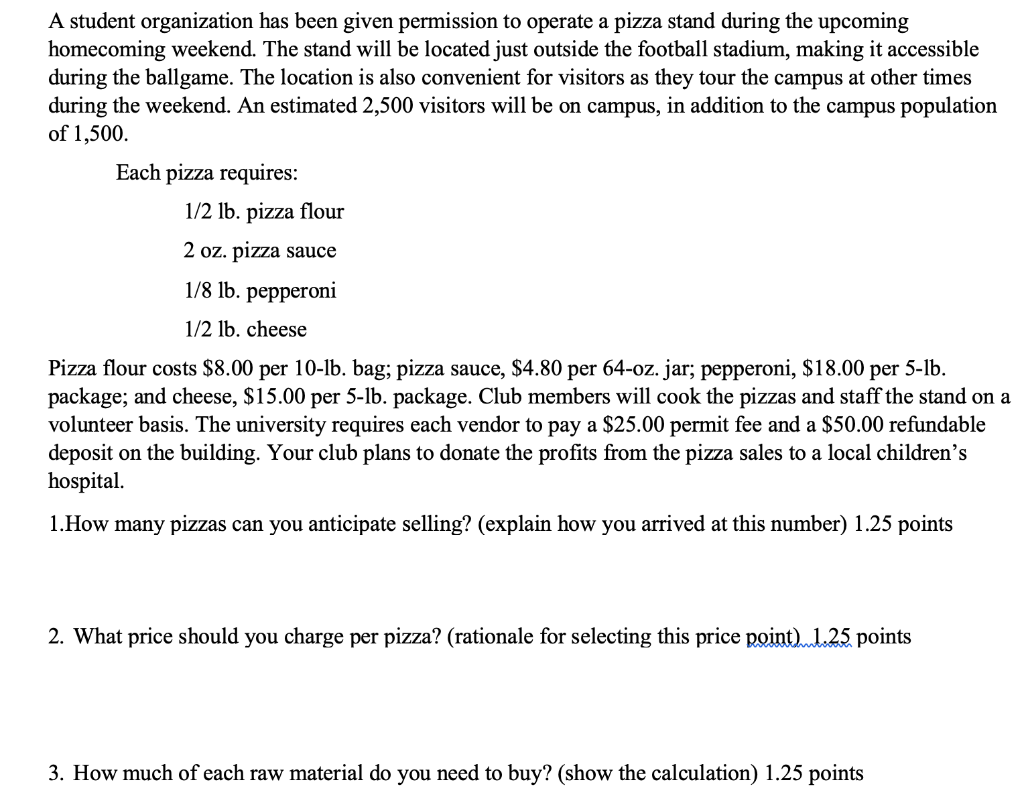

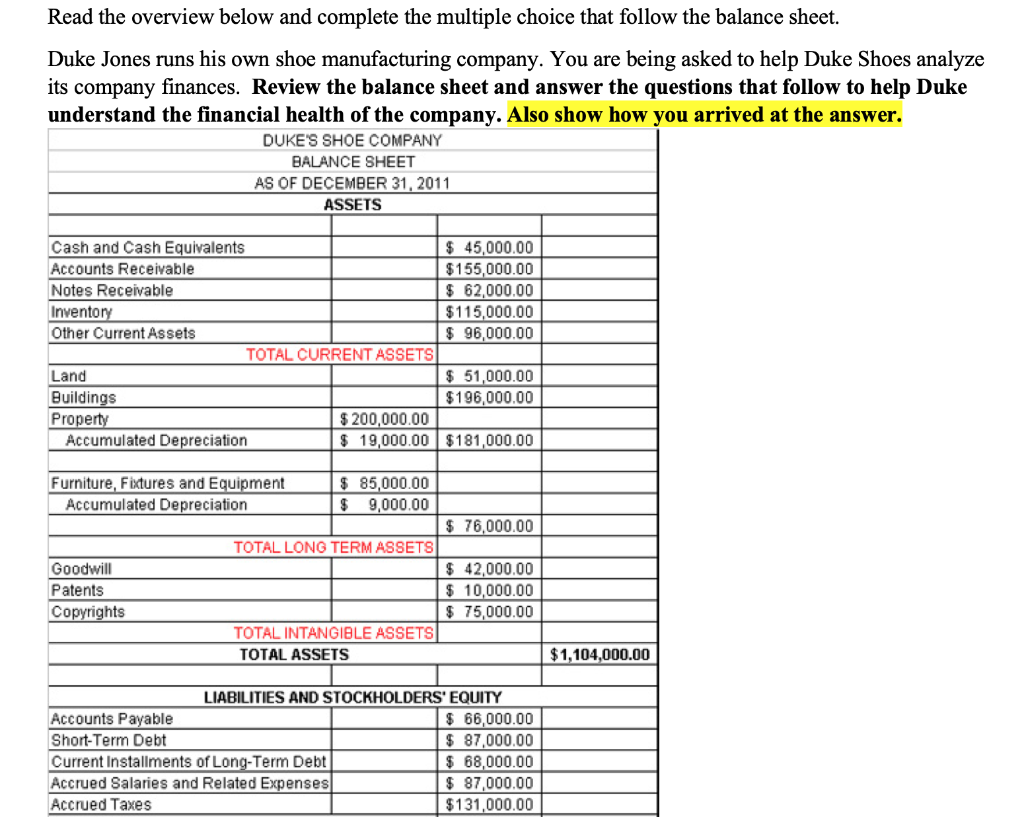

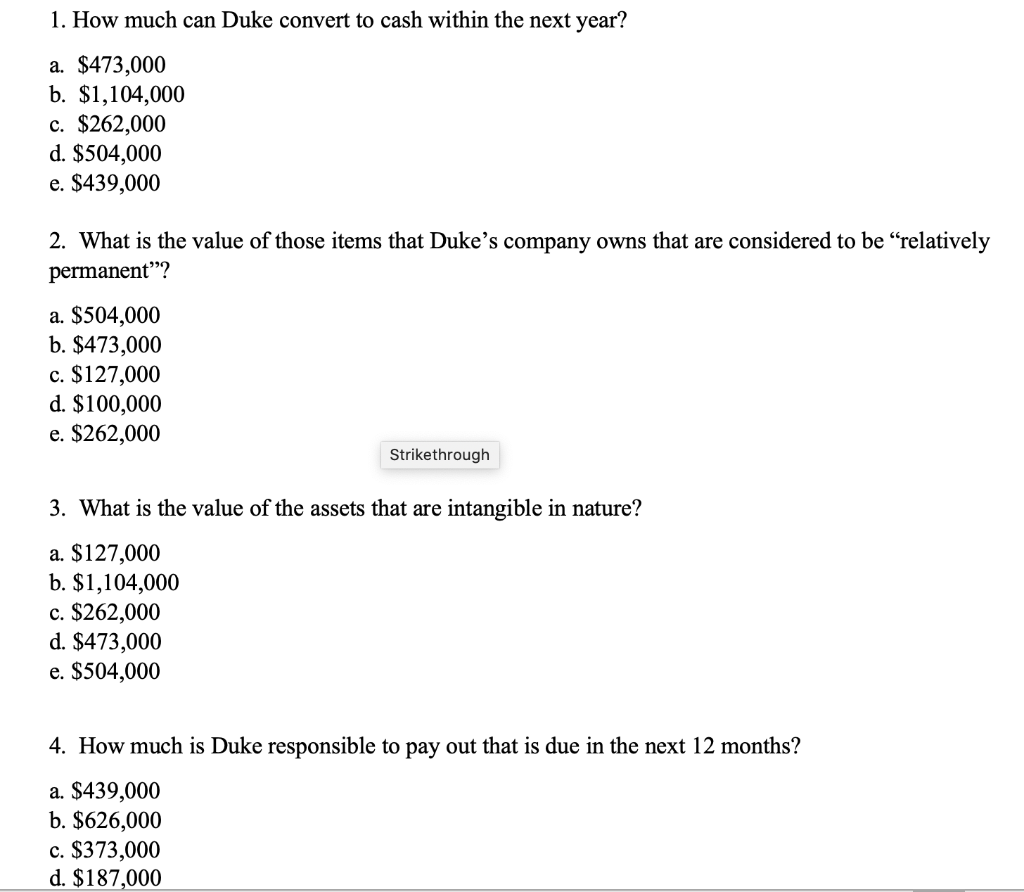

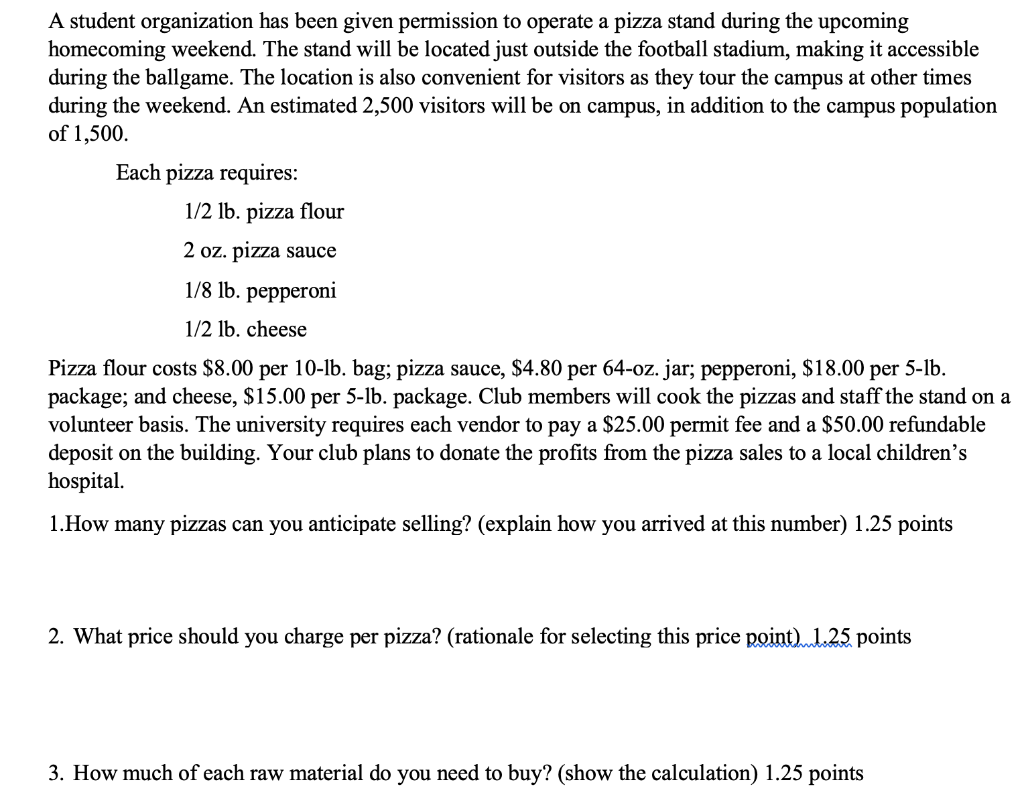

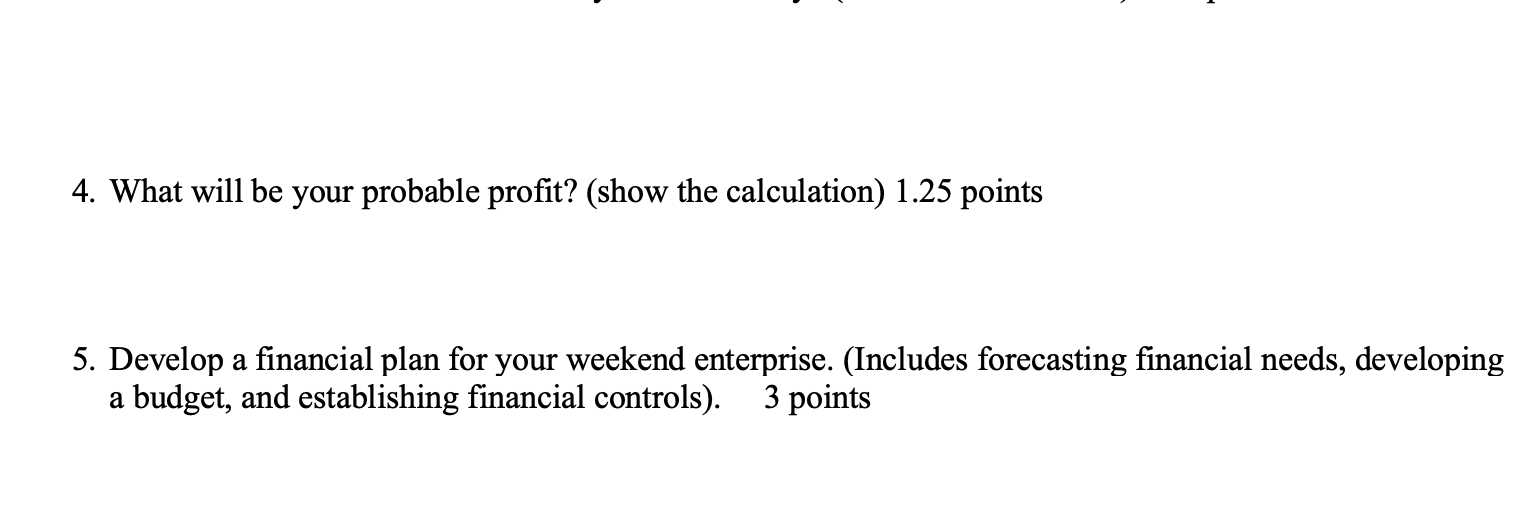

A student organization has been given permission to operate a pizza stand during the upcoming homecoming weekend. The stand will be located just outside the football stadium, making it accessible during the ballgame. The location is also convenient for visitors as they tour the campus at other times during the weekend. An estimated 2,500 visitors will be on campus, in addition to the campus population of 1,500. Each pizza requires: 1/2 lb. pizza flour 2 oz. pizza sauce 1/8 lb. pepperoni 1/2 lb. cheese Pizza flour costs $8.00 per 10-lb. bag; pizza sauce, $4.80 per 64-oz. jar; pepperoni, $18.00 per 5-lb. package; and cheese, $15.00 per 5-lb. package. Club members will cook the pizzas and staff the stand on a volunteer basis. The university requires each vendor to pay a $25.00 permit fee and a $50.00 refundable deposit on the building. Your club plans to donate the profits from the pizza sales to a local children's hospital. 1. How many pizzas can you anticipate selling? (explain how you arrived at this number) 1.25 points 2. What price should you charge per pizza? (rationale for selecting this price point.ml:25 points 3. How much of each raw material do you need to buy? (show the calculation) 1.25 points 4. What will be your probable profit? (show the calculation) 1.25 points 5. Develop a financial plan for your weekend enterprise. (Includes forecasting financial needs, developing a budget, and establishing financial controls). 3 points Read the overview below and complete the multiple choice that follow the balance sheet. Duke Jones runs his own shoe manufacturing company. You are being asked to help Duke Shoes analyze its company finances. Review the balance sheet and answer the questions that follow to help Duke understand the financial health of the company. Also show how you arrived at the answer. DUKE'S SHOE COMPANY BALANCE SHEET AS OF DECEMBER 31, 2011 ASSETS Cash and Cash Equivalents $ 45,000.00 Accounts Receivable $ 155,000.00 Notes Receivable $ 62,000.00 Inventory $115,000.00 Other Current Assets $ 96,000.00 TOTAL CURRENT ASSETS Land $ 51,000.00 Buildings $196,000.00 Property $ 200,000.00 Accumulated Depreciation $ 19,000.00 $181,000.00 Furniture, Fixtures and Equipment Accumulated Depreciation $ 85,000.00 $ 9,000.00 $ 76,000.00 TOTAL LONG TERM ASSETS Goodwill Patents Copyrights $ 42,000.00 $ 10,000.00 $ 75,000.00 TOTAL INTANGIBLE ASSETS TOTAL ASSETS $1,104,000.00 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts Payable $ 66,000.00 Short-Term Debt $ 87,000.00 Current Installments of Long-Term Debt $ 68,000.00 Accrued Salaries and Related Expenses $ 87,000.00 Accrued Taxes $131,000.00 1. How much can Duke convert to cash within the next year? a. $473,000 b. $1,104,000 c. $262,000 d. $504,000 e. $439,000 2. What is the value of those items that Duke's company owns that are considered to be relatively permanent? a. $504,000 b. $473,000 c. $127,000 d. $100,000 e. $262,000 Strikethrough 3. What is the value of the assets that are intangible in nature? a. $127,000 b. $1,104,000 c. $262,000 d. $473,000 e. $504,000 4. How much is Duke responsible to pay out that is due in the next 12 months? a. $439,000 b. $626,000 c. $373,000 d. $187,000 5. What amount does Duke have to worry about paying in OVER one year from now? a. $187,000 b. $473,000 c. $439,000 d. $478,000 e. $626,000 Strikethrough A student organization has been given permission to operate a pizza stand during the upcoming homecoming weekend. The stand will be located just outside the football stadium, making it accessible during the ballgame. The location is also convenient for visitors as they tour the campus at other times during the weekend. An estimated 2,500 visitors will be on campus, in addition to the campus population of 1,500. Each pizza requires: 1/2 lb. pizza flour 2 oz. pizza sauce 1/8 lb. pepperoni 1/2 lb. cheese Pizza flour costs $8.00 per 10-lb. bag; pizza sauce, $4.80 per 64-oz. jar; pepperoni, $18.00 per 5-lb. package; and cheese, $15.00 per 5-lb. package. Club members will cook the pizzas and staff the stand on a volunteer basis. The university requires each vendor to pay a $25.00 permit fee and a $50.00 refundable deposit on the building. Your club plans to donate the profits from the pizza sales to a local children's hospital. 1. How many pizzas can you anticipate selling? (explain how you arrived at this number) 1.25 points 2. What price should you charge per pizza? (rationale for selecting this price point.ml:25 points 3. How much of each raw material do you need to buy? (show the calculation) 1.25 points 4. What will be your probable profit? (show the calculation) 1.25 points 5. Develop a financial plan for your weekend enterprise. (Includes forecasting financial needs, developing a budget, and establishing financial controls). 3 points Read the overview below and complete the multiple choice that follow the balance sheet. Duke Jones runs his own shoe manufacturing company. You are being asked to help Duke Shoes analyze its company finances. Review the balance sheet and answer the questions that follow to help Duke understand the financial health of the company. Also show how you arrived at the answer. DUKE'S SHOE COMPANY BALANCE SHEET AS OF DECEMBER 31, 2011 ASSETS Cash and Cash Equivalents $ 45,000.00 Accounts Receivable $ 155,000.00 Notes Receivable $ 62,000.00 Inventory $115,000.00 Other Current Assets $ 96,000.00 TOTAL CURRENT ASSETS Land $ 51,000.00 Buildings $196,000.00 Property $ 200,000.00 Accumulated Depreciation $ 19,000.00 $181,000.00 Furniture, Fixtures and Equipment Accumulated Depreciation $ 85,000.00 $ 9,000.00 $ 76,000.00 TOTAL LONG TERM ASSETS Goodwill Patents Copyrights $ 42,000.00 $ 10,000.00 $ 75,000.00 TOTAL INTANGIBLE ASSETS TOTAL ASSETS $1,104,000.00 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts Payable $ 66,000.00 Short-Term Debt $ 87,000.00 Current Installments of Long-Term Debt $ 68,000.00 Accrued Salaries and Related Expenses $ 87,000.00 Accrued Taxes $131,000.00 1. How much can Duke convert to cash within the next year? a. $473,000 b. $1,104,000 c. $262,000 d. $504,000 e. $439,000 2. What is the value of those items that Duke's company owns that are considered to be relatively permanent? a. $504,000 b. $473,000 c. $127,000 d. $100,000 e. $262,000 Strikethrough 3. What is the value of the assets that are intangible in nature? a. $127,000 b. $1,104,000 c. $262,000 d. $473,000 e. $504,000 4. How much is Duke responsible to pay out that is due in the next 12 months? a. $439,000 b. $626,000 c. $373,000 d. $187,000 5. What amount does Duke have to worry about paying in OVER one year from now? a. $187,000 b. $473,000 c. $439,000 d. $478,000 e. $626,000 Strikethrough

2.

2.