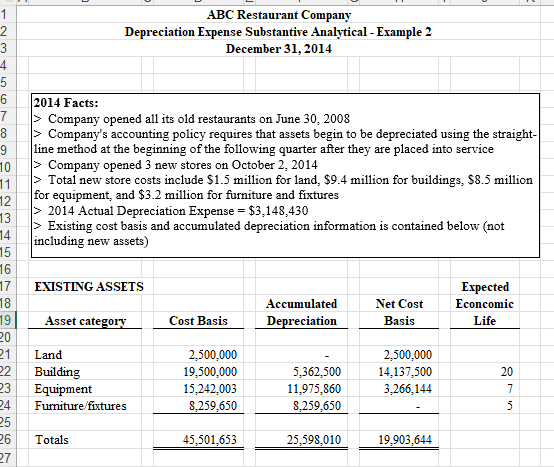

1 2 ABC Restaurant Company Depreciation Expense Substantive Analytical - Example 2 December 31, 2014 2014 Facts: > Company opened all its old restaurants on June 30, 2008 > Company's accounting policy requires that assets begin to be depreciated using the straight- line method at the beginning of the following quarter after they are placed into service > Company opened 3 new stores on October 2, 2014 > Total new store costs include $1.5 million for land, $9.4 million for buildings, $8.5 million for equipment, and $3.2 million for furniture and fixtures > 2014 Actual Depreciation Expense = $3,148,430 > Existing cost basis and accumulated depreciation information is contained below (not including new assets) 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 191 20 21 22 23 24 25 26 27 EXISTING ASSETS Asset category Expected Econcomic Life Accumulated Depreciation Net Cost Basis Cost Basis Land Building Equipment Furniture fixtures 2,500,000 19,500,000 15,242,003 8,259,650 5,362,500 11,975,860 8,259,650 2,500,000 14,137,500 3,266,144 20 7 5 Totals 45,501,653 25,598,010 19,903,644 1 2 ABC Restaurant Company Depreciation Expense Substantive Analytical - Example 2 December 31, 2014 2014 Facts: > Company opened all its old restaurants on June 30, 2008 > Company's accounting policy requires that assets begin to be depreciated using the straight- line method at the beginning of the following quarter after they are placed into service > Company opened 3 new stores on October 2, 2014 > Total new store costs include $1.5 million for land, $9.4 million for buildings, $8.5 million for equipment, and $3.2 million for furniture and fixtures > 2014 Actual Depreciation Expense = $3,148,430 > Existing cost basis and accumulated depreciation information is contained below (not including new assets) 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 191 20 21 22 23 24 25 26 27 EXISTING ASSETS Asset category Expected Econcomic Life Accumulated Depreciation Net Cost Basis Cost Basis Land Building Equipment Furniture fixtures 2,500,000 19,500,000 15,242,003 8,259,650 5,362,500 11,975,860 8,259,650 2,500,000 14,137,500 3,266,144 20 7 5 Totals 45,501,653 25,598,010 19,903,644