Answered step by step

Verified Expert Solution

Question

1 Approved Answer

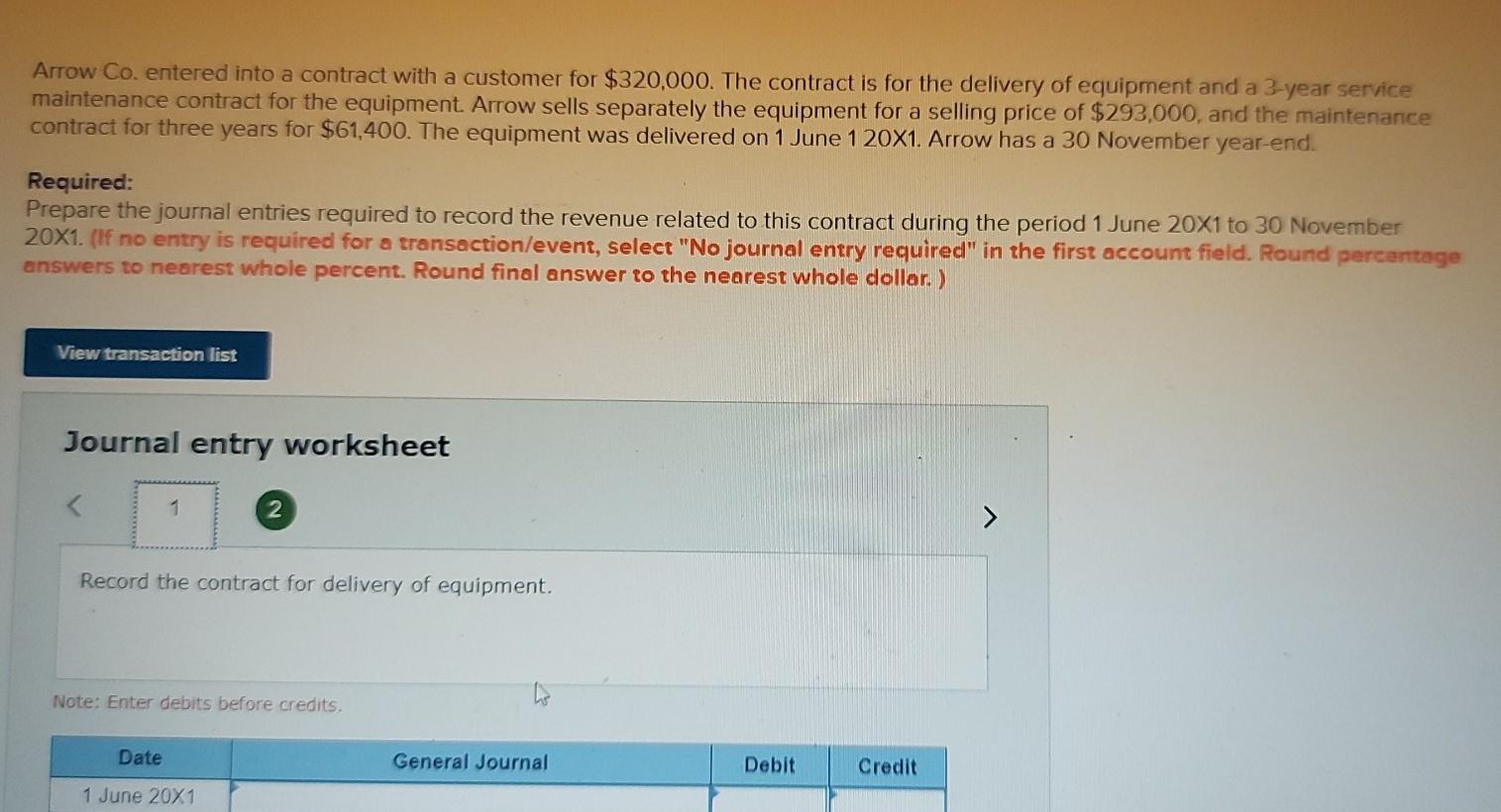

1 2 Arrow Co. entered into a contract with a customer for $320,000. The contract is for the delivery of equipment and a 3-year service

1

2

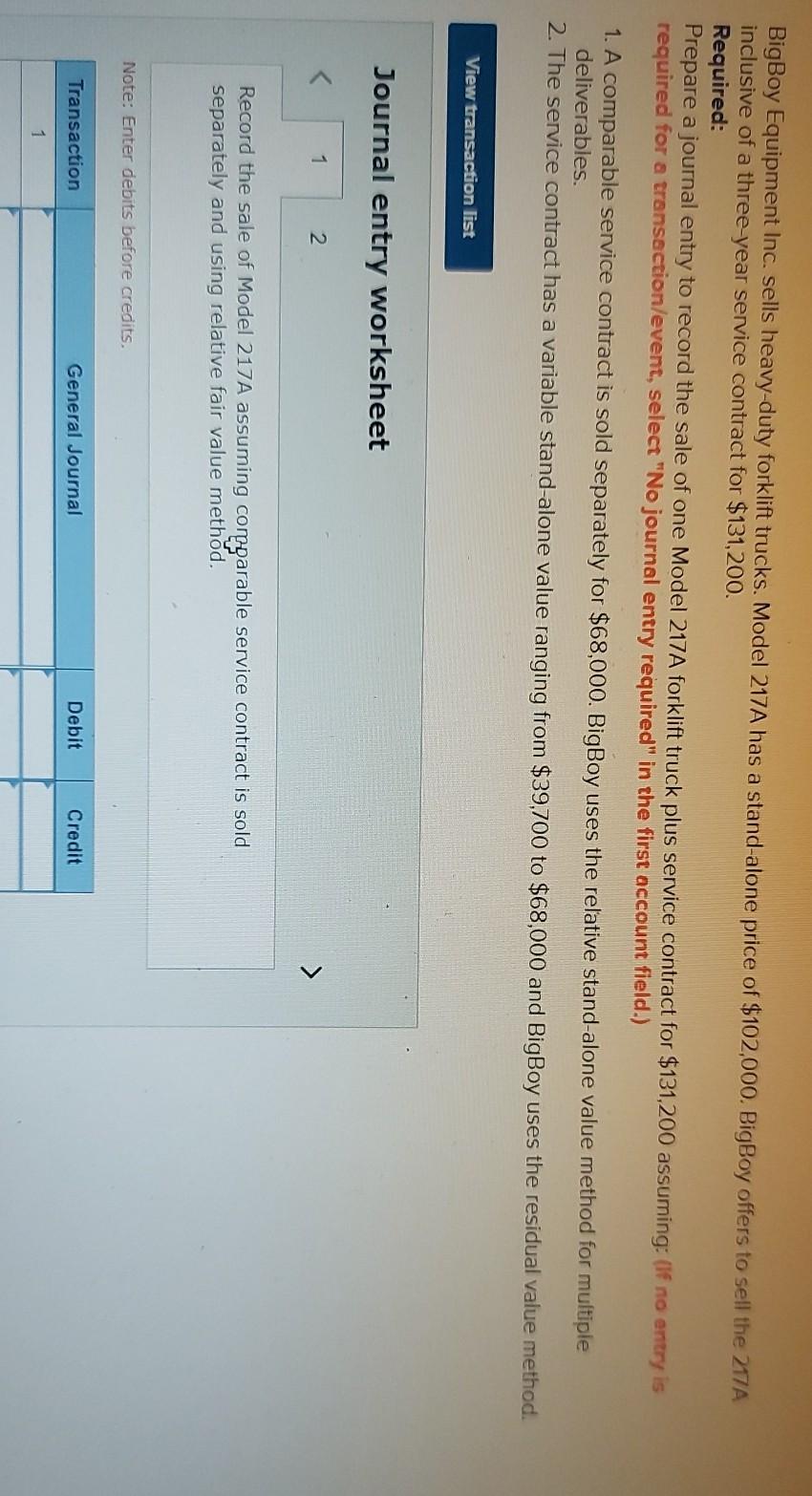

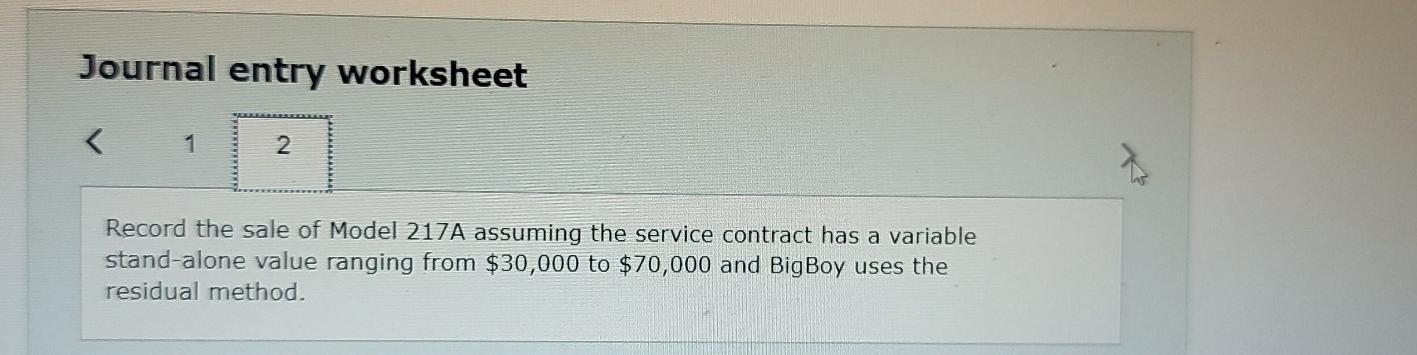

Arrow Co. entered into a contract with a customer for $320,000. The contract is for the delivery of equipment and a 3-year service maintenance contract for the equipment Arrow sells separately the equipment for a selling price of $293,000, and the maintenance contract for three years for $61,400. The equipment was delivered on 1 June 120X1. Arrow has a 30 November year-end. Required: Prepare the journal entries required to record the revenue related to this contract during the period 1 June 20x1 to 30 November 20X1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round percentage answers to nearest whole percent. Round final answer to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 > Record the contract for delivery of equipment, Note: Enter debits before credits. ho Date General Journal Debit Credit 1 June 20X1 Journal entry worksheet Record the liability related to the contract. BigBoy Equipment Inc. sells heavy-duty forklift trucks. Model 217A has a stand-alone price of $102,000. BigBoy offers to sell the 217A inclusive of a three-year service contract for $131,200. Required: Prepare a journal entry to record the sale of one Model 217A forklift truck plus service contract for $131,200 assuming: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. A comparable service contract is sold separately for $68,000. BigBoy uses the relative stand-alone value method for multiple deliverables. 2. The service contract has a variable stand-alone value ranging from $39,700 to $68,000 and BigBoy uses the residual value method. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started