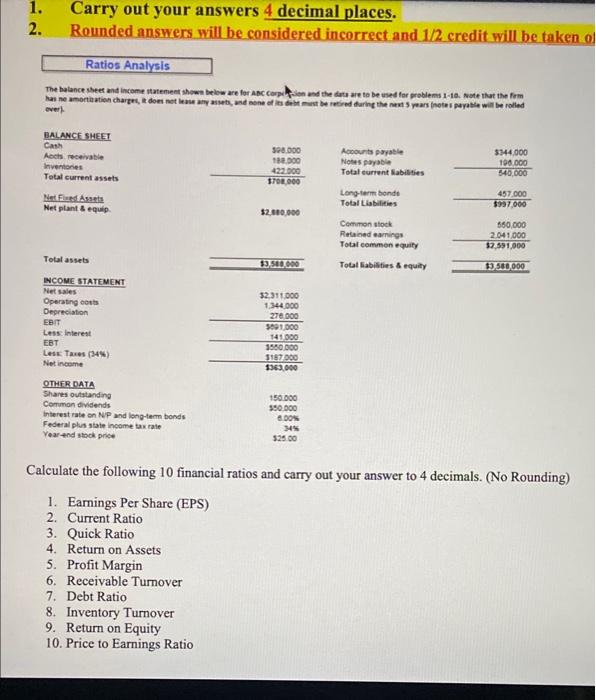

1. 2. Carry out your answers 4 decimal places. Rounded answers will be considered incorrect and 1/2 credit will be taken o Ratios Analysis The balance sheet and income teen shown below are for ABC Compound the data are to be used for problems 1.10. Note that the form has ne motivation charge does not least, und none of its de mest be retired during the next 3 years notes payable will be rolled over BALANCE SHEET Cash Aects receivable Inventions Total current assets 598.000 138.000 422.000 1700 000 Accounts payable Notes payable Total current abilities 3344.000 190.000 540,000 Need Assets Net plant & equip Long-term bonde Total Liabilities 457.000 $97.000 $2.000.000 Common stock Retained earnings Totalcommon equity Total abilities & equity 550.000 2.041.000 $2.591,000 Total assets 13.500.000 13560000 INCOME STATEMENT Net Sales Operating costs Depreciation EBIT Less interest EBT Les Taxes (34) Net income 32.311.000 1.344.000 276.000 5091.000 141 000 3560.000 3187000 1363.000 OTHER DATA Shares outstanding Common dividends Interest rate on NP and long-term bonds Federal plus state income tax rate Year-end stock price 150.000 550.000 6.00 34% 525.00 Calculate the following 10 financial ratios and carry out your answer to 4 decimals. (No Rounding) 1. Earnings Per Share (EPS) 2. Current Ratio 3. Quick Ratio 4. Return on Assets 5. Profit Margin 6. Receivable Turnover 7. Debt Ratio 8. Inventory Turnover 9. Return on Equity 10. Price to Earnings Ratio 1. 2. Carry out your answers 4 decimal places. Rounded answers will be considered incorrect and 1/2 credit will be taken o Ratios Analysis The balance sheet and income teen shown below are for ABC Compound the data are to be used for problems 1.10. Note that the form has ne motivation charge does not least, und none of its de mest be retired during the next 3 years notes payable will be rolled over BALANCE SHEET Cash Aects receivable Inventions Total current assets 598.000 138.000 422.000 1700 000 Accounts payable Notes payable Total current abilities 3344.000 190.000 540,000 Need Assets Net plant & equip Long-term bonde Total Liabilities 457.000 $97.000 $2.000.000 Common stock Retained earnings Totalcommon equity Total abilities & equity 550.000 2.041.000 $2.591,000 Total assets 13.500.000 13560000 INCOME STATEMENT Net Sales Operating costs Depreciation EBIT Less interest EBT Les Taxes (34) Net income 32.311.000 1.344.000 276.000 5091.000 141 000 3560.000 3187000 1363.000 OTHER DATA Shares outstanding Common dividends Interest rate on NP and long-term bonds Federal plus state income tax rate Year-end stock price 150.000 550.000 6.00 34% 525.00 Calculate the following 10 financial ratios and carry out your answer to 4 decimals. (No Rounding) 1. Earnings Per Share (EPS) 2. Current Ratio 3. Quick Ratio 4. Return on Assets 5. Profit Margin 6. Receivable Turnover 7. Debt Ratio 8. Inventory Turnover 9. Return on Equity 10. Price to Earnings Ratio