Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 2 . OHaganBooks.com is seeking a $ 2 9 0 , 0 0 0 loan to finance its continuing losses. One of the best

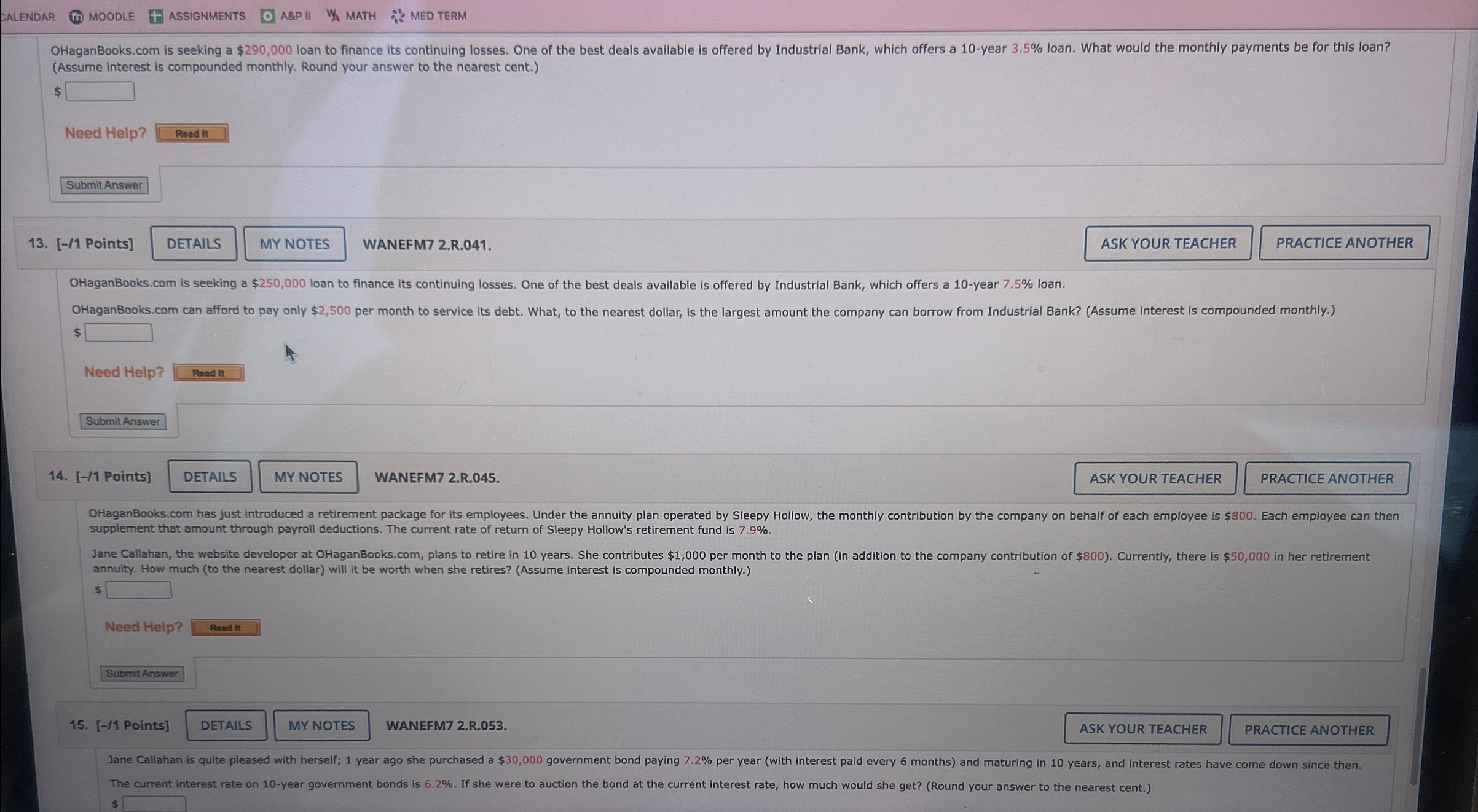

OHaganBooks.com is seeking a $ loan to finance its continuing losses. One of the best deals available is offered by Industrial Bank, which offers a year loan. What would the monthly payments be for this loan?Assume interest is compounded monthly. Round your answer to the nearest cent.Relaunch to update :Need Help?Read ItSubmit Answe

PointsDETAILSMY NOTESWANEFMRASK YOUR TEACHERPRACTICE ANOTHEROHaganBooks.com is seeking a $ loan to finance its continuing losses. One of the best deals available is offered by Industrial Bank, which offers a year loan.OHaganBooks.com can afford to pay only $ per month to service its debt. What, to the nearest dollar, is the largest amount the company can borrow from Industrial Bank? Assume interest is compounded monthly.Need Help?Submit Answe

PointsDETAILSMY NOTESWANEFMRASK YOUR TEACHERPRACTICE ANOTHEROHaganBooks.com has just introduced a retirement package for its employees. Under the annuity plan operated by Sleepy Hollow, the monthly contribution by the company on behalf of each employee is $ Each employee can then supplement that amount through payroll deductions. The current rate of return of Sleepy Hollow's retirement fund is Jane Callahan, the website developer at HaganBooks.com, plans to retire in years. She contributes $ per month to the plan in addition to the company contribution of $ Currently, there is $ in her retirement annuity. How much to the nearest dollar will it be worth when she retires? Assume interest is compounded monthly.Need Help?Submit Answe

PointsRead ItDETAILSMY NOTESWANEFMRASK YOUR TEACHERPRACTICE ANOTHERJane Callahan is quite pleased with herself; year ago she purchased a $ government bond paying per year with interest paid every months and maturing in years, and interest rates have come down since then.The current interest rate on year government bonds is If she were to auction the bond at the current interest rate, how much would she get? Round your answer to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started