Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. (Please check if im right) Which of the following is correct in regard to held-to-maturity securities? They are debt securities. Unrealized holding gains

1.

2. (Please check if im right)

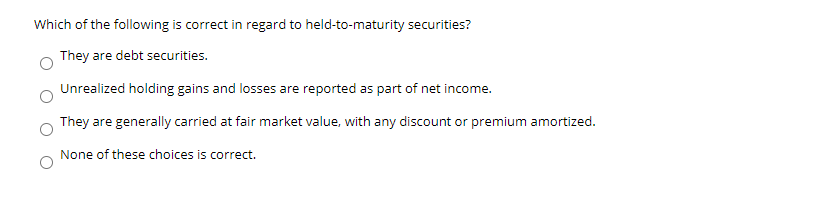

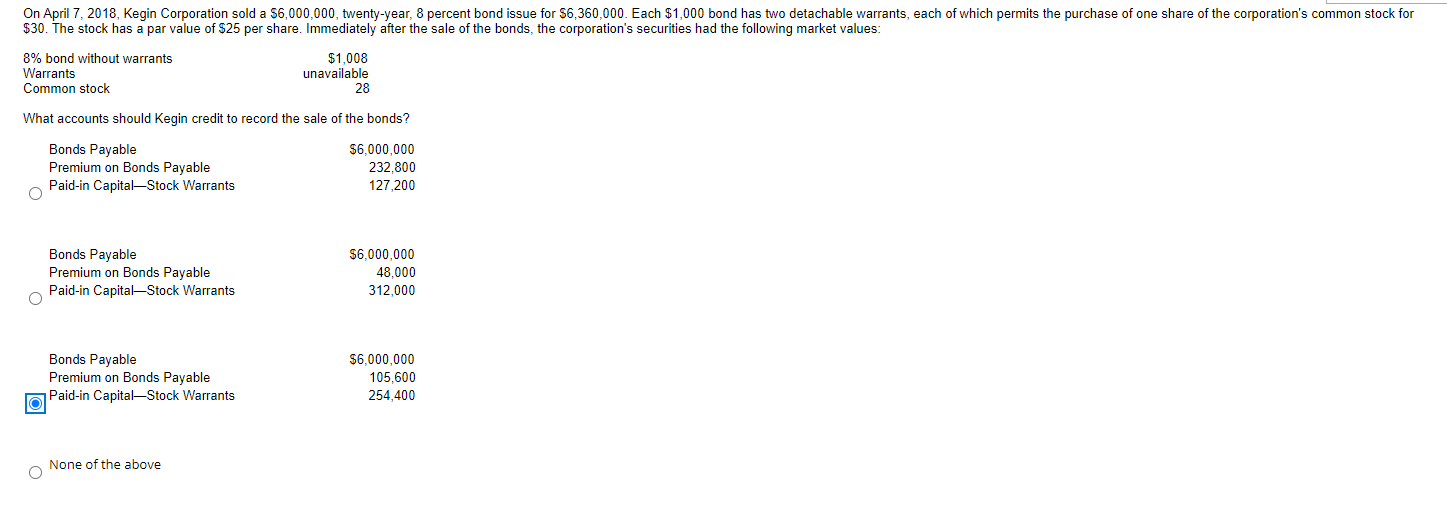

Which of the following is correct in regard to held-to-maturity securities? They are debt securities. Unrealized holding gains and losses are reported as part of net income. They are generally carried at fair market value, with any discount or premium amortized. None of these choices is correct. On April 7, 2018, Kegin Corporation sold a $6,000,000, twenty-year, 8 percent bond issue for $6,360,000. Each $1,000 bond has two detachable warrants, each of which permits the purchase of one share of the corporation's common stock for $30. The stock has a par value of $25 per share. Immediately after the sale of the bonds, the corporation's securities had the following market values: 8% bond without warrants Warrants Common stock $1,008 unavailable 28 What accounts should Kegin credit to record the sale of the bonds? Bonds Payable Premium on Bonds Payable Paid-in CapitalStock Warrants $6,000,000 232.800 127,200 Bonds Payable Premium on Bonds Payable Paid-in Capital-Stock Warrants $6.000.000 48,000 312.000 Bonds Payable Premium on Bonds Payable Paid-in Capital-Stock Warrants $6,000,000 105,600 254,400 None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started