Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. please explain how to solve c part for both questions. Thank you!! OA-14 Close Date: Sat, Apr 9, 2022, 04:00 PM Question 5

1.

2.

please explain how to solve c part for both questions.

Thank you!!

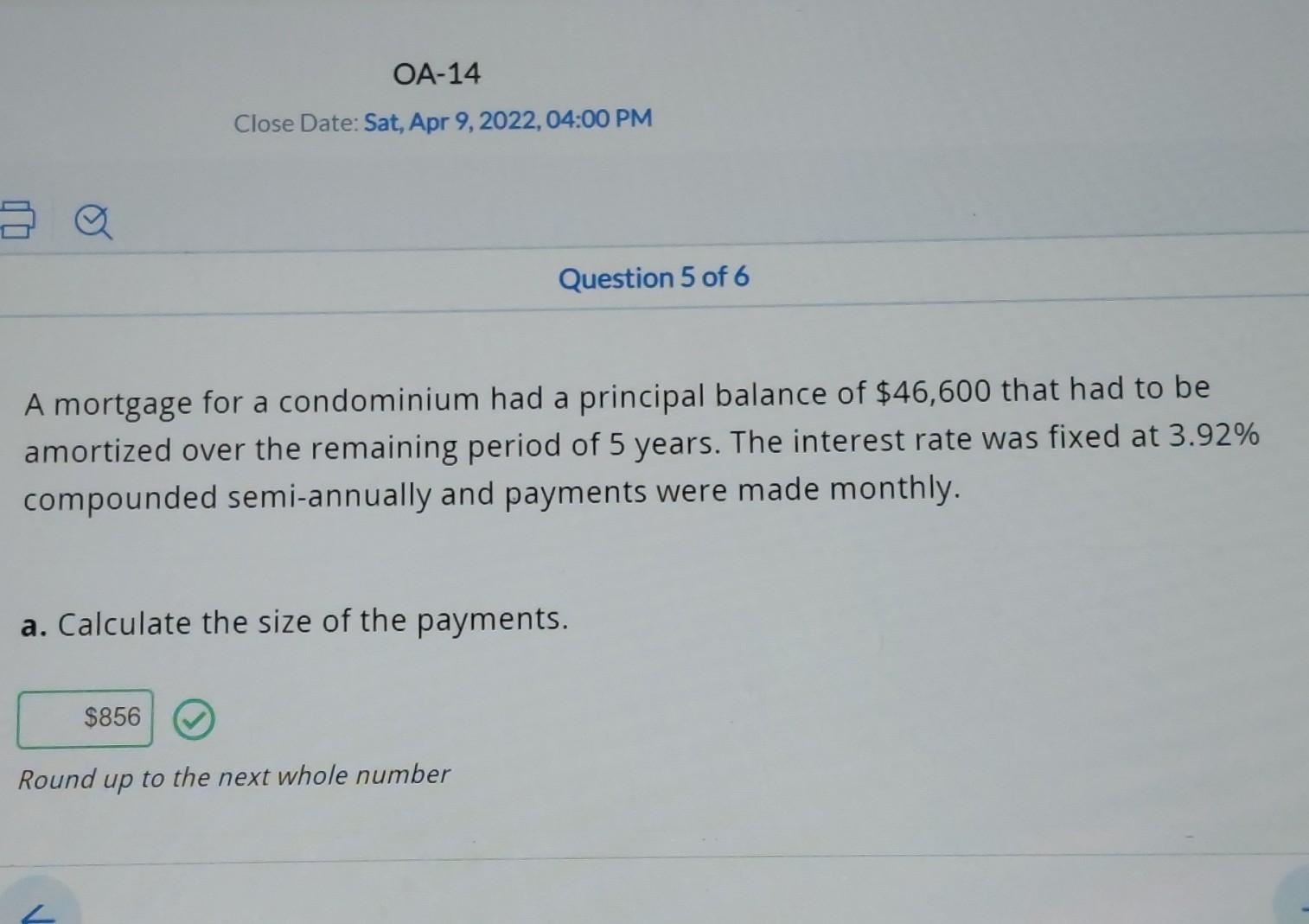

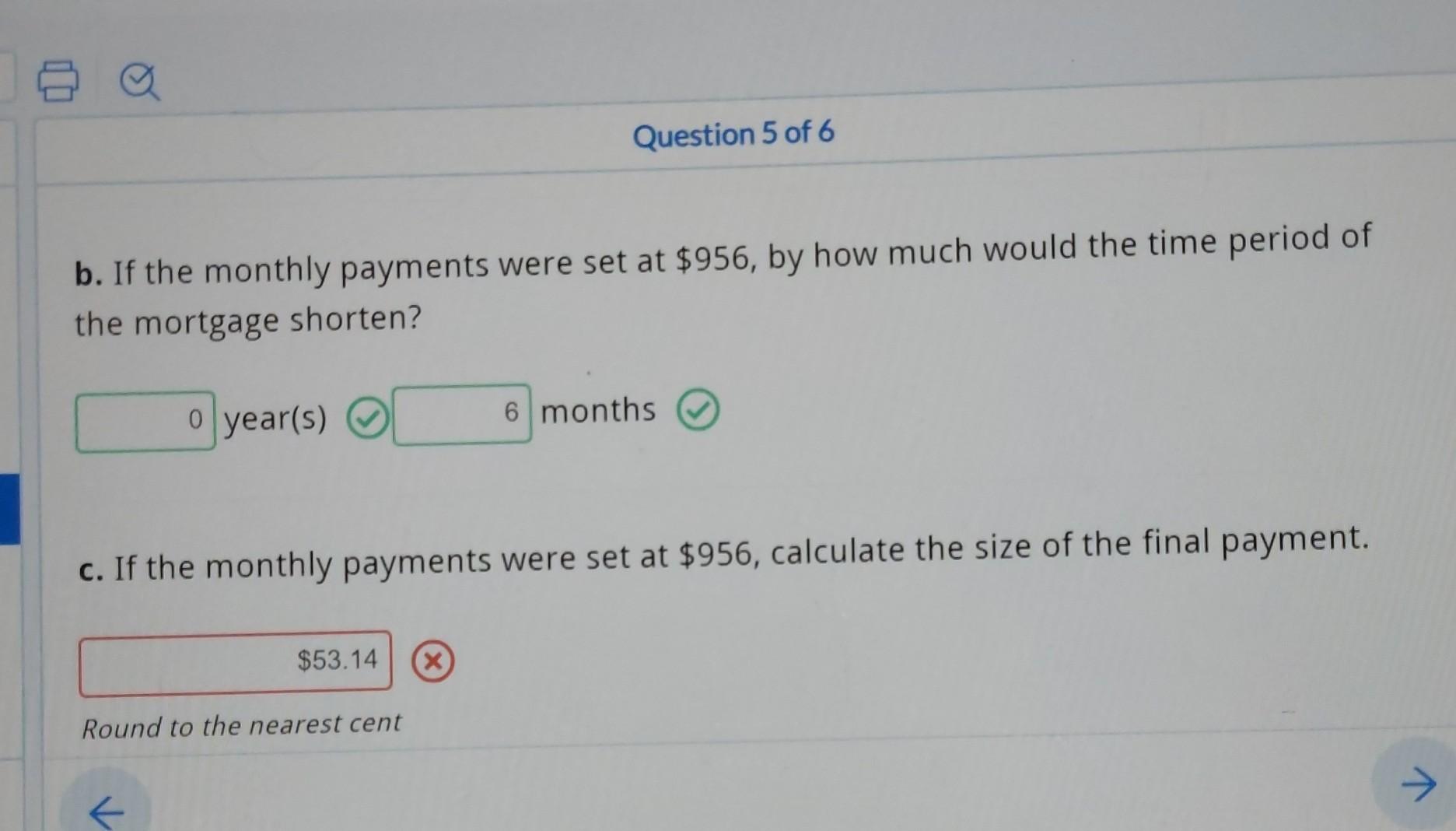

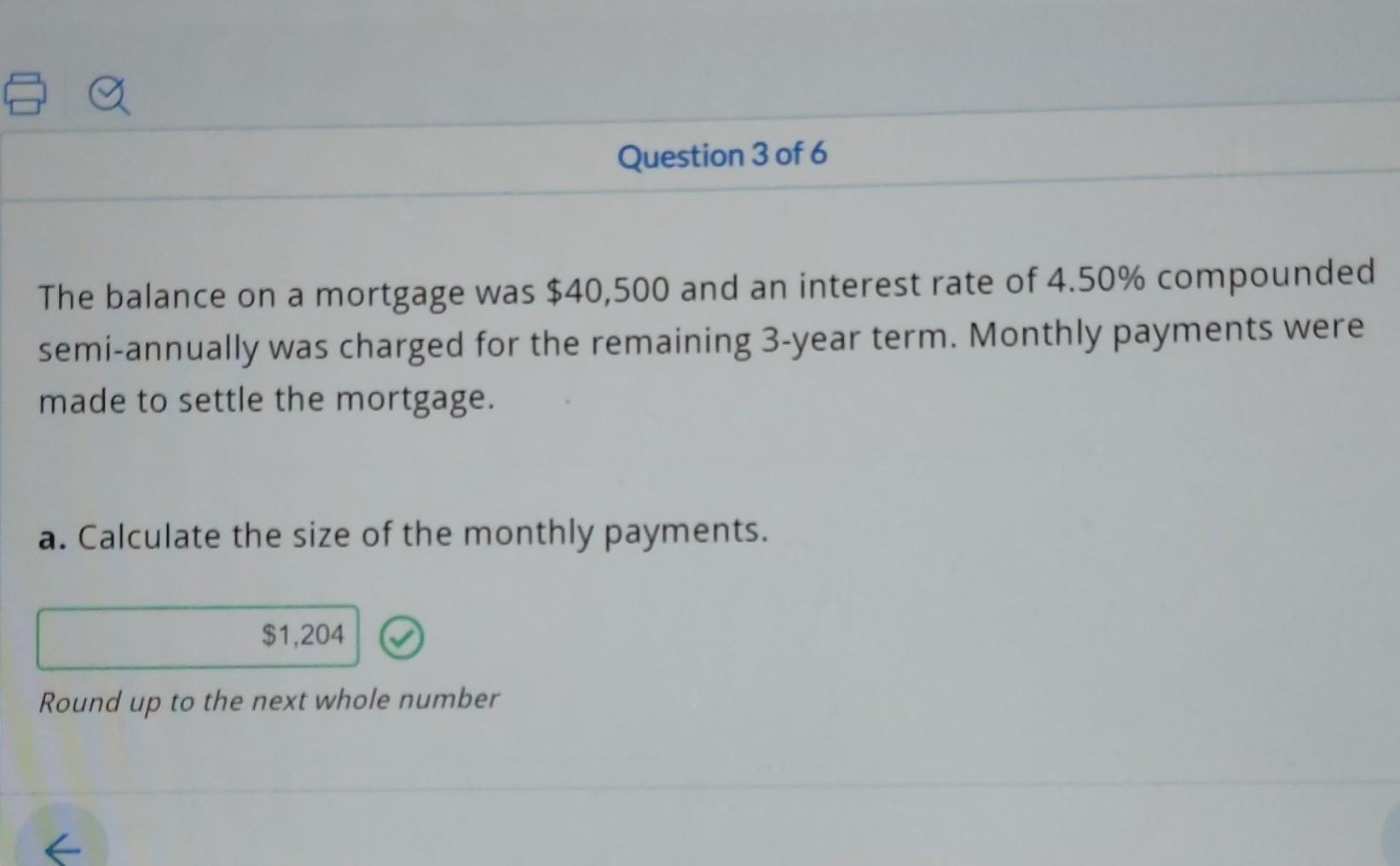

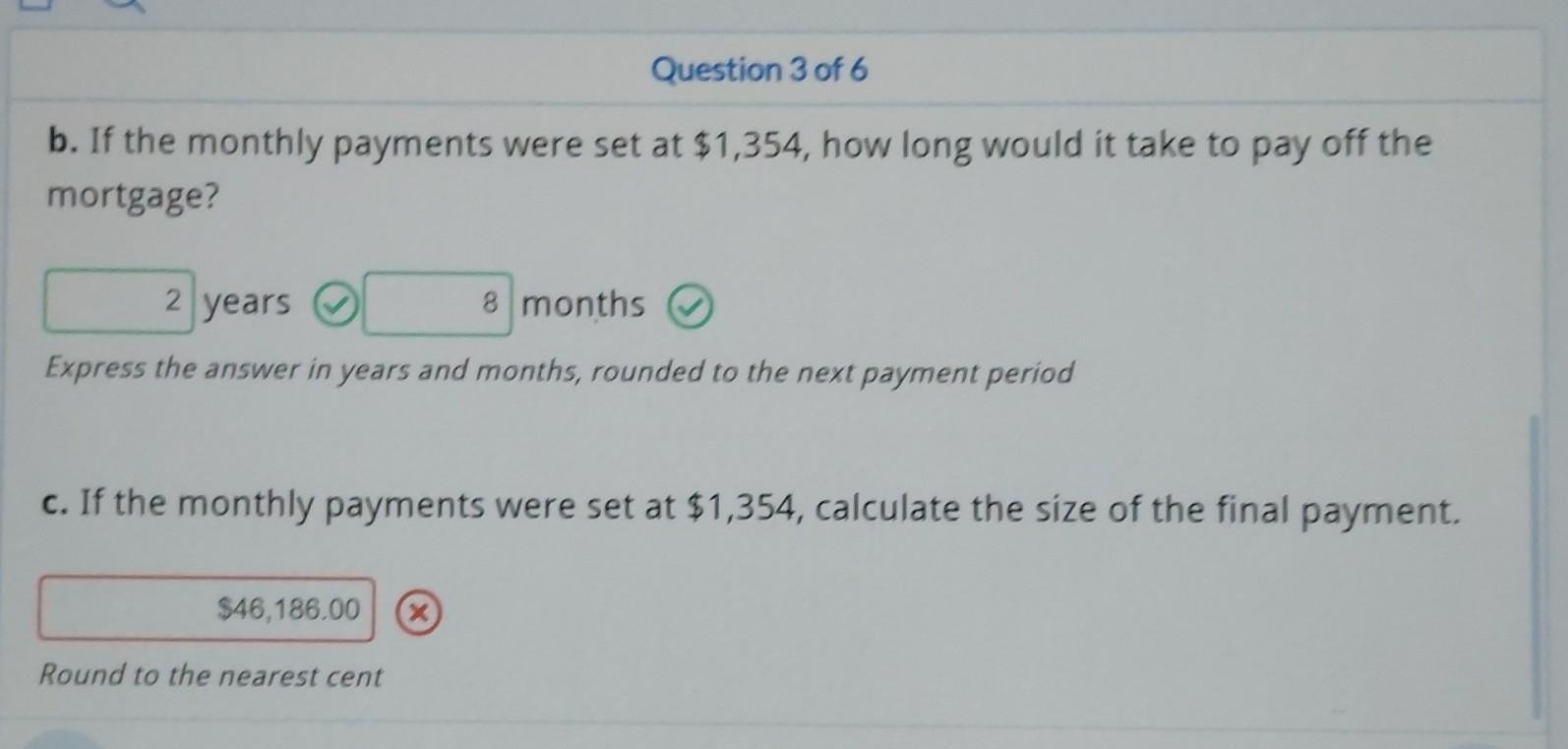

OA-14 Close Date: Sat, Apr 9, 2022, 04:00 PM Question 5 of 6 a A mortgage for a condominium had a principal balance of $46,600 that had to be amortized over the remaining period of 5 years. The interest rate was fixed at 3.92% compounded semi-annually and payments were made monthly. a. Calculate the size of the payments. $856 Round up to the next whole number Question 5 of 6 b. If the monthly payments were set at $956, by how much would the time period of the mortgage shorten? 0 year(s) 6 months c. If the monthly payments were set at $956, calculate the size of the final payment. $53.14 X Round to the nearest cent > Question 3 of 6 The balance on a mortgage was $40,500 and an interest rate of 4.50% compounded semi-annually was charged for the remaining 3-year term. Monthly payments were made to settle the mortgage. a. Calculate the size of the monthly payments. $1,204 Round to the next whole number k Question 3 of 6 b. If the monthly payments were set at $1,354, how long would it take to pay off the mortgage? 2 years 8 months Express the answer in years and months, rounded to the next payment period c. If the monthly payments were set at $1,354, calculate the size of the final payment. $46,186.00 Round to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started