Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. [2 points] Suppose that 7 years ago you bought a home for $350,000, paying 20% as a down payment, and financing the rest

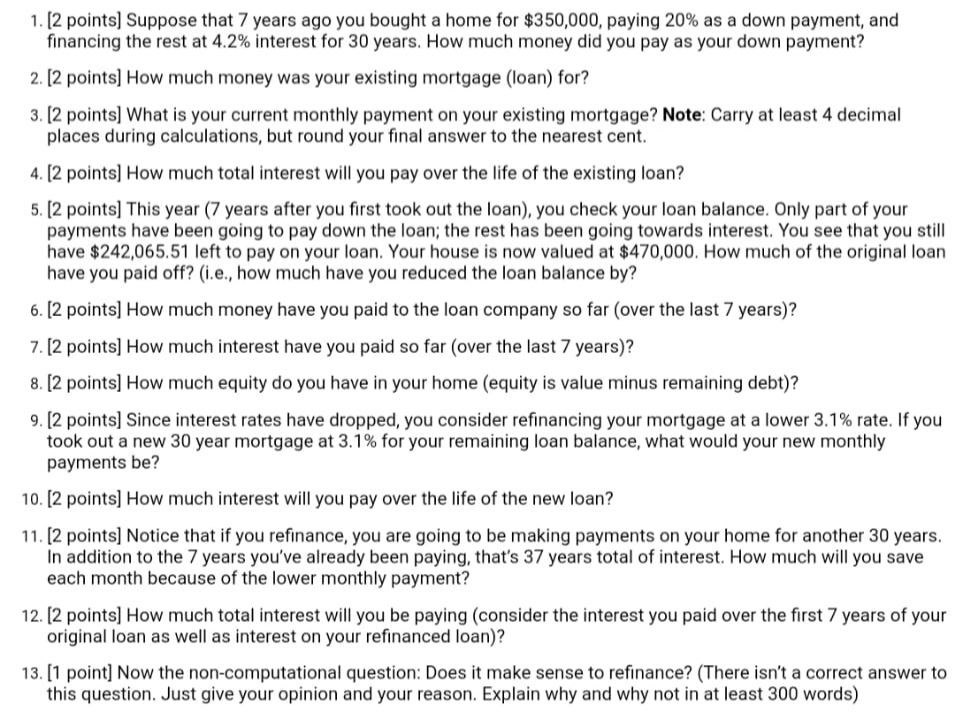

1. [2 points] Suppose that 7 years ago you bought a home for $350,000, paying 20% as a down payment, and financing the rest at 4.2% interest for 30 years. How much money did you pay as your down payment? 2. [2 points] How much money was your existing mortgage (loan) for? 3. [2 points] What is your current monthly payment on your existing mortgage? Note: Carry at least 4 decimal places during calculations, but round your final answer to the nearest cent. 4. [2 points] How much total interest will you pay over the life of the existing loan? 5. [2 points] This year (7 years after you first took out the loan), you check your loan balance. Only part of your payments have been going to pay down the loan; the rest has been going towards interest. You see that you still have $242,065.51 left to pay on your loan. Your house is now valued at $470,000. How much of the original loan have you paid off? (i.e., how much have you reduced the loan balance by? 6. [2 points] How much money have you paid to the loan company so far (over the last 7 years)? 7. [2 points] How much interest have you paid so far (over the last 7 years)? 8. [2 points] How much equity do you have in your home (equity is value minus remaining debt)? 9. [2 points] Since interest rates have dropped, you consider refinancing your mortgage at a lower 3.1% rate. If you took out a new 30 year mortgage at 3.1% for your remaining loan balance, what would your new monthly payments be? 10. [2 points] How much interest will you pay over the life of the new loan? 11. [2 points] Notice that if you refinance, you are going to be making payments on your home for another 30 years. In addition to the 7 years you've already been paying, that's 37 years total of interest. How much will you save each month because of the lower monthly payment? 12. [2 points] How much total interest will you be paying (consider the interest you paid over the first 7 years of your original loan as well as interest on your refinanced loan)? 13. [1 point] Now the non-computational question: Does it make sense to refinance? (There isn't a correct answer to this question. Just give your opinion and your reason. Explain why and why not in at least 300 words)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started