1.

2.

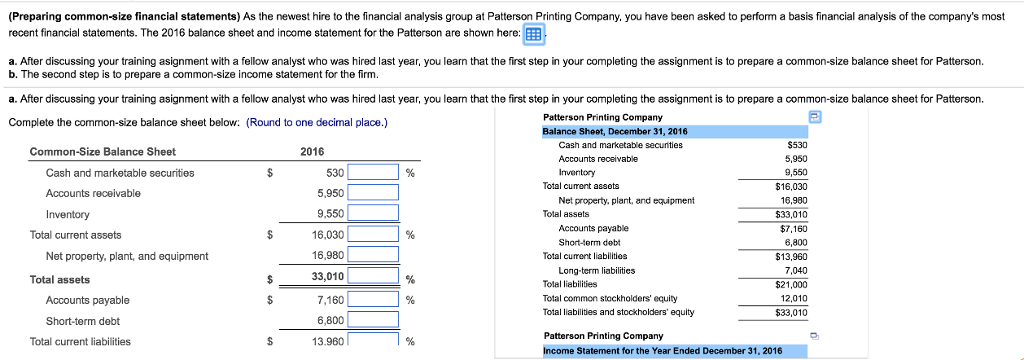

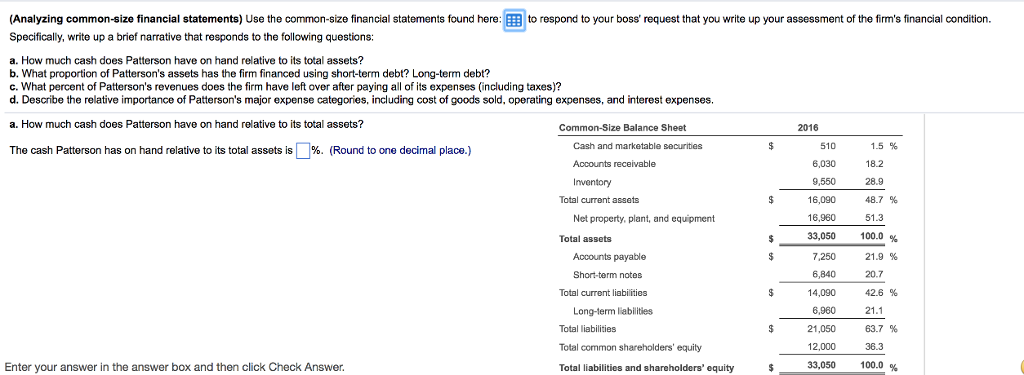

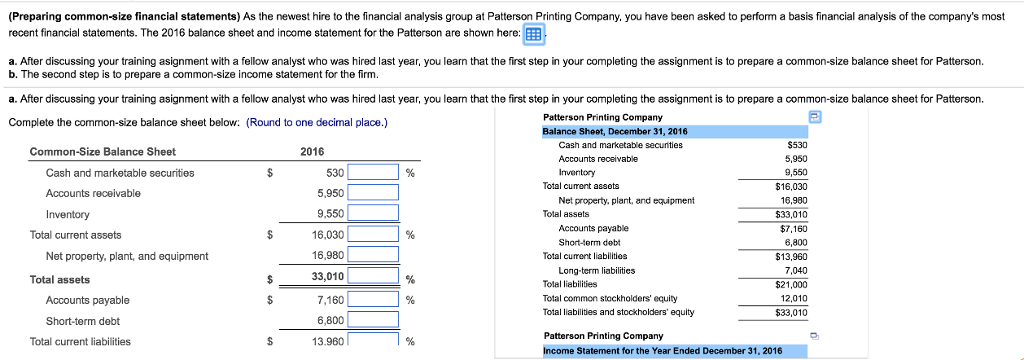

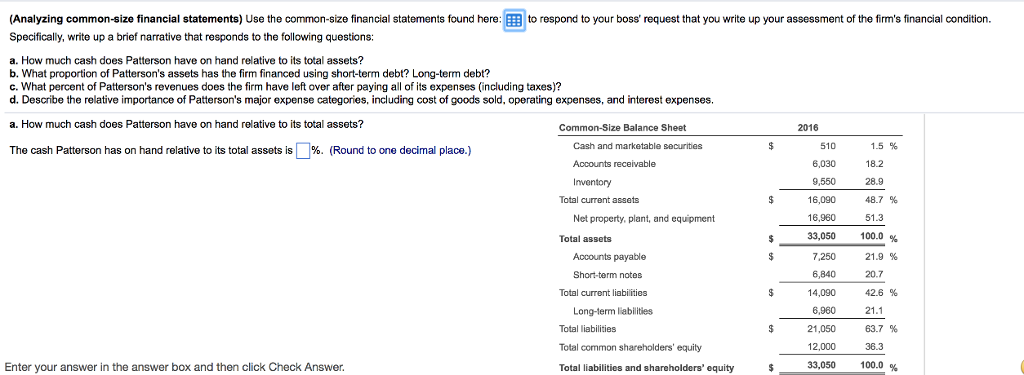

(Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to perform a basis financial analysis of the company's most recent financial statements. The 2016 balance sheet and income statement for the Patterson are shown here: a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. b. The second step is to prepare a common-size income statement for the firm. a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. Complete the common-size balance sheet below: (Round to one decimal place.) Patterson Printing Company Balance Sheet, December 31, 2016 S530 5,950 9,550 $16,030 16,980 533,010 $7,160 6,800 $13,960 7,040 $21,000 12,010 $33,010 Cash and marketable securties Accounts receivable Common-Size Balance Sheet 2016 530 5,950 9,550 16,030 16,980 33,010 7,160 6,800 13.960 Cash and marketable securities Total cument assets Accounts receivable Net property, plant, and equipment Total assets Accounts payable Total current assets Short-term debt Net property, plant, and equipment Total curent liabiltles Long-term liabilities Total liabilities Total common stockholders' equity Total liabilities and stockholders' equity Total assets Accounts payable Short-term debt Patterson Printing Company Income Statement for the Year Ended December 31, 2016 Total current liabilities (Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to perform a basis financial analysis of the company's most recent financial statements. The 2016 balance sheet and income statement for the Patterson are shown here: a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. b. The second step is to prepare a common-size income statement for the firm. a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. Complete the common-size balance sheet below: (Round to one decimal place.) Patterson Printing Company Balance Sheet, December 31, 2016 S530 5,950 9,550 $16,030 16,980 533,010 $7,160 6,800 $13,960 7,040 $21,000 12,010 $33,010 Cash and marketable securties Accounts receivable Common-Size Balance Sheet 2016 530 5,950 9,550 16,030 16,980 33,010 7,160 6,800 13.960 Cash and marketable securities Total cument assets Accounts receivable Net property, plant, and equipment Total assets Accounts payable Total current assets Short-term debt Net property, plant, and equipment Total curent liabiltles Long-term liabilities Total liabilities Total common stockholders' equity Total liabilities and stockholders' equity Total assets Accounts payable Short-term debt Patterson Printing Company Income Statement for the Year Ended December 31, 2016 Total current liabilities