1) 2)

2)

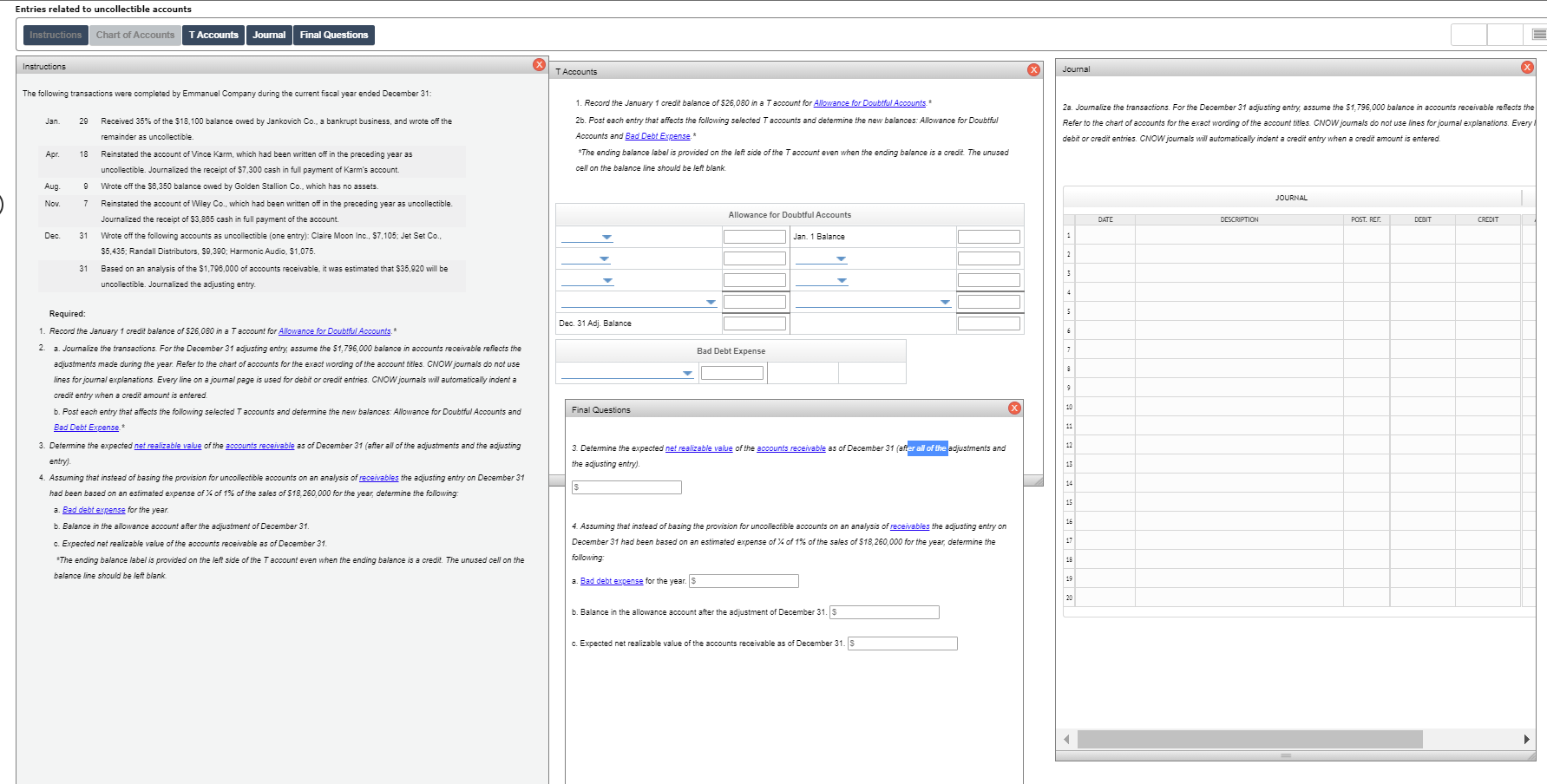

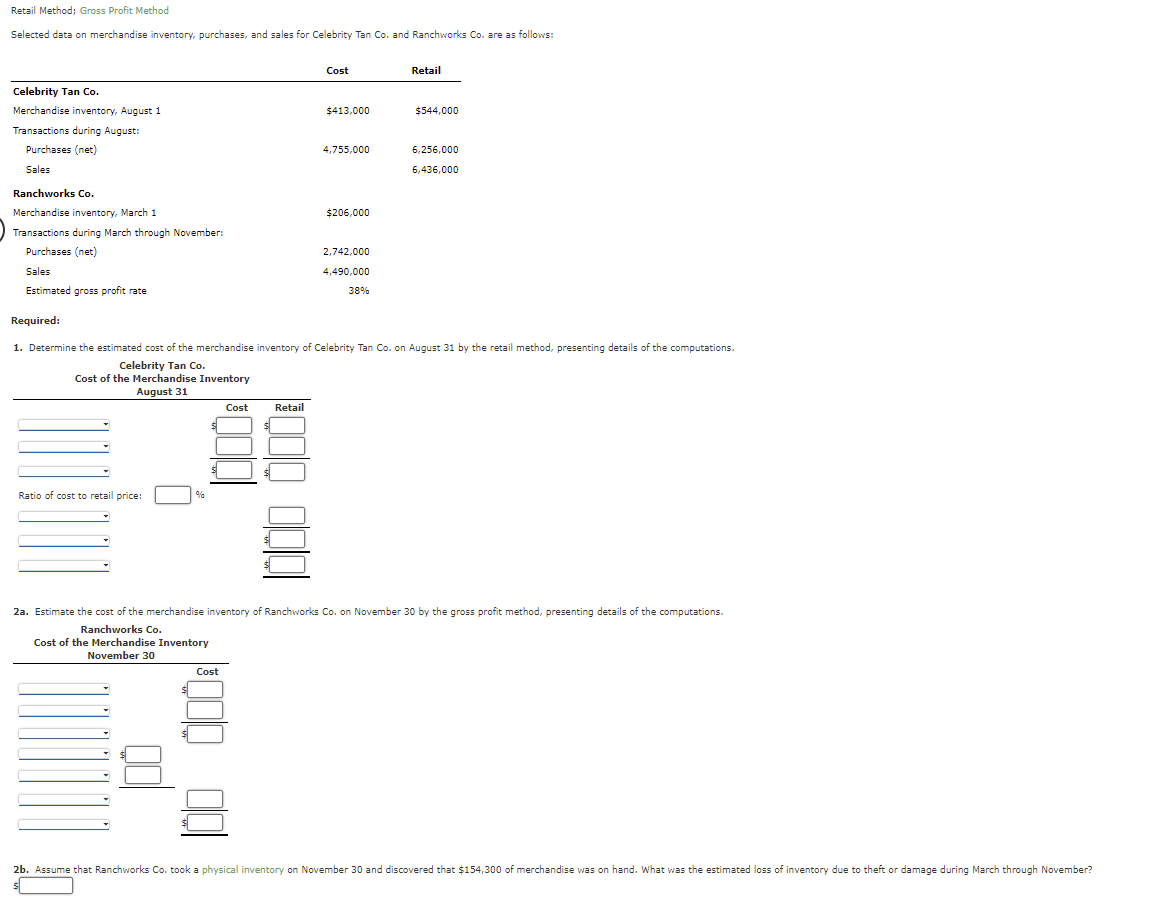

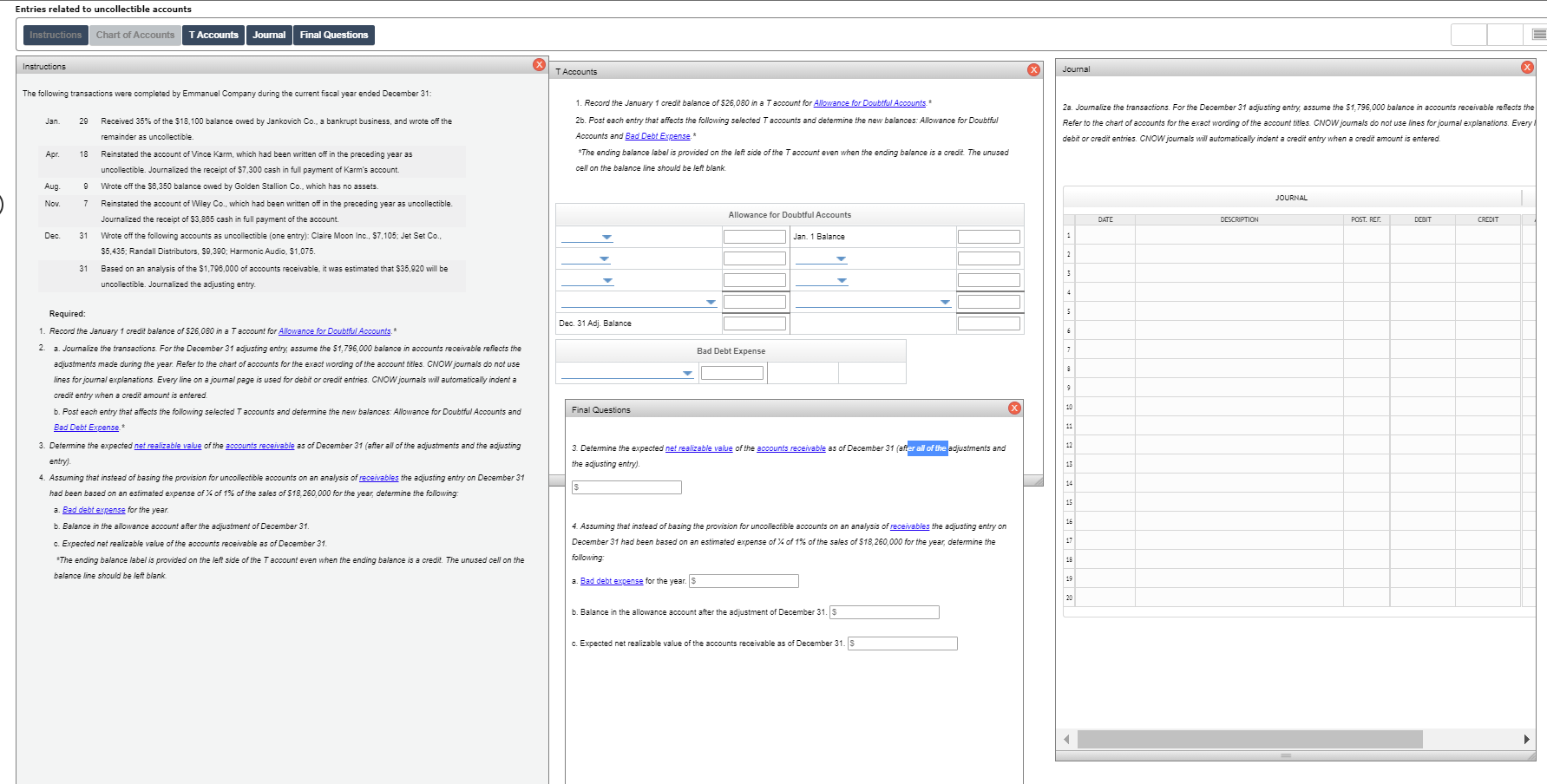

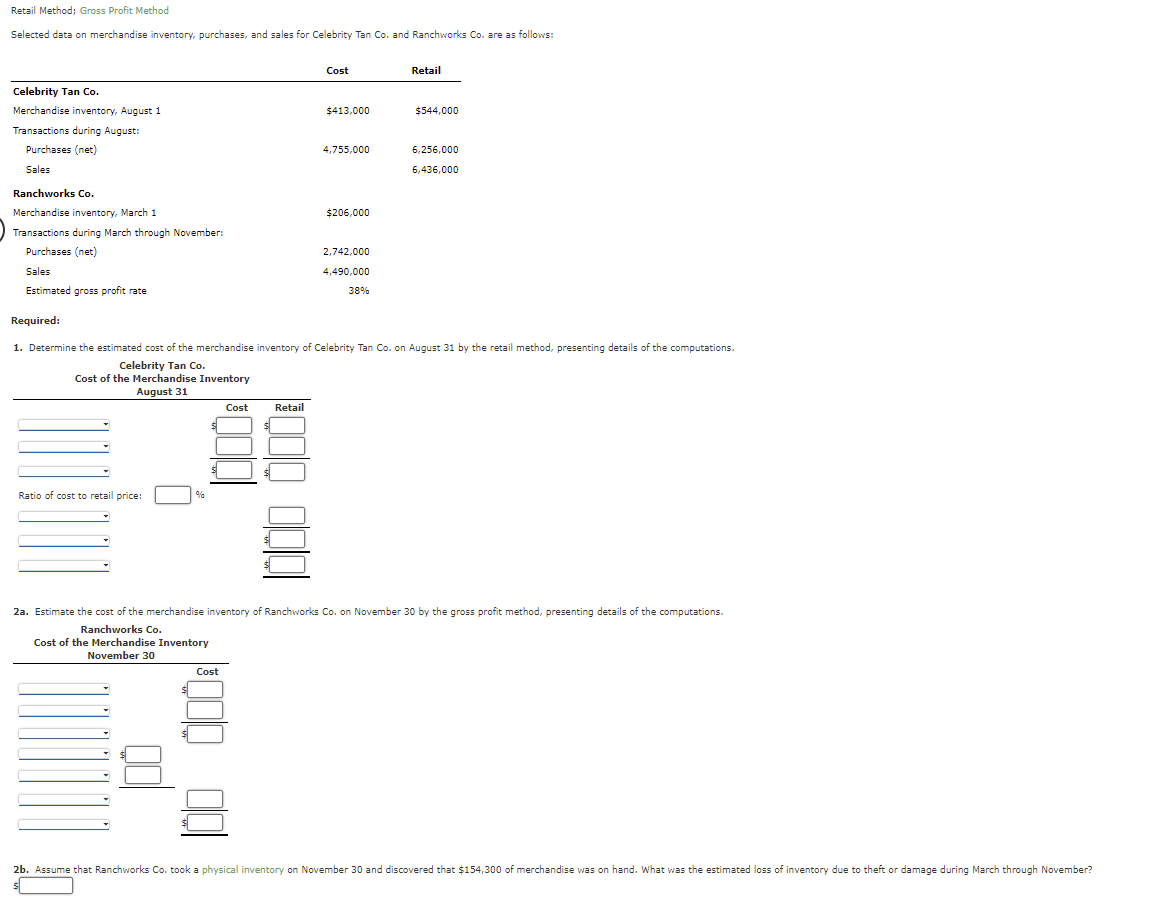

Retail Method: Gross Profit Method Selected data on merchandise inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Cost Retail $413,000 $544,000 Celebrity Tan Co. Merchandise inventory, August 1 Transactions during August: Purchases (net) 4,755,000 6,256,000 Sales 6,436,000 $206,000 Ranchworks Co. Merchandise inventory, March 1 Transactions during March through November: Purchases (net) Sales Estimated gross profit rate 2,742,000 4,490,000 38% Required: 1. Determine the estimated cost of the merchandise inventory of Celebrity Tan Co. on August 31 by the retail method, presenting details of the computations. Celebrity Tan Co. Cost of the Merchandise Inventory August 31 Cost Retail Ratio of cost to retail price: 2a. Estimate the cost of the merchandise inventory of Ranchworks Co. on November 30 by the gross profit method, presenting details of the computations. Ranchworks Co. Cost of the Merchandise Inventory November 30 Cost On 00 2b. Assume that Ranchworks Co. took a physical inventory on November 30 and discovered that $154,300 of merchandise was on hand. What was the estimated loss of inventory due to theft or damage during March through November? Entries related to uncollectible accounts Instructions Chart of Accounts T Accounts Journal Final Questions Instructions TAccounts x Journal The following transactions were completed by Emmanuel Company during the current fiscal year ended December 31 Jan 29 Received 35% of the $18,100 balance owed by Jankovich Co., a bankrupt business, and wrote off the remainder as uncollectible 1. Record the January 1 credit balance of 526,080 in a T account for Allowance for Doubtful Accounts 2b. Post each entry that affects the following selected T accounts and determine the new balances: Allowance for Doubtful Accounts and Bad Debt Expense* *The ending balance label is provided on the left side of the Taccount even when the ending balance is a credit. The unused cell on the balance line should be left blank 2a. Journalize the transactions. For the December 31 adjusting entry, assume the $1,796,000 balance in accounts receivable reflects the Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every debitor credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Apr. 18 Aug 9 JOURNAL Nov. 7 Allowance for Doubtful Accounts Reinstated the account of Vince Karm, which had been written off in the preceding year as uncollectible. Journalized the receipt of $7.300 cash in full payment of Karm's account. Wrote off the $6.350 balance owed by Golden Stallion Co., which has no assets. Reinstated the account of Wiley Co., which had been written off in the preceding year as uncollectible Journalized the receipt of $3,885 cash in full payment of the account. Wrote off the following accounts as uncollectible (one entry): Claire Moon Inc., 57,105: Jet Set Co., $5,435Randall Distributors. 89,390: Harmonic Audio. $1.075. Based on an analysis of the $1,796,000 of accounts receivable, it was estimated that S35,920 will be uncollectible. Journalized the adjusting entry. DATE DESCRIPTION POST. REF. DOBIT CREDIT Dec 31 Jan. 1 Balance 2 31 3 4 S Dec 31 Adj. Balance 6 Bad Debt Expense Required: 1. Record the January 1 credit balance of S26.080 in a T account for Allowance for Doubtful Accounts.* 2. a. Journalize the transactions. For the December 31 adjusting entry, assume the S1,796,000 balance in accounts receivable reflects the adjustments made during the year. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indenta credit entry when a credit amount is entered b. Post each entry that affects the following selected T accounts and determine the new balances: Allowance for Doubtful Accounts and Bad Debt Expense 8 Final Questions 3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry) 3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry) S 15 16 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on December 31 had been based on an estimated expense of % of 1% of the sales of 518,260,000 for the year, determine the following a. Bad debt expense for the year. b. Balance in the allowance account after the adjustment of December 31. c. Expected net realizable value of the accounts receivable as of December 31. *The ending balance label is provided on the left side of the Taccount even when the ending balance is a credit. The unused cell on the balance line should be left blank 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on December 31 had been based on an estimated expense of % of 1% of the sales of $18.260,000 for the year, determine the following a. Bad debt expense for the year. S b. Balance in the allowance account after the adjustment of December 31. $ c. Expected net realizable value of the accounts receivable as of December 31. S

2)

2)