Answered step by step

Verified Expert Solution

Question

1 Approved Answer

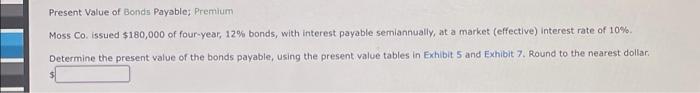

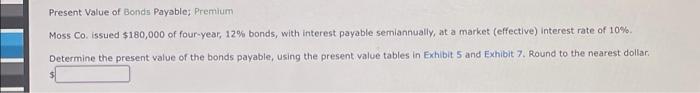

1) 2) using same exhibits in previous part Present Value of Bonds Payable; Premium Moss Co. Issued $180,000 of four-year, 12% bonds, with interest payable

1)

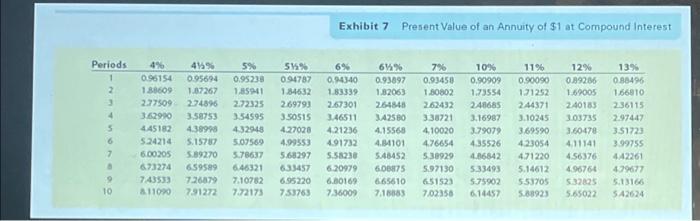

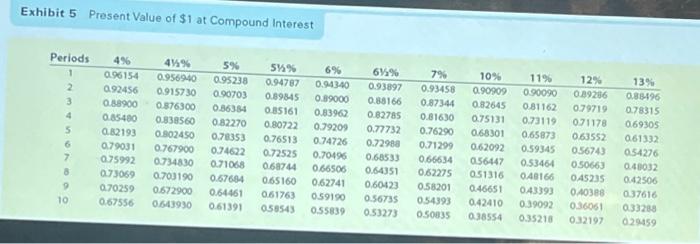

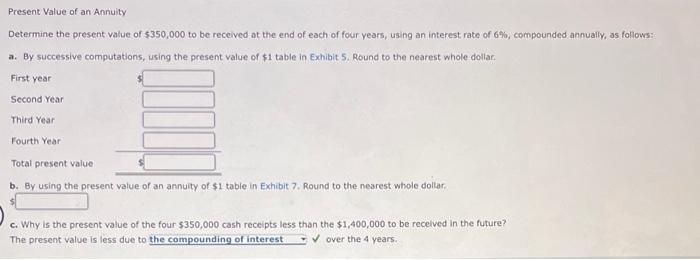

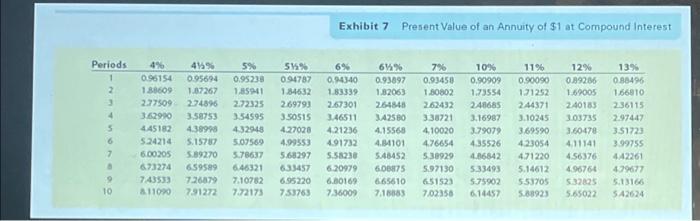

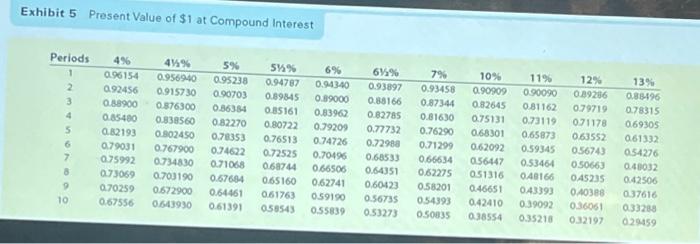

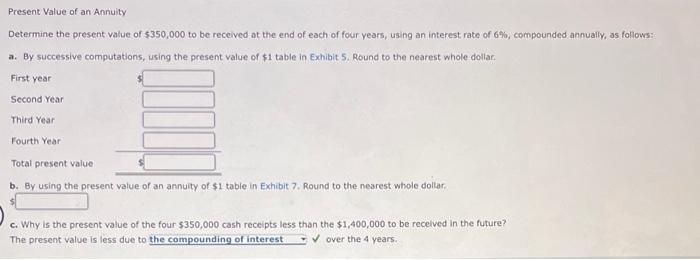

Present Value of Bonds Payable; Premium Moss Co. Issued $180,000 of four-year, 12% bonds, with interest payable semiannually, at a market (effective) interest rate of 10% Determine the present value of the bonds payable, using the present value tables in Exhibit 5 and Exhibit 7. Round to the nearest dollar Exhibit 7 Present Value of an Annuity of $1 at Compound Interest Periods 1 2 4 5 6 7 4% 0.96154 1.88609 2.77509 3.62900 445182 5.24214 6.00205 673274 743533 A11020 45 0.95694 1.87267 274896 3.58753 4.38993 5.15787 5.89270 659589 7.26879 791272 5% 0.95238 13541 2.72325 3.54595 4329448 5.07569 5.78637 6.46321 7.10782 7.72173 56% 094787 1.84632 269793 3.50515 4.27028 4.99553 5.68297 6.33457 6.95220 753763 6% 0.94340 1.83339 2.67301 3.46511 4.21236 491732 S.58230 6.20979 6.00169 7.36000 67% 0.93897 1.32063 264845 3A2580 4.15568 4.9101 5.48452 608875 665610 7.16383 7% 0.93458 1.80802 262432 3.38721 4.10020 4.76654 5.38929 5.97130 6.51523 7.02350 10% 0.90909 1.73554 248685 3.16987 3.79079 4.35526 4.16842 533493 5.75902 614457 11% 0.90090 121252 2.44371 3.10245 3.69590 423054 4.71220 5.14612 5.53705 5.88923 12% 0.89286 1.69005 240183 103735 3.60478 4.11141 4.56376 496764 532825 5.65022 13% 0.88496 166810 2:36115 2.97447 3.51723 3.99755 442261 4.79677 5.13166 5A2624 10 Exhibit 5 Present Value of $1 at Compound Interest Periods 1 2 3 5 G 7 8 . 10 4% 0.96154 092456 0.88900 0.85400 0.82193 0.79031 0.75992 0.73059 0.70259 0.67556 47% 0.956940 0.915730 0.376300 0.838560 0.802450 0.767900 0.734830 0.703190 0.572900 0.143930 5% 098238 0.90703 0.36354 0.82270 0.78353 0.74622 0.71068 0.67684 0.64451 0.61391 5%% 0.94787 0.89845 0.85161 0.80722 0.76513 0.72525 0.68744 0.65160 0.61763 050543 6% 0.94340 0.89000 0.83962 0.79209 0.74726 0.70495 0.66506 0.62741 0.59190 0.55839 6%% 0.93897 0.80166 0.82785 0.77732 0.72983 0.68533 0.64351 0.60423 0.56735 0.53273 79 0.93458 0.87344 0.81630 0.76290 0.71299 0.66634 0.62275 0.58201 054393 0.50035 10% 0.90909 0.32645 0.75131 0.68301 0.62092 056447 051316 0.46651 0.42410 0.38554 11% 090090 0.81162 073119 0.65873 0.59345 0.53464 0.40166 043393 0.39092 0.35210 12% 0.89236 0.79719 071178 0.63552 0.56743 0.50663 045235 010388 0.36051 0.32197 13% 0.89496 0.78315 0.69305 0.61332 054276 040032 0.42506 0.37616 0.33288 029459 Present Value of an Annuity Determine the present value of $350,000 to be received at the end of each of four years, using an interest rate of 6%, compounded annually, as follows: a. By successive computations, using the present value of $1 table in exhibit S. Round to the nearest whole dollar. First year Second Year Third Year Fourth Year Total present value b. By using the present value of an annuity of $1 table in Exhibit 7. Round to the nearest whole dollar, c. Why is the present value of the four $350,000 cash receipts less than the $1,400,000 to be received in the future? The present value is less due to the compounding of interest over the 4 years

2)

using same exhibits in previous part

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started