Answered step by step

Verified Expert Solution

Question

1 Approved Answer

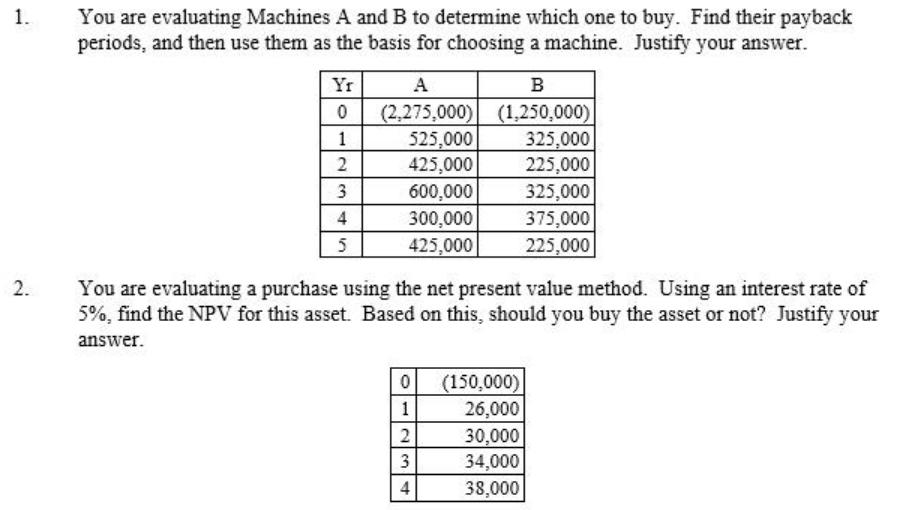

1. 2. You are evaluating Machines A and B to determine which one to buy. Find their payback periods, and then use them as

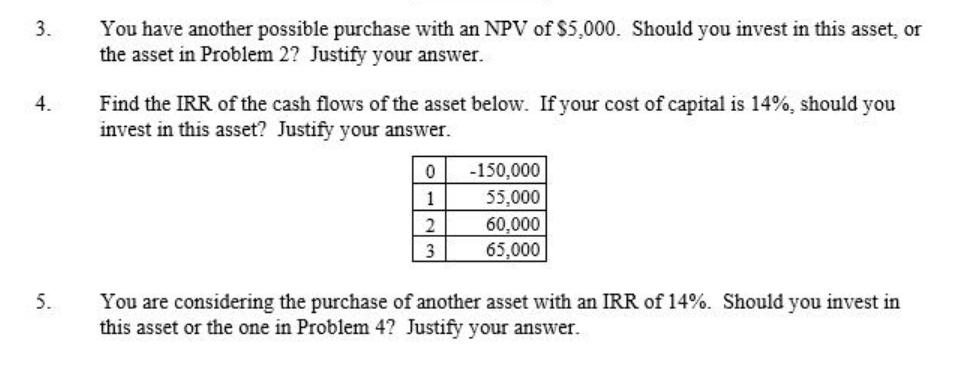

1. 2. You are evaluating Machines A and B to determine which one to buy. Find their payback periods, and then use them as the basis for choosing a machine. Justify your answer. Yr 0 12 2 3 4 5 A (2,275,000) 525,000 425,000 600,000 300,000 425,000 B (1,250,000) 325,000 225,000 0 1 2 3 4 You are evaluating a purchase using the net present value method. Using an interest rate of 5%, find the NPV for this asset. Based on this, should you buy the asset or not? Justify your answer. 325,000 375,000 225,000 (150,000) 26,000 30,000 34,000 38,000 3. 4. 5. You have another possible purchase with an NPV of $5,000. Should you invest in this asset, or the asset in Problem 2? Justify your answer. Find the IRR of the cash flows of the asset below. If your cost of capital is 14% , should you invest in this asset? Justify your answer. 0 1 2 23 3 -150,000 55,000 60,000 65,000 You are considering the purchase of another asset with an IRR of 14%. Should you invest in this asset or the one in Problem 4? Justify your answer.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the payback period of projects as follows Project A Year Cash Flow Cumulative Cash Flow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started