Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (25 points) Atlantic Company has purchased both shares of stock and a bond instrument from Bay Company. Bay shares sell at S8.00 per share.

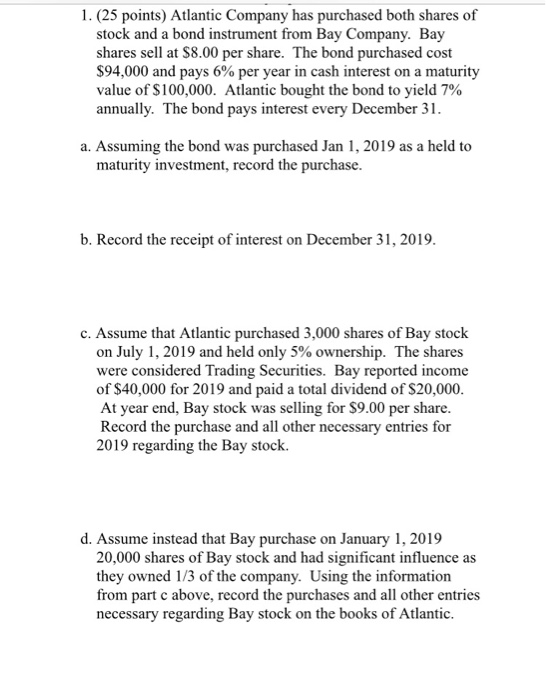

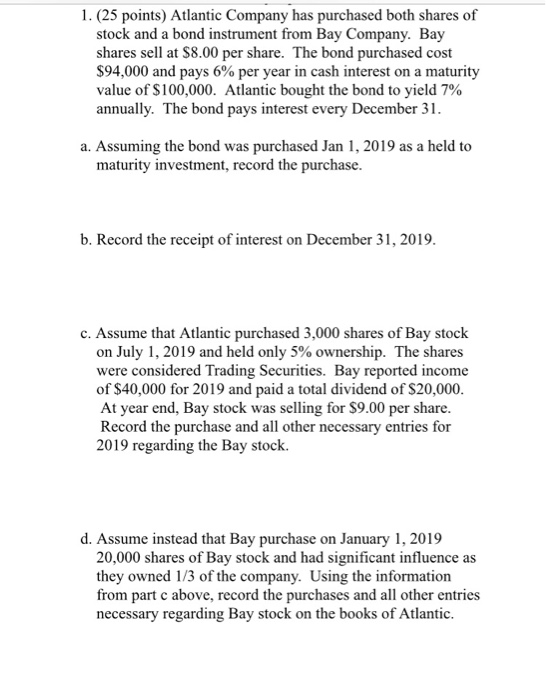

1. (25 points) Atlantic Company has purchased both shares of stock and a bond instrument from Bay Company. Bay shares sell at S8.00 per share. The bond purchased cost $94,000 and pays 6% per year in cash interest on a maturity value of $100,000. Atlantic bought the bond to yield 7% annually. The bond pays interest every December3 a. Assuming the bond was purchased Jan 1, 2019 as a held to maturity investment, record the purchase. b. Record the receipt of interest on December 31, 2019. c. Assume that Atlantic purchased 3,000 shares of Bay stock on July 1, 2019 and held only 5% ownership. The shares were considered Trading Securities. Bay reported income of $40,000 for 2019 and paid a total dividend of $20,000. At year end, Bay stock was selling for $9.00 per share. Record the purchase and all other necessary entries for 2019 regarding the Bay stock. d. Assume instead that Bay purchase on January 1, 2019 20,000 shares of Bay stock and had significant influence as they owned 1/3 of the company. Using the information from part c above, record the purchases and all other entries necessary regarding Bay stock on the books of Atlantic

1. (25 points) Atlantic Company has purchased both shares of stock and a bond instrument from Bay Company. Bay shares sell at S8.00 per share. The bond purchased cost $94,000 and pays 6% per year in cash interest on a maturity value of $100,000. Atlantic bought the bond to yield 7% annually. The bond pays interest every December3 a. Assuming the bond was purchased Jan 1, 2019 as a held to maturity investment, record the purchase. b. Record the receipt of interest on December 31, 2019. c. Assume that Atlantic purchased 3,000 shares of Bay stock on July 1, 2019 and held only 5% ownership. The shares were considered Trading Securities. Bay reported income of $40,000 for 2019 and paid a total dividend of $20,000. At year end, Bay stock was selling for $9.00 per share. Record the purchase and all other necessary entries for 2019 regarding the Bay stock. d. Assume instead that Bay purchase on January 1, 2019 20,000 shares of Bay stock and had significant influence as they owned 1/3 of the company. Using the information from part c above, record the purchases and all other entries necessary regarding Bay stock on the books of Atlantic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started