Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (25 points) Consider the following open economy. Furthermore, - the flat labor-income tax rate levied on households is 20%, the flat tax rate on

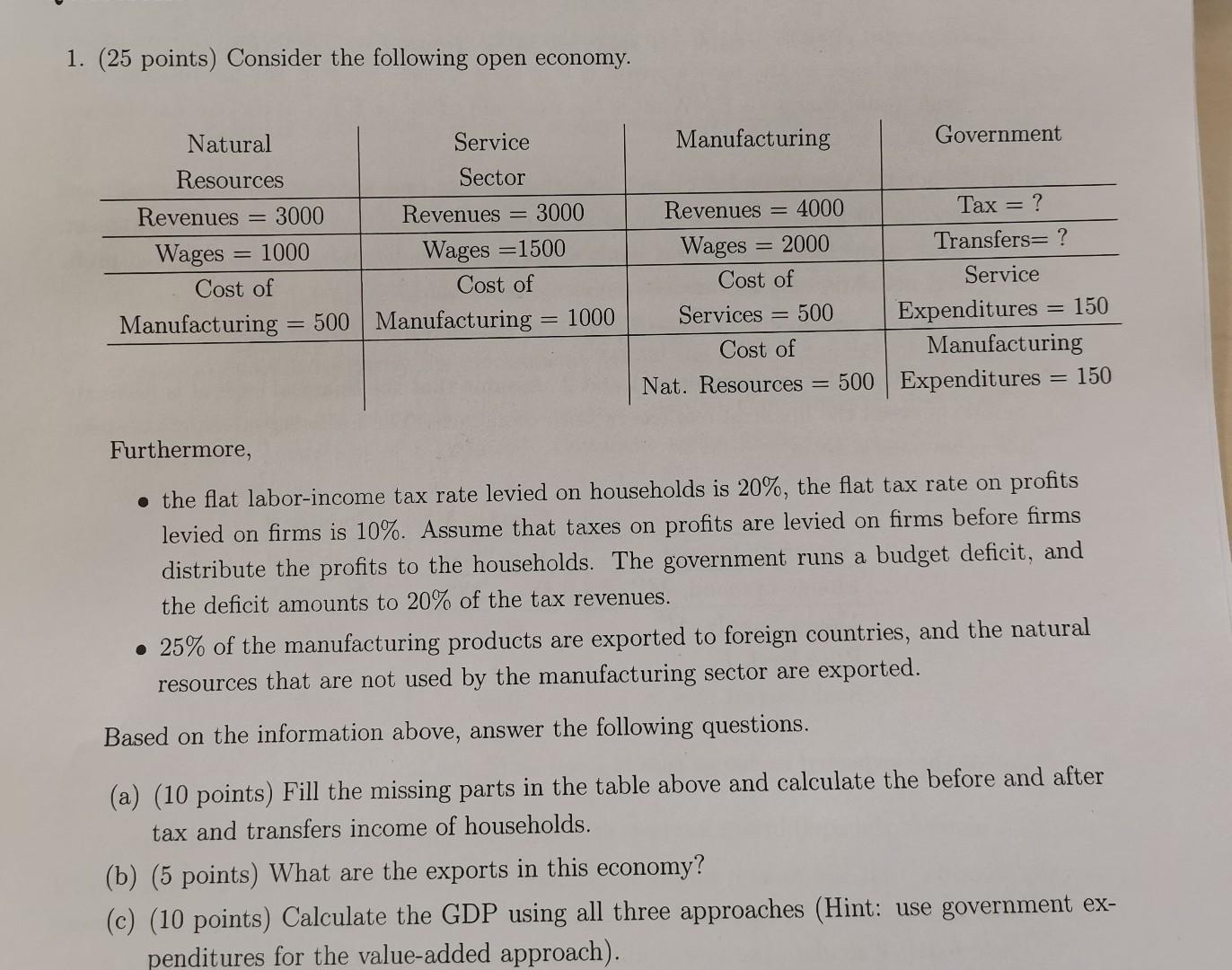

1. (25 points) Consider the following open economy. Furthermore, - the flat labor-income tax rate levied on households is 20%, the flat tax rate on profits levied on firms is 10%. Assume that taxes on profits are levied on firms before firms distribute the profits to the households. The government runs a budget deficit, and the deficit amounts to 20% of the tax revenues. - 25% of the manufacturing products are exported to foreign countries, and the natural resources that are not used by the manufacturing sector are exported. Based on the information above, answer the following questions. (a) (10 points) Fill the missing parts in the table above and calculate the before and after tax and transfers income of households. (b) (5 points) What are the exports in this economy? (c) (10 points) Calculate the GDP using all three approaches (Hint: use government expenditures for the value-added approach)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started