Question

1. 2.If the discount factor for an option that expires in 4 months is 0.80, what is the continuously-compounded interest rate? (Enter your answer in

1.

2.If the discount factor for an option that expires in 4 months is 0.80, what is the continuously-compounded interest rate? (Enter your answer in percent per year; e.g., 5.0 for five percent per year)

3.An implied volatility calculation provides a value for which of the following inputs to the Black-Scholes equation?

t

K

r

4. Which of the following is true about the volatility smile? (Choose all correct answers. Incorrect answers will count against you.)

It is not consistent with the assumptions of put-call parity.

It is consistent with the assumptions of the Black-Scholes equation.

It is not consistent with the assumptions of the Black-Scholes equation.

It is consistent with the assumptions of put-call parity.

5.

Hormel Foods regularly buys agricultural products as intermediate goods in its food production business. Which of the following positions would Hormel Foods use to hedge its exposure to future movements in the price of agricultural products.

A long futures.

A short forward.

None of the choices is correct.

A portfolio of a long call and a short put with the same strike.

A portfolio of a long call and a long put with the same strike.

6.

The payoff of a put option with underlying S and strike K is described by which of the following? (Choose all correct answers. Incorrect answers will count against you.)

max(K,0)

max(S-K,0)

max(K-S,0)

max(S,0)

None of the choices given is correct.

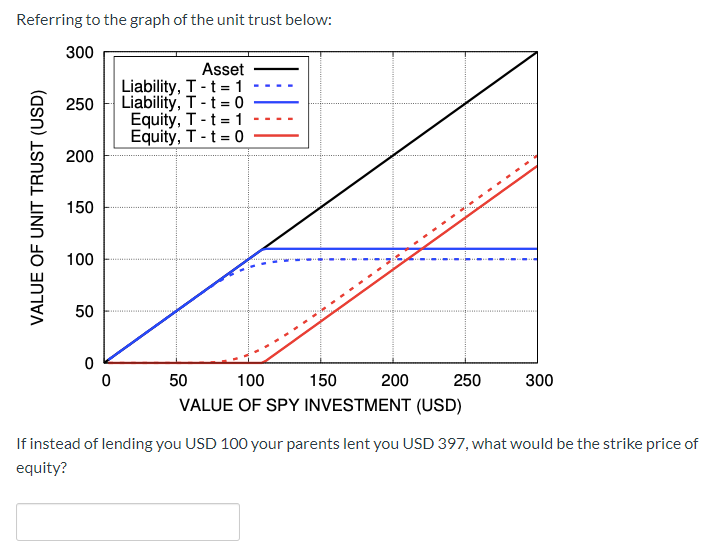

Referring to the graph of the unit trust below: 300 Asset Liability, T-t=1 250 Liability, T - t= 0 Equity, T - t= 1 Equity, T - t= 0 200 VALUE OF UNIT TRUST (USD) 150 100 50 0 0 50 100 150 200 250 300 VALUE OF SPY INVESTMENT (USD) If instead of lending you USD 100 your parents lent you USD 397, what would be the strike price of equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started