Answered step by step

Verified Expert Solution

Question

1 Approved Answer

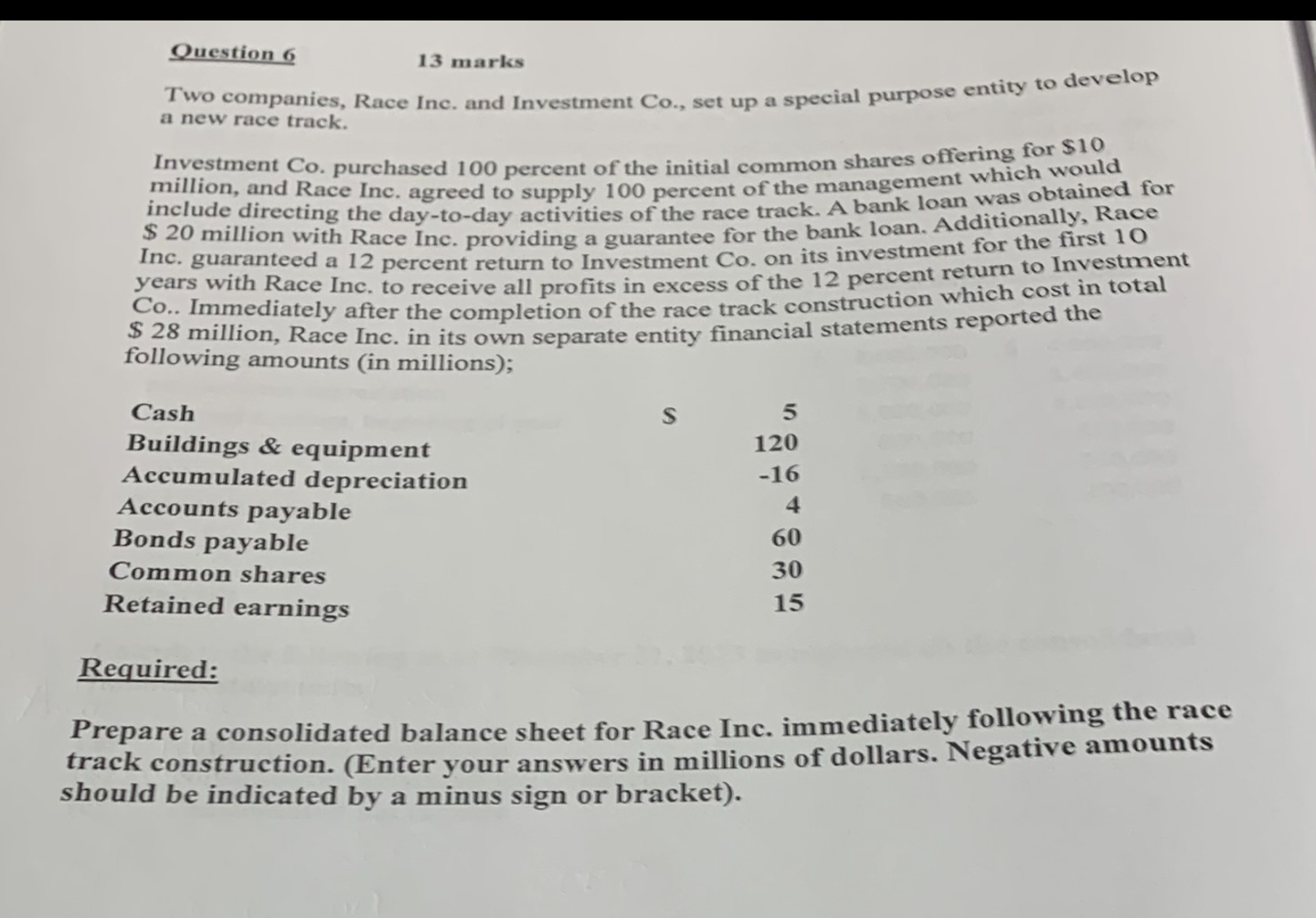

1 3 marks Two companies, Race Inc. and Investment Co . , set up a special purpose entity to develop a new race track. Investment

marks

Two companies, Race Inc. and Investment Co set up a special purpose entity to develop

a new race track.

Investment Co purchased percent of the initial common shares offering for $

million, and Race Inc. agreed to supply percent of the management which would

include directing the daytoday activities of the race track. A bank loan was obtained for

$ million with Race Inc. providing a guarantee for the bank loan. Additionally, Race

Inc. guaranteed a percent return to Investment Co on its investment for the first

years with Race Inc. to receive all profits in excess of the percent return to Investment

Co Immediately after the completion of the race track construction which cost in total

$ million, Race Inc. in its own separate entity financial statements reported the

following amounts in millions;

Required:

Prepare a consolidated balance sheet for Race Inc. immediately following the race

track construction. Enter your answers in millions of dollars. Negative amounts

should be indicated by a minus sign or bracket

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started