Answered step by step

Verified Expert Solution

Question

1 Approved Answer

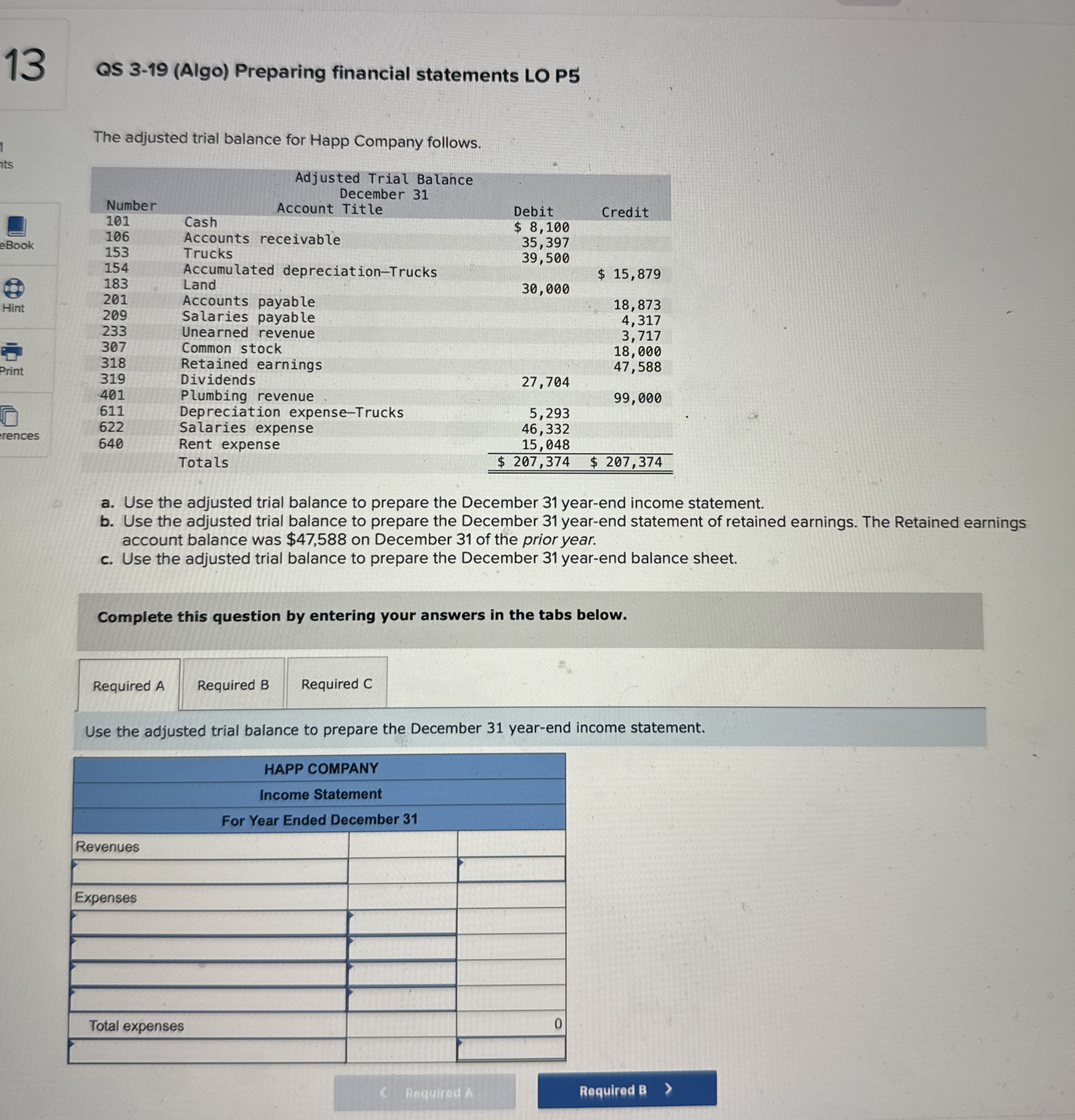

1 3 QS 3 - 1 9 ( Algo ) Preparing financial statements LO P 5 The adjusted trial balance for Happ Company follows.

QS Algo Preparing financial statements LO P

The adjusted trial balance for Happ Company follows.

table

tableAdjusted Trial BalanceDecember Cash,$ Accounts receivable,Trucks,Accumulated depreciationTrucks,,$ Land,Accounts payable,,Salaries payable,,Unearned revenue,,Common stock,,Retained earnings,,Dividends,Plumbing revenue,,Depreciation expenseTrucks,Salaries expense,Rent expense,Totals,$ $

a Use the adjusted trial balance to prepare the December yearend income statement.

b Use the adjusted trial balance to prepare the December yearend statement of retained earnings. The Retained earnings account balance was $ on December of the prior year.

c Use the adjusted trial balance to prepare the December yearend balance sheet.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Use the adjusted trial balance to prepare the December yearend income statement.

tableHAPP COMPANY,Income Statement,,RevenuesExpensesTotal expenses,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started