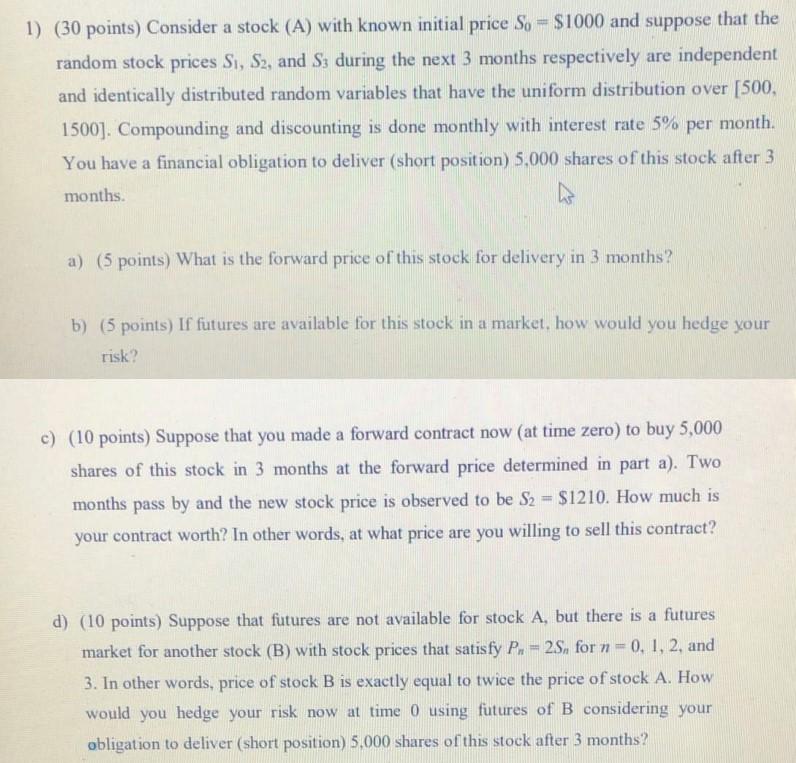

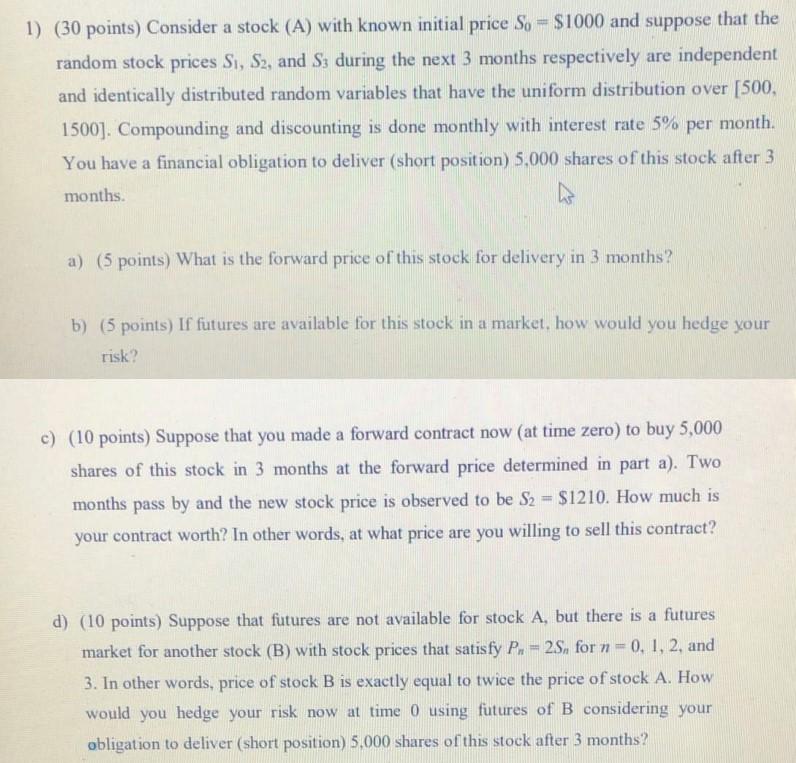

1) (30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next 3 months respectively are independent and identically distributed random variables that have the uniform distribution over [500, 1500]. Compounding and discounting is done monthly with interest rate 5% per month. You have a financial obligation to deliver (short position) 5,000 shares of this stock after 3 months. a) ( 5 points) What is the forward price of this stock for delivery in 3 months? b) (5 points) If futures are available for this stock in a market, how would you hedge your risk? c) (10 points) Suppose that you made a forward contract now (at time zero) to buy 5,000 shares of this stock in 3 months at the forward price determined in part a). Two months pass by and the new stock price is observed to be S2=$1210. How much is your contract worth? In other words, at what price are you willing to sell this contract? d) (10 points) Suppose that futures are not available for stock A, but there is a futures market for another stock (B) with stock prices that satisfy Pn=2Sn for n=0,1,2, and 3. In other words, price of stock B is exactly equal to twice the price of stock A. How would you hedge your risk now at time 0 using futures of B considering your obligation to deliver (short position) 5,000 shares of this stock after 3 months? 1) (30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next 3 months respectively are independent and identically distributed random variables that have the uniform distribution over [500, 1500]. Compounding and discounting is done monthly with interest rate 5% per month. You have a financial obligation to deliver (short position) 5,000 shares of this stock after 3 months. a) ( 5 points) What is the forward price of this stock for delivery in 3 months? b) (5 points) If futures are available for this stock in a market, how would you hedge your risk? c) (10 points) Suppose that you made a forward contract now (at time zero) to buy 5,000 shares of this stock in 3 months at the forward price determined in part a). Two months pass by and the new stock price is observed to be S2=$1210. How much is your contract worth? In other words, at what price are you willing to sell this contract? d) (10 points) Suppose that futures are not available for stock A, but there is a futures market for another stock (B) with stock prices that satisfy Pn=2Sn for n=0,1,2, and 3. In other words, price of stock B is exactly equal to twice the price of stock A. How would you hedge your risk now at time 0 using futures of B considering your obligation to deliver (short position) 5,000 shares of this stock after 3 months