Answered step by step

Verified Expert Solution

Question

1 Approved Answer

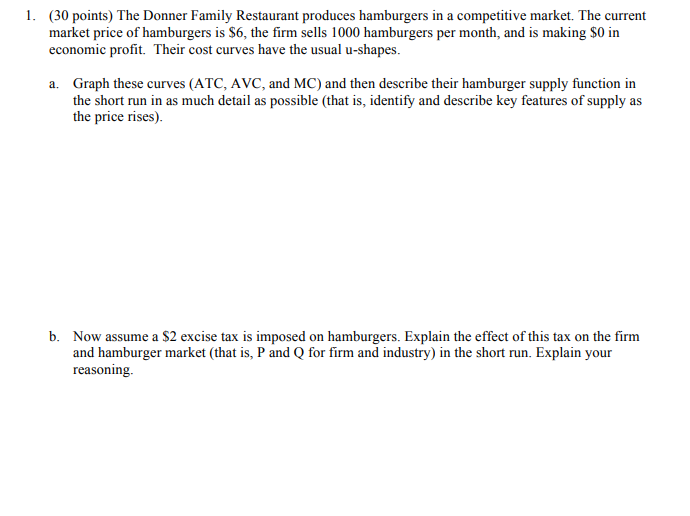

1. (30 points) The Donner Family Restaurant produces hamburgers in a competitive market. The current market price of hamburgers is $6, the firm sells

1. (30 points) The Donner Family Restaurant produces hamburgers in a competitive market. The current market price of hamburgers is $6, the firm sells 1000 hamburgers per month, and is making $0 in economic profit. Their cost curves have the usual u-shapes. a. Graph these curves (ATC, AVC, and MC) and then describe their hamburger supply function in the short run in as much detail as possible (that is, identify and describe key features of supply as the price rises). b. Now assume a $2 excise tax is imposed on hamburgers. Explain the effect of this tax on the firm and hamburger market (that is, P and Q for firm and industry) in the short run. Explain your reasoning. c. Now assume that instead of the tax in "b" above, the city levies a $2000 monthly tax on restaurants. The tax has been assessed on their restaurant license and cannot be avoided for one year. What effect will this have on the firm and market for hamburgers (that is, P and Q for firm and industry) in the short run. Explain your reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started