Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 . ( 4 2 . 5 points ) Pete Corporation acquired 1 0 0 % ownership of Sue Company on January 1 , 2

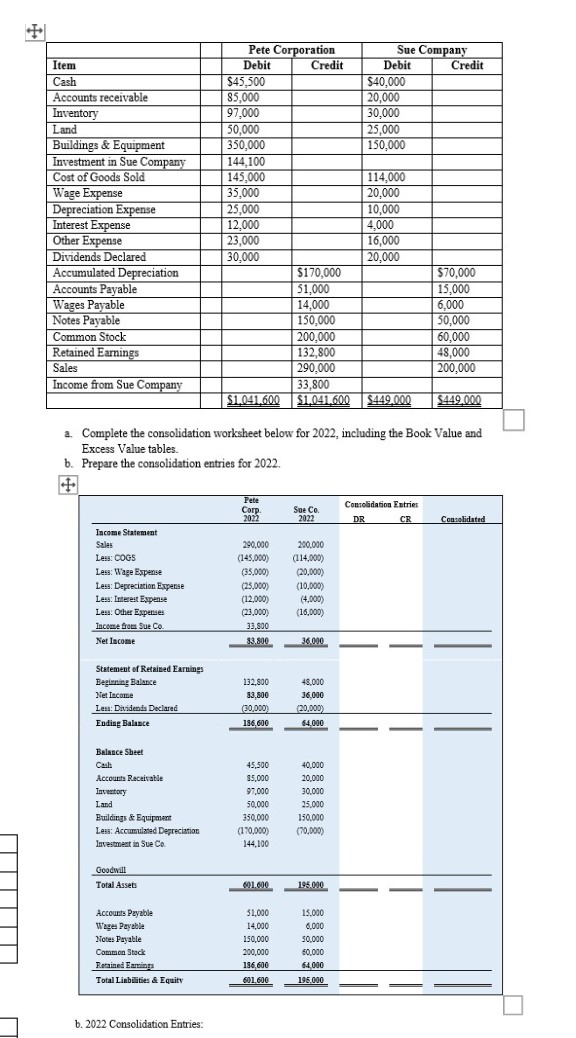

points Pete Corporation acquired ownership of Sue Company on January for $ At that date, the fair value of Sues buildings and equipment was $ more than the book value. Buildings and equipment are depreciated on a year basis; the balance of Sues accumulated depreciation was $ on the date of acquisition. Petes management concluded on December that goodwill involved in its acquisition of Sue shares had been impaired and the correct carrying value was $ Now The trial balance information for Pete and Sue for December is below in the image.. Complete the consolidation worksheet below for including the Book Value anda. Complete the consolidation worksheet below for including the Book Value and

Excess Value tables.

b Prepare the consolidation entries for

b Consolidation Entries:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started