Answered step by step

Verified Expert Solution

Question

1 Approved Answer

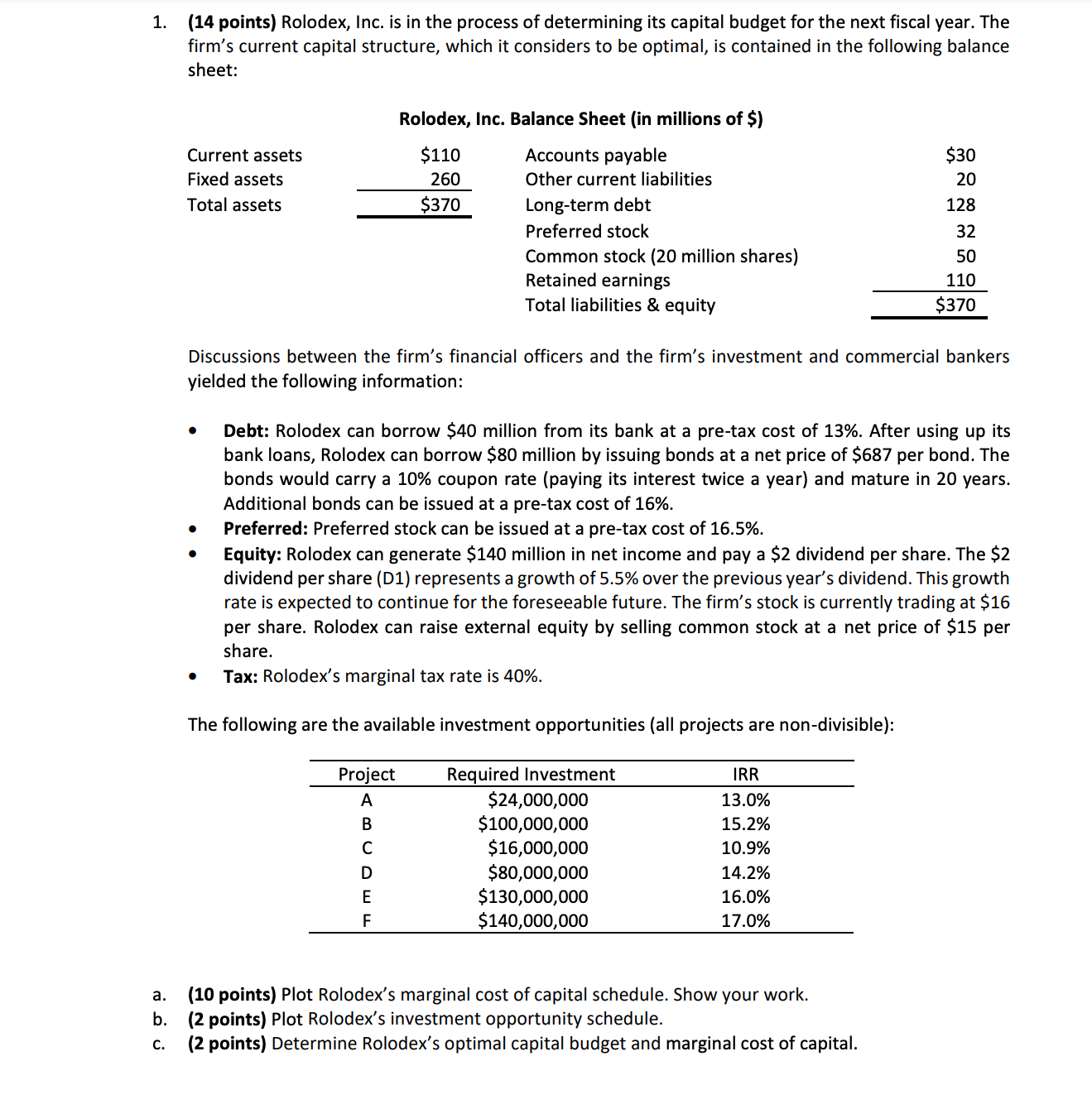

( 1 4 points ) Rolodex, Inc. is in the process of determining its capital budget for the next fiscal year. The firm's current capital

points Rolodex, Inc. is in the process of determining its capital budget for the next fiscal year. The

firm's current capital structure, which it considers to be optimal, is contained in the following balance

sheet:

Rolodex, Inc. Balance Sheet in millions of $

Discussions between the firm's financial officers and the firm's investment and commercial bankers

yielded the following information:

Debt: Rolodex can borrow $ million from its bank at a pretax cost of After using up its

bank loans, Rolodex can borrow $ million by issuing bonds at a net price of $ per bond. The

bonds would carry a coupon rate paying its interest twice a year and mature in years.

Additional bonds can be issued at a pretax cost of

Preferred: Preferred stock can be issued at a pretax cost of

Equity: Rolodex can generate $ million in net income and pay a $ dividend per share. The $

dividend per share D represents a growth of over the previous year's dividend. This growth

rate is expected to continue for the foreseeable future. The firm's stock is currently trading at $

per share. Rolodex can raise external equity by selling common stock at a net price of $ per

share.

Tax: Rolodex's marginal tax rate is

The following are the available investment opportunities all projects are nondivisible:

a points Plot Rolodex's marginal cost of capital schedule. Show your work.

b points Plot Rolodex's investment opportunity schedule.

c points Determine Rolodex's optimal capital budget and marginal cost of capital.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started