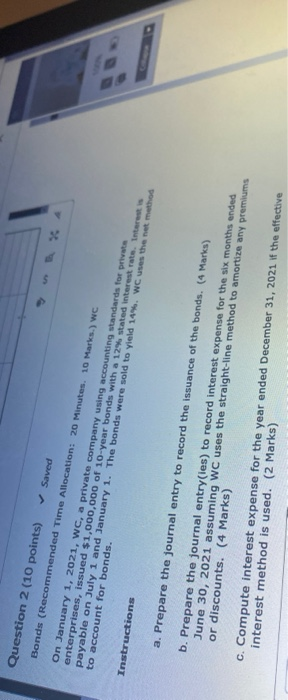

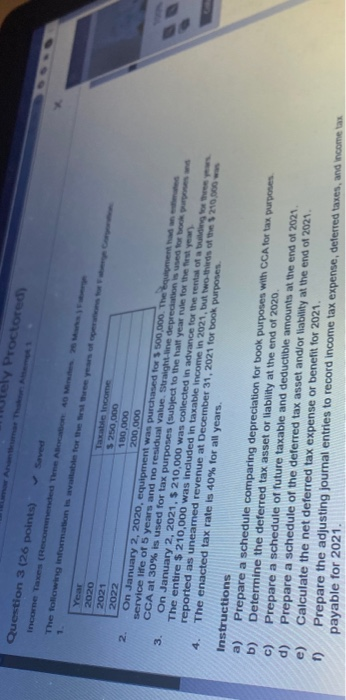

1) 4) RS requirements, a provision is recognized the amount of the loss can be reliably measured and it is probable that an asset has been impaired or a liability incurred as of the financial statement date. the amount of the loss cannot be measured reliably but it is probable that an 2) asset has been impaired or a liability incurred as of the financial statement date. it relates to a lawsuit commenced after the statement of financial position O3) date, the outcome of which can be reliably measured. it relates to an asset recognized as impaired after the statement of financial position date. 5) disclosure is required. Instructions Question 2 (10 points) Saved Bonds (Recommended Time Allocation: 20 Minutes. 10 Marks.) WC On January 1, 2021, WC, a private company using accounting standards for private enterprises, issued $1,000,000 of 10-year bonds with a 12% stated interest rate resis payable on July 1 and January 1. The bonds were sold to yield 14%. WC uses the method to account for bonds. a. Prepare the journal entry to record the issuance of the bonds. (4 Marks) b. Prepare the journal entry(les) to record interest expense for the six months ended June 30, 2021 assuming WC uses the straight-line method to amortize any premiums or discounts. (4 Marks) c. Compute interest expense for the year ended December 31, 2021 If the effective interest method is used. (2 Marks) ly Proctored) Question 3 (26 points) - saved Incone Taxes (Recommended The Acabo de 20 1. The following information is wat to the three year Year Taxable income 2020 $ 250,000 2021 180.000 2022 200.000 2 On January 2, 2020, equipment was purchased for $500,000. The bome service life of 5 years and no residual value Straight line depreciation we tortor CCA at 30% is used for tax purposes (subject to the all year rule for the first year On January 2, 2021, $ 210,000 was collected in advance for the reagoe 3. The entire $ 210,000 was included in taxable income in 2021, but two-thirds of the 2100 reported as unearned revenue at December 31, 2021 for book purposes The enacted tax rate is 40% for all years. 4. Instructions a) b) Determine the deferred tax asset or liability at the end of 2020 Prepare a schedule comparing depreciation for book purposes with CCA for tax purposes c) Prepare a schedule of future taxable and deductible amounts at the end of 2021 d) Prepare a schedule of the deferred tax asset andlor liability at the end of 2021 e) Calculate the net deferred tax expense or benefit for 2021 1) Prepare the adjusting journal entries to record income tax expense, deterred taxes, and income tax payable for 2021. 1) 4) RS requirements, a provision is recognized the amount of the loss can be reliably measured and it is probable that an asset has been impaired or a liability incurred as of the financial statement date. the amount of the loss cannot be measured reliably but it is probable that an 2) asset has been impaired or a liability incurred as of the financial statement date. it relates to a lawsuit commenced after the statement of financial position O3) date, the outcome of which can be reliably measured. it relates to an asset recognized as impaired after the statement of financial position date. 5) disclosure is required. Instructions Question 2 (10 points) Saved Bonds (Recommended Time Allocation: 20 Minutes. 10 Marks.) WC On January 1, 2021, WC, a private company using accounting standards for private enterprises, issued $1,000,000 of 10-year bonds with a 12% stated interest rate resis payable on July 1 and January 1. The bonds were sold to yield 14%. WC uses the method to account for bonds. a. Prepare the journal entry to record the issuance of the bonds. (4 Marks) b. Prepare the journal entry(les) to record interest expense for the six months ended June 30, 2021 assuming WC uses the straight-line method to amortize any premiums or discounts. (4 Marks) c. Compute interest expense for the year ended December 31, 2021 If the effective interest method is used. (2 Marks) ly Proctored) Question 3 (26 points) - saved Incone Taxes (Recommended The Acabo de 20 1. The following information is wat to the three year Year Taxable income 2020 $ 250,000 2021 180.000 2022 200.000 2 On January 2, 2020, equipment was purchased for $500,000. The bome service life of 5 years and no residual value Straight line depreciation we tortor CCA at 30% is used for tax purposes (subject to the all year rule for the first year On January 2, 2021, $ 210,000 was collected in advance for the reagoe 3. The entire $ 210,000 was included in taxable income in 2021, but two-thirds of the 2100 reported as unearned revenue at December 31, 2021 for book purposes The enacted tax rate is 40% for all years. 4. Instructions a) b) Determine the deferred tax asset or liability at the end of 2020 Prepare a schedule comparing depreciation for book purposes with CCA for tax purposes c) Prepare a schedule of future taxable and deductible amounts at the end of 2021 d) Prepare a schedule of the deferred tax asset andlor liability at the end of 2021 e) Calculate the net deferred tax expense or benefit for 2021 1) Prepare the adjusting journal entries to record income tax expense, deterred taxes, and income tax payable for 2021