Answered step by step

Verified Expert Solution

Question

1 Approved Answer

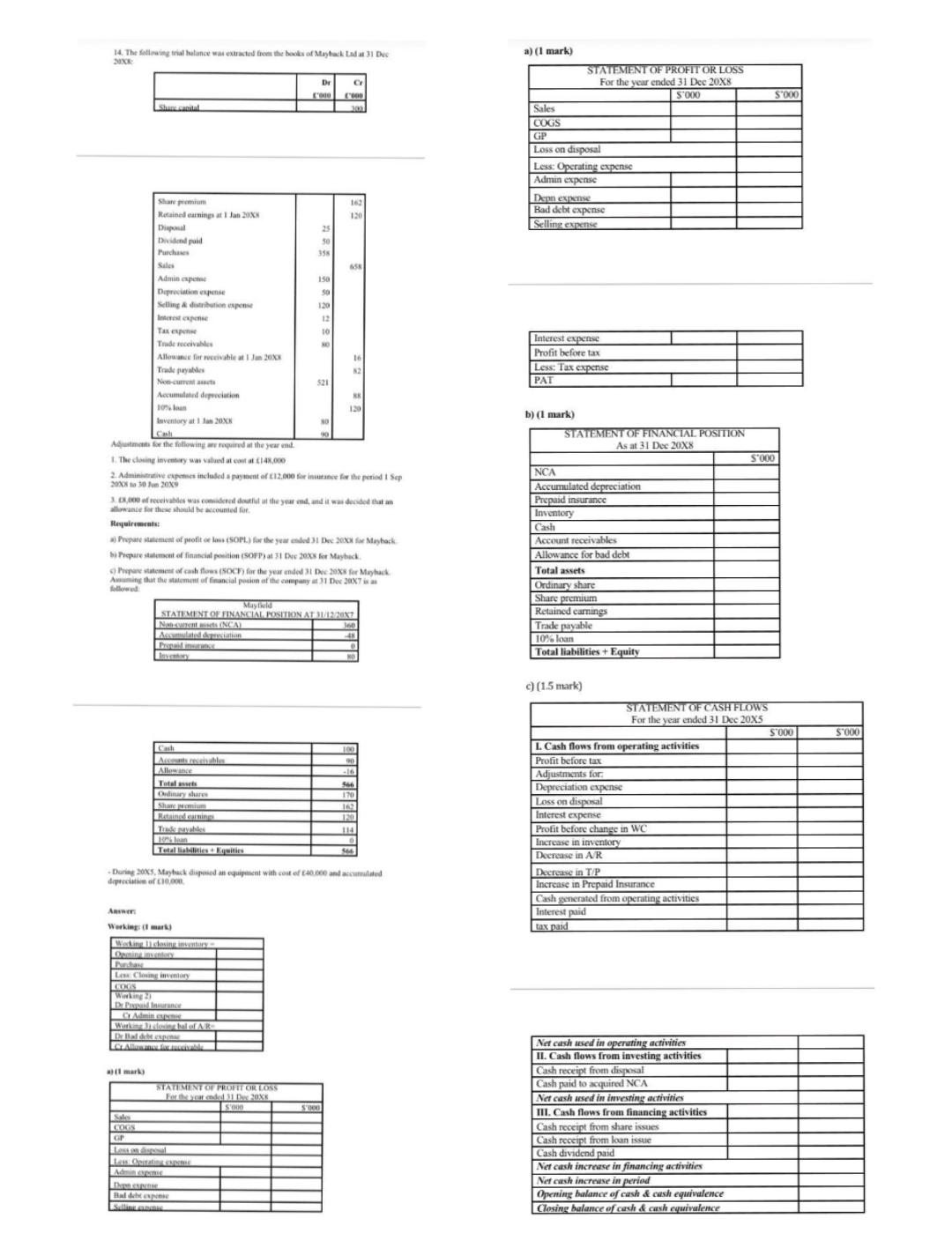

1 4 . The following trial balance was extracted from the books of Maybach Ltd at 3 1 Dec 2 0 X 8 . 1

The following trial balance was extracted from the books of Maybach Ltd at Dec X The closing inventory was valued at cost at

Administrative expenses included a payment of

for insurance for the period Sep

to Jun

of receivables was considered doutful at the year end, and it was decided that an allowance for these should be accounted for.

The follouing rial alane was etratd fiom the bocks of Mayhack Ld at DecShuocenitalShare pecmiumRtainod earnings at Jan XPundhusesSilesAnsserAdmin cspeneDeeciie epenseSelling & datrihticn eupenelnterest cxpenseehaseTas espensTrade receivablesWorkting Allowance for receivahble at I Jan XTrde pyables lounAdustments oe the following are roquired at the year endThe closing invenory was vaued al cast al Iab markInventory at Jan XHCahRequirements:Adminiive cspenses included a payment of C for insurance for the period I SepX t Jun XE of receivables was conidercd dutl ut the yar end, and it was decided that anallawance for these should be accounted for.a Prepare statcment of peofit oe lass sOPL far the year ended Des Xs for Maytack,b Prepure statemcnt of financial position SOFP a Dee X for Mayhack.Prepare satement of cash flows SC for the yer endod Dec X or MayhackAsuming that the stalement of fnancial posion of the company at Dee X isasnvetoeAsets blsAllew anceTotel ansetsOndinary sharesShare pWorking: markMayficldSTATEMENT OF INANCIAL POSITION AT Xcnt asts NCAWeckingLcesing insentoryOpnin inventecyTotal liabilitics EqeiticseesiinDuring oxs, Mayback disposcd an equipment with cost of E and adepreciation of ELClosing inventoryWorkine ucasi hDlal dkte expenJoanGAllonun fcivabeLess on dsposalLes Oetin csypenseBad debe cxpensDR LOSSSoal markSalesCOGGPLoss on disposalLess: Operating expenseAdmin expcnseSelling expenseInterest expensePAs: Tax cxpensebL markNCASTATEMENT OF PROFIT OR LOSSFor the year ended Dec XTsoCashSTATEMENT OF FINANCIAL POSITIONAs at Dee XAccumulated depreciationPrepaid insuranceInventoryAccount receivablesAllowance for bad debtTotal assetsOrdinary shareShare premiumRetaincd carningTrade payable loanTotal liabilities Equity markL Cash lows from operating activitiesProfit before taxAdiustmscnts for:Depreciation expenseLoss on disposalInterest expenseProfit before change in WCIncrease in inventorDecrease in ARDecrease in TSTATEMENT OF CASH FLOWSFor the year ended Dec XIncrcase in Prepaid nsuranceInterest paidtax paidCash generated from operating activiticsNet cash sed in eperating activitiesIL Cash lows from investing activitieCash receipt from disposalCash paid to acquired NCANet cash used in investing activitiesII, Cash flows from financing activitiesCash receipt from share iCash receipt from loan isCash dividend paidNet cash increase in financing activitiesNet cash increase in periodSOOpening balance of cash & cash equivalenceClosing balance of cash & cash cequivalenceSOSO

Requirements: a Prepare statement of profit or loss SOPL for the year ended Dec

for Mayfield. b Prepare statement of financial position SOFP at Dec

for Mayfield. c Prepare statement of cash flows SOCF for the year ended

for Mayfield. Assuming that the statement of financial posion of the company at

is as followed:

I need the detailed and step by step answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started