Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (40 points) As a new Investment Analyst for Long & Mays (L&M) Capital Management, Inc., you are to estimate the mean, variance, standard deviation

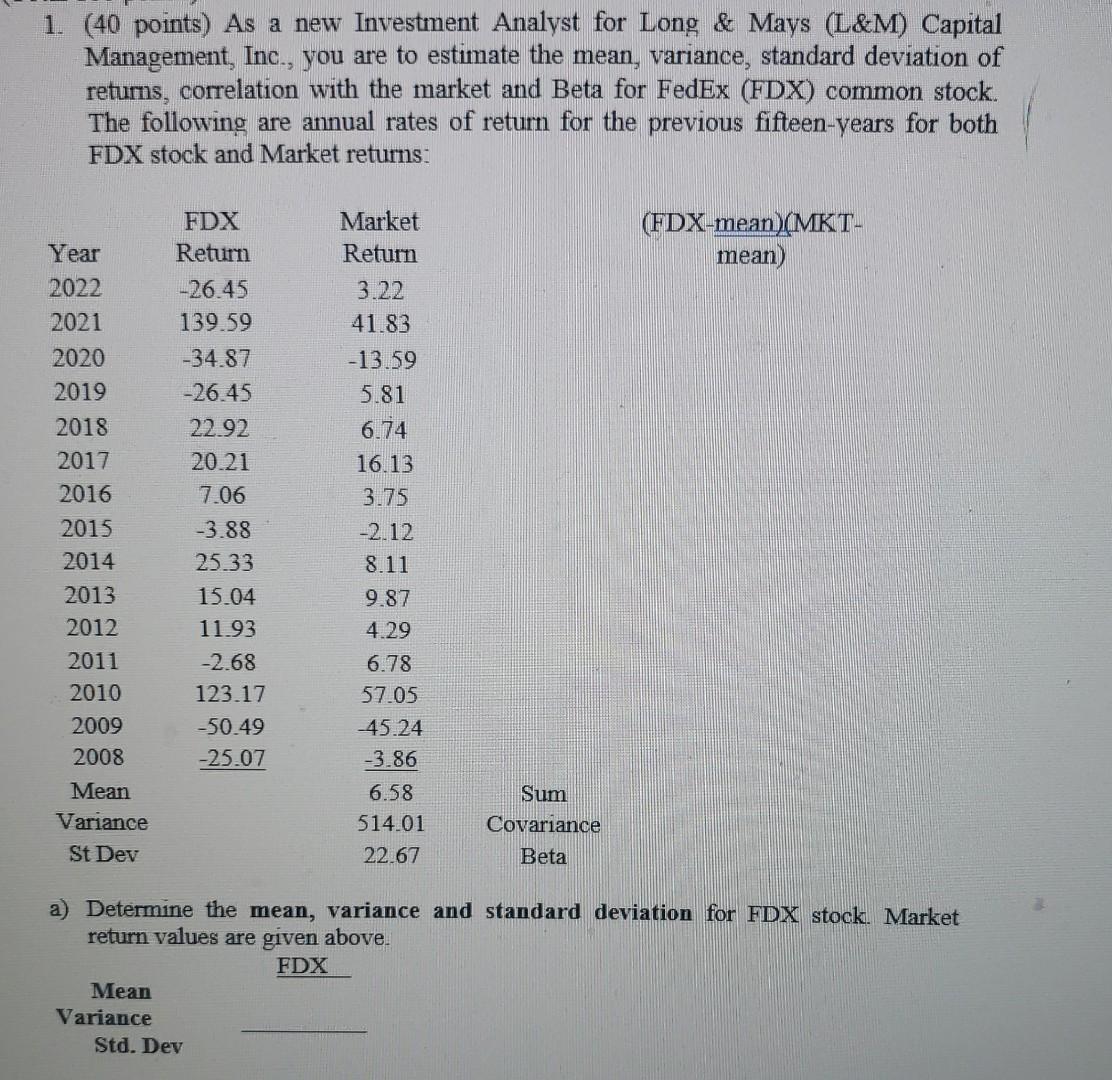

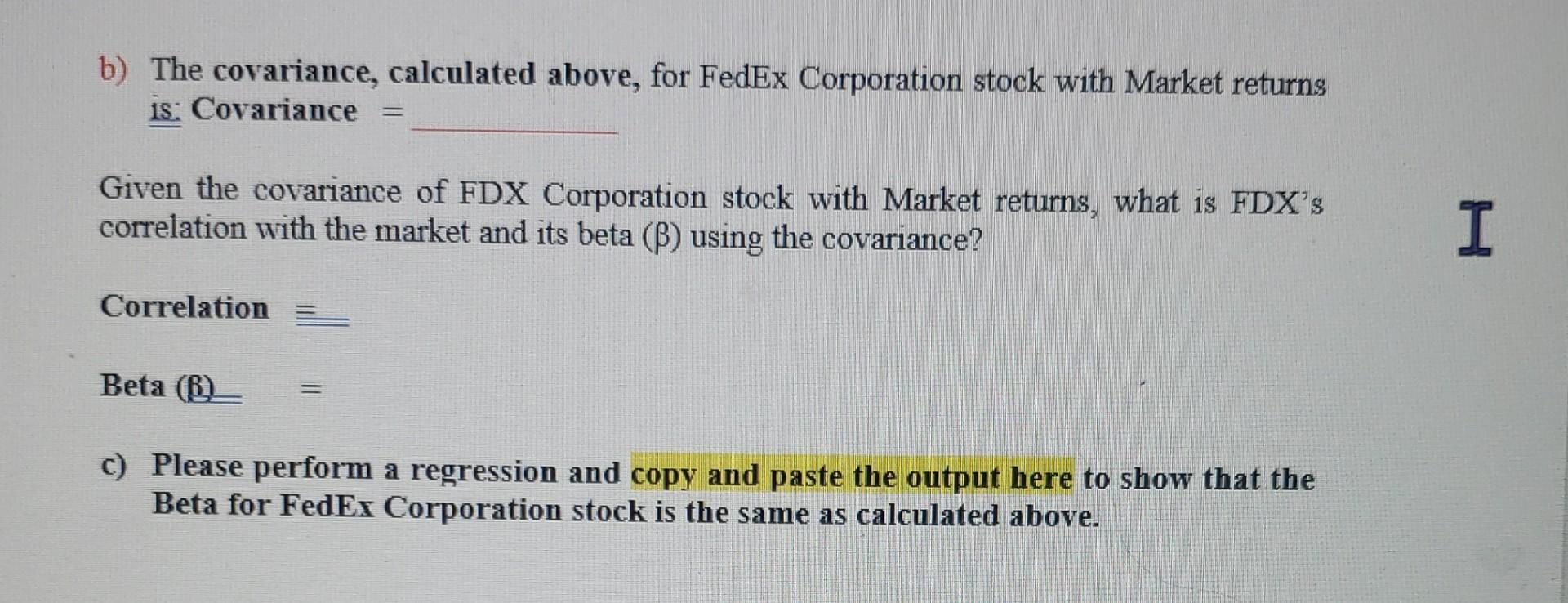

1. (40 points) As a new Investment Analyst for Long & Mays (L&M) Capital Management, Inc., you are to estimate the mean, variance, standard deviation of retums, correlation with the market and Beta for FedEx (FDX) common stock. The following are annual rates of return for the previous fifteen-years for both FDX stock and Market returns (FDX-mean(MKT- mean) Year 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 FDX Return -26.45 139.59 -34.87 -26.45 22.92 20.21 7.06 -3.88 25.33 15.04 11.93 -2.68 123.17 -50.49 -25.07 Market Return 3.22 41.83 -13.59 5.81 6.74 16.13 3.75 -2.12 8.11 9.87 4.29 6.78 57.05 45.24 -3.86 6.58 514.01 22.67 Mean Variance Sum Covariance Beta St Dev a) Determine the mean, variance and standard deviation for FDX stock. Market return values are given above. FDX Mean Variance Std. Dev b) The covariance, calculated above, for FedEx Corporation stock with Market returns is: Covariance = Given the covariance of FDX Corporation stock with Market returns, what is FDX's correlation with the market and its beta () using the covariance? I Correlation Beta (6) = c) Please perform a regression and copy and paste the output here to show that the Beta for FedEx Corporation stock is the same as calculated above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started