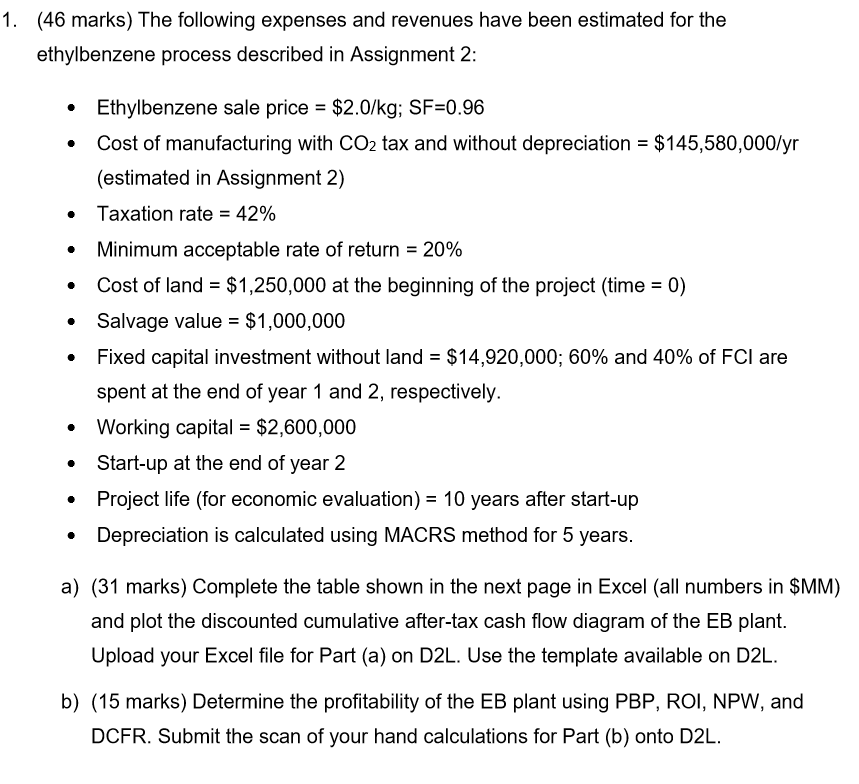

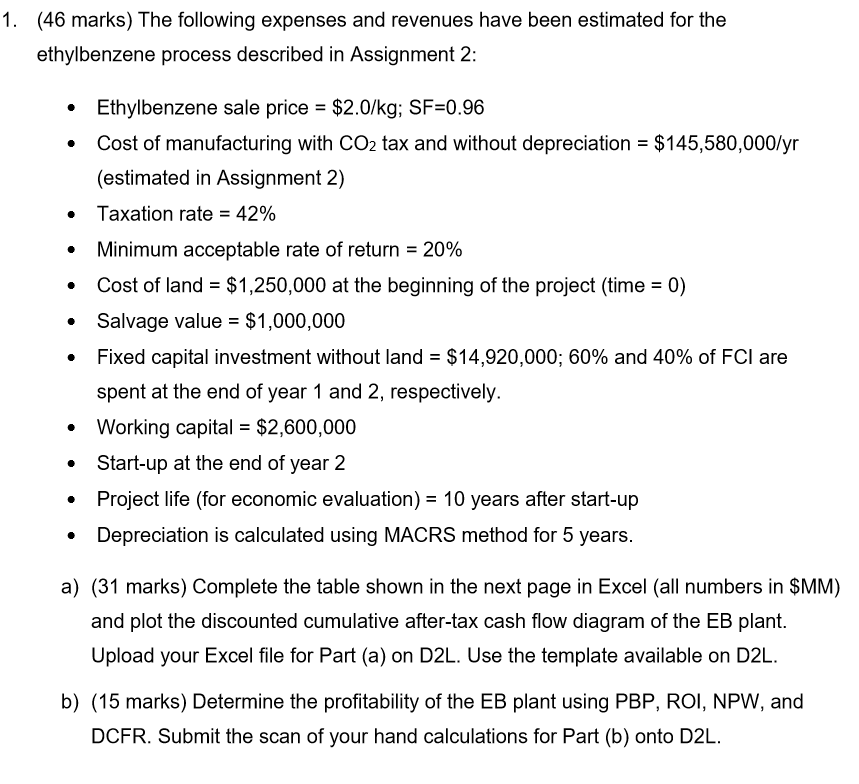

1. (46 marks) The following expenses and revenues have been estimated for the ethylbenzene process described in Assignment 2: Ethylbenzene sale price = $2.0/kg; SF=0.96 Cost of manufacturing with CO2 tax and without depreciation = $145,580,000/yr (estimated in Assignment 2) Taxation rate = 42% Minimum acceptable rate of return = 20% Cost of land = $1,250,000 at the beginning of the project (time = 0) Salvage value = $1,000,000 Fixed capital investment without land = $14,920,000; 60% and 40% of FCI are spent at the end of year 1 and 2, respectively. Working capital = $2,600,000 Start-up at the end of year 2 Project life (for economic evaluation) = 10 years after start-up Depreciation is calculated using MACRS method for 5 years. a) (31 marks) Complete the table shown in the next page in Excel (all numbers in $MM) and plot the discounted cumulative after-tax cash flow diagram of the EB plant. Upload your Excel file for Part (a) on D2L. Use the template available on D2L. b) (15 marks) Determine the profitability of the EB plant using PBP, ROI, NPW, and DCFR. Submit the scan of your hand calculations for Part (b) onto D2L. 1. (46 marks) The following expenses and revenues have been estimated for the ethylbenzene process described in Assignment 2: Ethylbenzene sale price = $2.0/kg; SF=0.96 Cost of manufacturing with CO2 tax and without depreciation = $145,580,000/yr (estimated in Assignment 2) Taxation rate = 42% Minimum acceptable rate of return = 20% Cost of land = $1,250,000 at the beginning of the project (time = 0) Salvage value = $1,000,000 Fixed capital investment without land = $14,920,000; 60% and 40% of FCI are spent at the end of year 1 and 2, respectively. Working capital = $2,600,000 Start-up at the end of year 2 Project life (for economic evaluation) = 10 years after start-up Depreciation is calculated using MACRS method for 5 years. a) (31 marks) Complete the table shown in the next page in Excel (all numbers in $MM) and plot the discounted cumulative after-tax cash flow diagram of the EB plant. Upload your Excel file for Part (a) on D2L. Use the template available on D2L. b) (15 marks) Determine the profitability of the EB plant using PBP, ROI, NPW, and DCFR. Submit the scan of your hand calculations for Part (b) onto D2L