Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 5 . 1 . What does the Black - Scholes - Merton stock option pricing model assume about the probability distribution of the stock

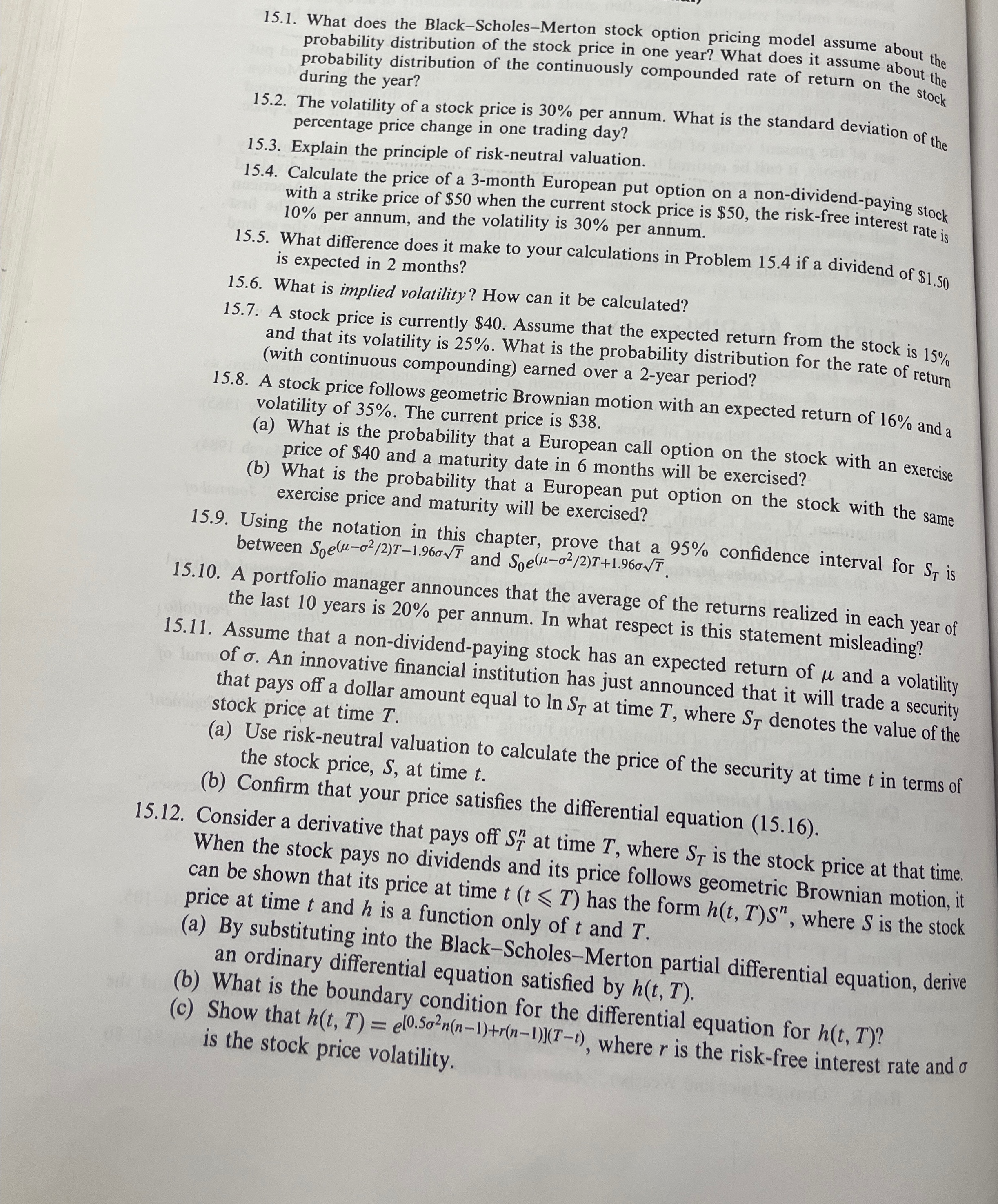

What does the BlackScholesMerton stock option pricing model assume about the probability distribution of the stock price in one year? What does it assume about the probability distribution of the continuously compounded rate of return on the stock during the year?

The volatility of a stock price is per annum. What is the standard deviation of the percentage price change in one trading day?

Explain the principle of riskneutral valuation.

Calculate the price of a month European put option on a nondividendpaying stock with a strike price of $ when the current stock price is $ the riskfree interest rate is per annum, and the volatility is per annum.

What difference does it make to your calculations in Problem if a dividend of $ is expected in months?

What is implied volatility? How can it be calculated?

A stock price is currently $ Assume that the expected return from the stock is and that its volatility is What is the probability distribution for the rate of return with continuous compounding earned over a year period?

A stock price follows geometric Brownian motion with an expected return of and a volatility of The current price is $

a What is the probability that a European call option on the stock with an exercise price of $ and a maturity date in months will be exercised?

b What is the probability that a European put option on the stock with the same exercise price and maturity will be exercised?

Using the notation in this chapter, prove that a confidence interval for is between and

A portfolio manager announces that the average of the returns realized in each year of the last years is per annum. In what respect is this statement misleading?

Assume that a nondividendpaying stock has an expected return of and a volatility of An innovative financial institution has just announced that it will trade a security that pays off a dollar amount equal to at time where denotes the value of the stock price at time

a Use riskneutral valuation to calculate the price of the security at time in terms of the stock price, at time

b Confirm that your price satisfies the differential equation

Consider a derivative that pays off at time where is the stock price at that time. When the stock pays no dividends and its price follows geometric Brownian motion, it can be shown that its price at time has the form where is the stock price at time and is a function only of and

a By substituting into the BlackScholesMerton partial differential equation, derive an ordinary differential equation satisfied by

b What is the boundary condition for the differential equation for

c Show that where is the riskfree interest rate and is the stock price volatility.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started