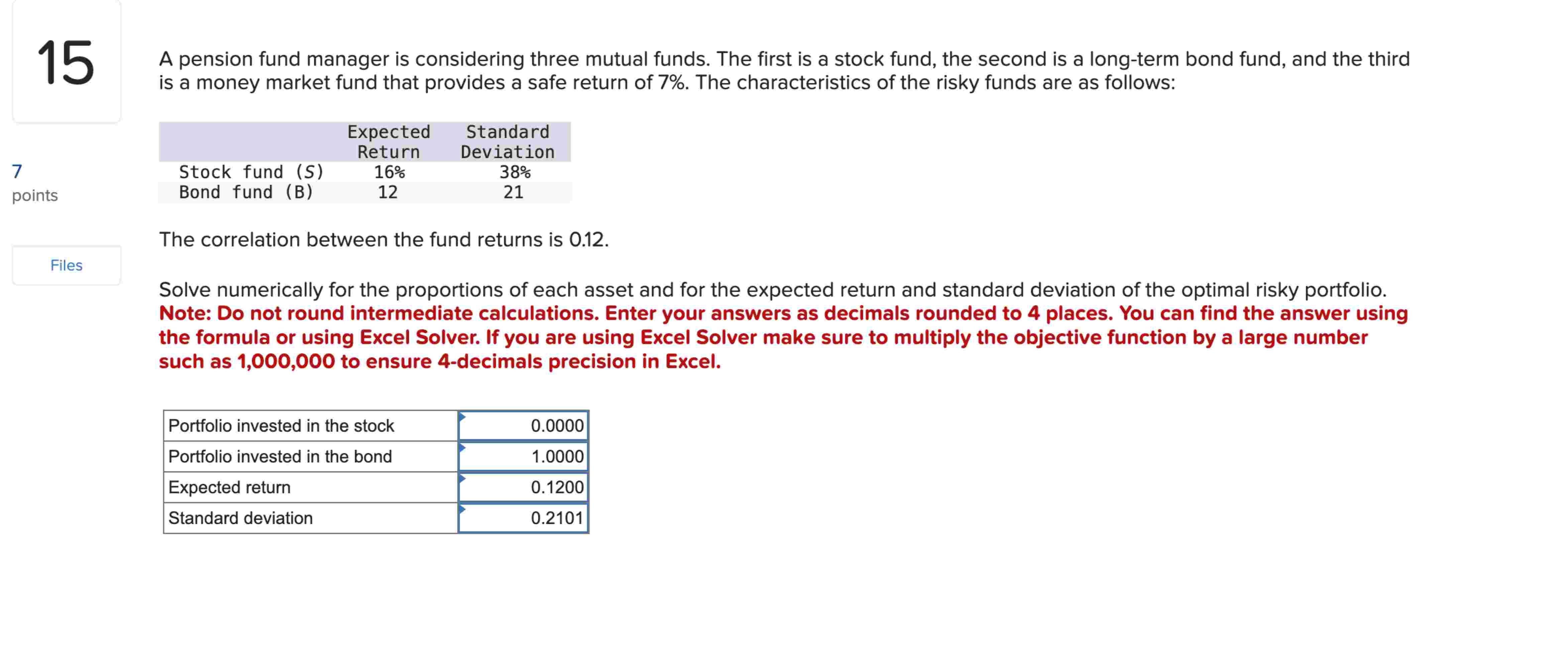

Question: 1 5 A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long - term bond

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a longterm bond fund, and the third

is a money market fund that provides a safe return of The characteristics of the risky funds are as follows:

The correlation between the fund returns is

Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio.

Note: Do not round intermediate calculations. Enter your answers as decimals rounded to places. You can find the answer using

the formula or using Excel Solver. If you are using Excel Solver make sure to multiply the objective function by a large number

such as to ensure decimals precision in Excel.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock