Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (5 points) Assume the following information for a bank quoting on spot exchange rates: Exchange rate of pound in U.S. S Exchange rate

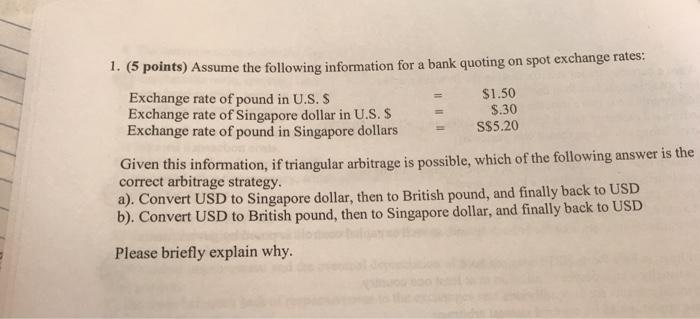

1. (5 points) Assume the following information for a bank quoting on spot exchange rates: Exchange rate of pound in U.S. S Exchange rate of Singapore dollar in U.S. $ Exchange rate of pound in Singapore dollars $1.50 $.30 S$5.20 Given this information, if triangular arbitrage is possible, which of the following answer is the correct arbitrage strategy. a). Convert USD to Singapore dollar, then to British pound, and finally back to USD b). Convert USD to British pound, then to Singapore dollar, and finally back to USD Please briefly explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The correct answer is b Convert USD to British pound then to Singapore dollar and finally back to USD Triangular arbitrage exploits inefficiencies in exchange rates to make a profit In this case the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started