Answered step by step

Verified Expert Solution

Question

1 Approved Answer

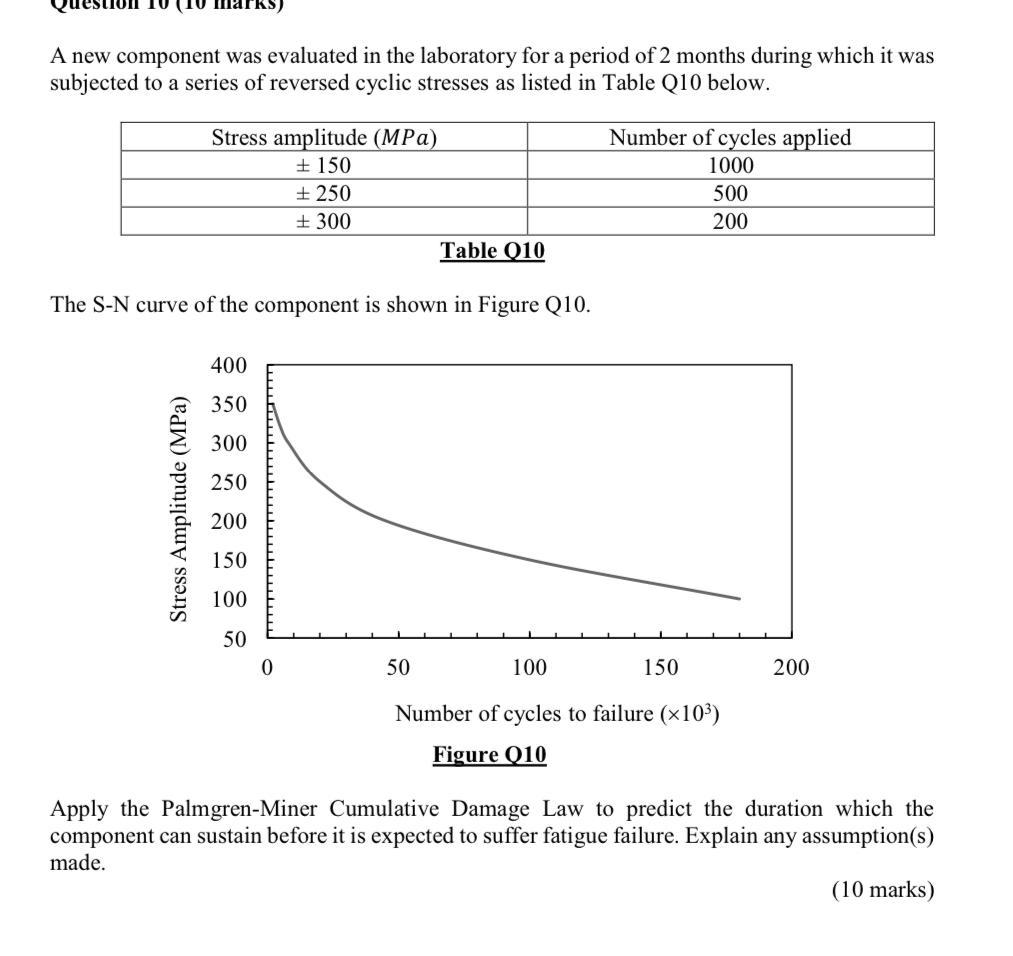

10 (1 A new component was evaluated in the laboratory for a period of 2 months during which it was subjected to a series

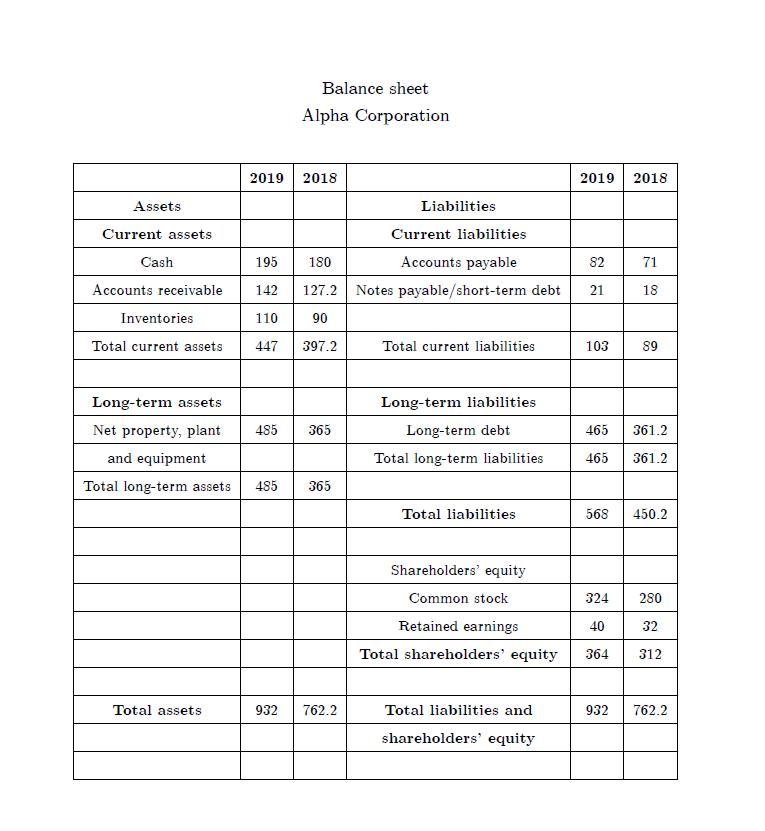

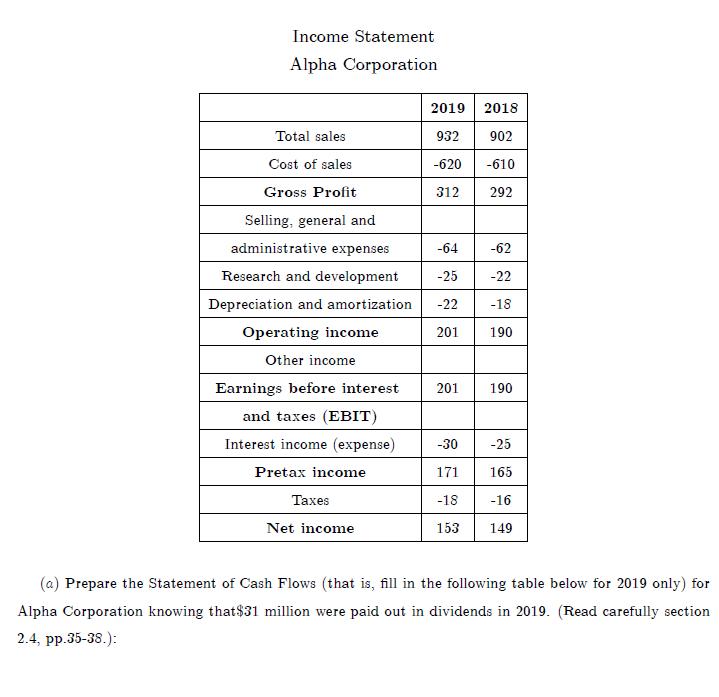

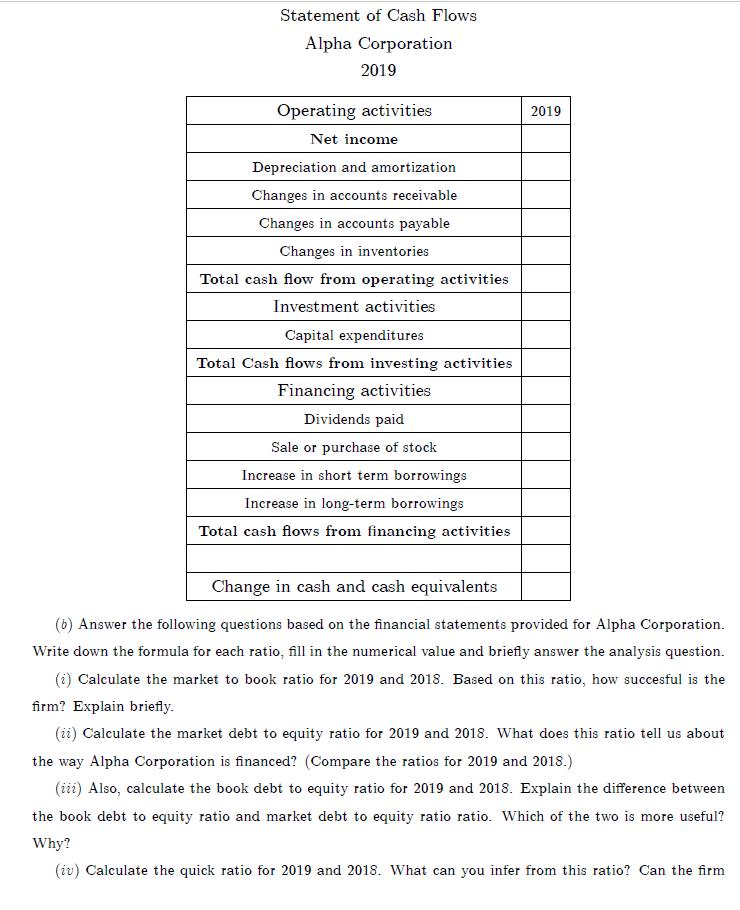

10 (1 A new component was evaluated in the laboratory for a period of 2 months during which it was subjected to a series of reversed cyclic stresses as listed in Table Q10 below. Stress amplitude (MPa) + 150 250 300 Stress Amplitude (MPa) The S-N curve of the component is shown in Figure Q10. 400 350 300 250 200 150 100 50 0 Table 010 50 100 Number of cycles applied 1000 500 200 150 Number of cycles to failure (x10) Figure Q10 200 Apply the Palmgren-Miner Cumulative Damage Law to predict the duration which the component can sustain before it is expected to suffer fatigue failure. Explain any assumption(s) made. (10 marks) Assets Current assets Cash Accounts receivable Inventories Total current assets Balance sheet Alpha Corporation Total assets 2019 2018 Long-term assets Net property, plant 485 365 and equipment Total long-term assets 485 365 Liabilities 195 180 142 127.2 Notes payable/short-term debt 110 90 447 397.2 932 762.2 Current liabilities Accounts payable Total current liabilities Long-term liabilities Long-term debt Total long-term liabilities Total liabilities Shareholders' equity Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2019 82 21 2018 71 18 103 89 465 361.2 465 361.2 568 450.2 932 324 280 40 32 364 312 762.2 Income Statement Alpha Corporation Total sales Cost of sales Gross Profit Selling, general and administrative expenses Research and development Depreciation and amortization Operating income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net income 2019 2018 932 902 -620 -610 312 292 -64 -62 -25 -22 -22 -18 201 190 201 190 -30 171 -18 153 -25 165 -16 149 (a) Prepare the Statement of Cash Flows (that is, fill in the following table below for 2019 only) for Alpha Corporation knowing that $31 million were paid out in dividends in 2019. (Read carefully section 2.4, pp.35-38.): Statement of Cash Flows Alpha Corporation 2019 Operating activities Net income Depreciation and amortization Changes in accounts receivable Changes in accounts payable Changes in inventories Total cash flow from operating activities Investment activities Capital expenditures Total Cash flows from investing activities Financing activities Dividends paid Sale or purchase of stock Increase in short term borrowings Increase in long-term borrowings Total cash flows from financing activities 2019 Change in cash and cash equivalents (6) Answer the following questions based on the financial statements provided for Alpha Corporation. Write down the formula for each ratio, fill in the numerical value and briefly answer the analysis question. (1) Calculate the market to book ratio for 2019 and 2018. Based on this ratio, how succesful is the firm? Explain briefly. (22) Calculate the market debt to equity ratio for 2019 and 2018. What does this ratio tell us about the way Alpha Corporation is financed? (Compare the ratios for 2019 and 2018.) (iii) Also, calculate the book debt to equity ratio for 2019 and 2018. Explain the difference between the book debt to equity ratio and market debt to equity ratio ratio. Which of the two is more useful? Why? (iv) Calculate the quick ratio for 2019 and 2018. What can you infer from this ratio? Can the firm meet its short-term liquidity needs? Explain why or why not. (v) Calculate the rate of return on equity, ROE and the rate of return on assets, ROA for 2019 and 2018. Interpret. (vi) Calculate the price to earnings ratio (PE) for 2019 and 2018. What can you infer from this ratio with respect to the market value of Alpha Corporation stock? Explain briefly.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Expla...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started