Answered step by step

Verified Expert Solution

Question

1 Approved Answer

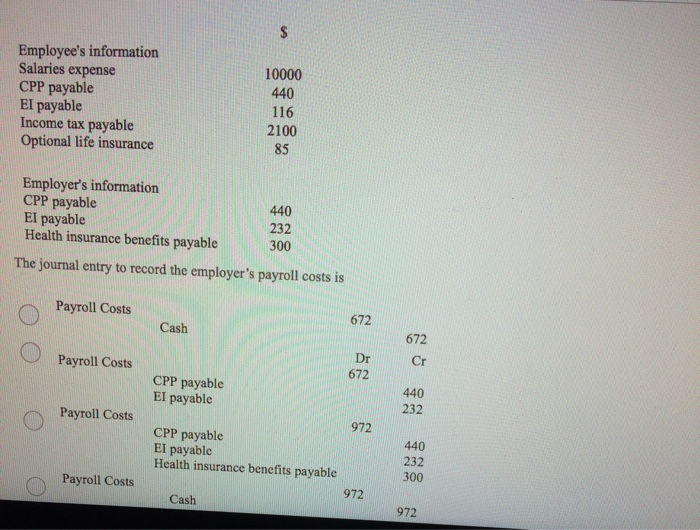

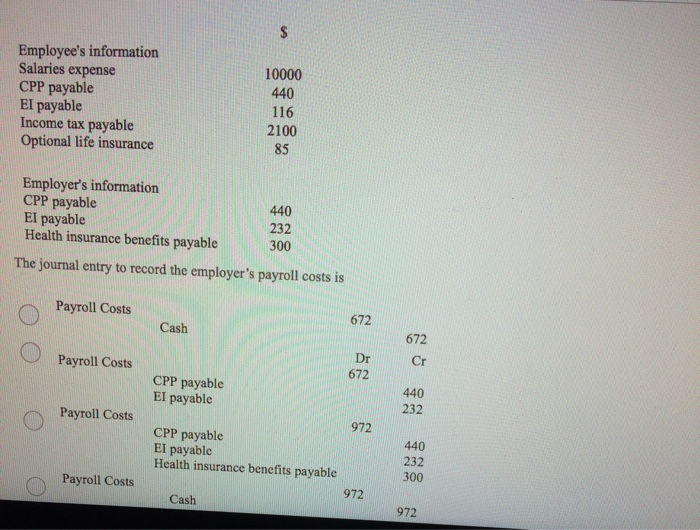

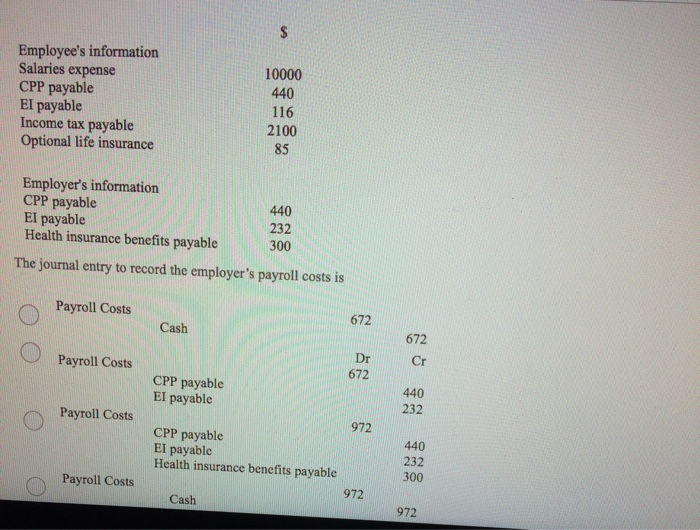

1 55 $ Employee's information Salaries expense CPP payable El payable Income tax payable Optional life insurance 10000 440 116 2100 85 Employer's information CPP

1

55

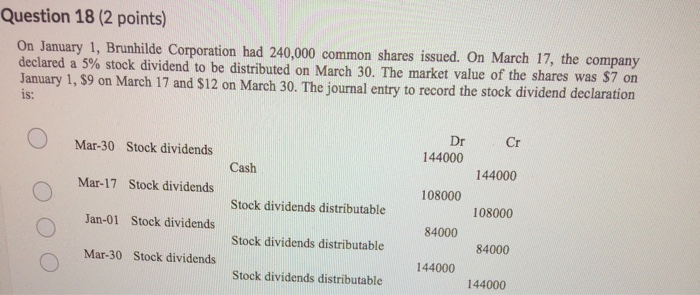

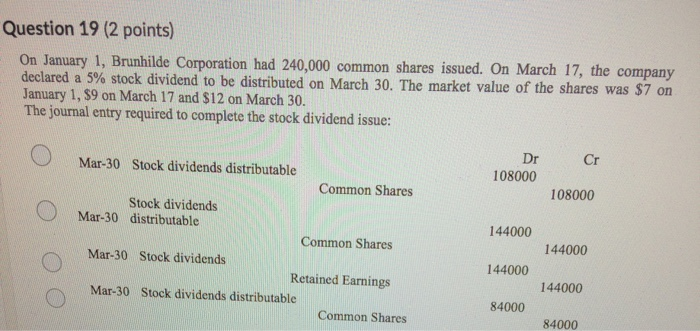

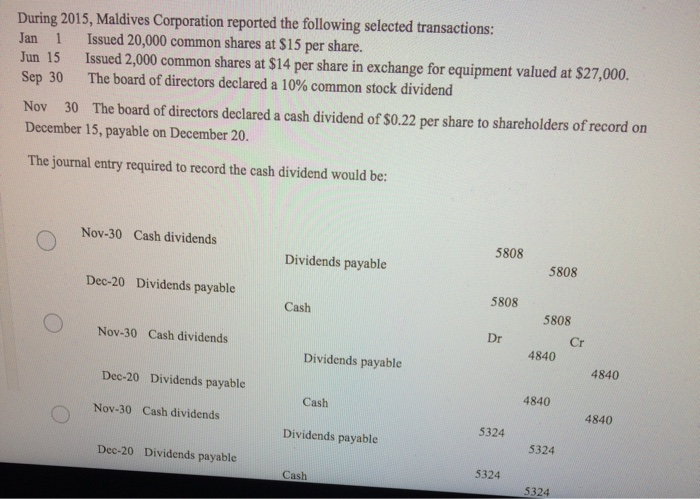

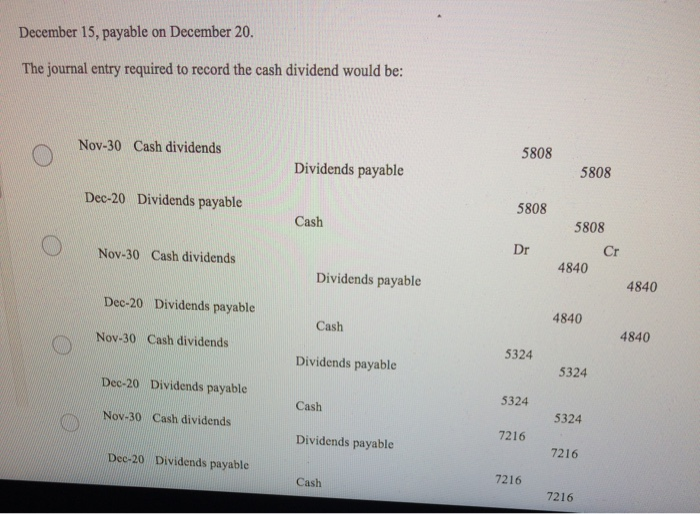

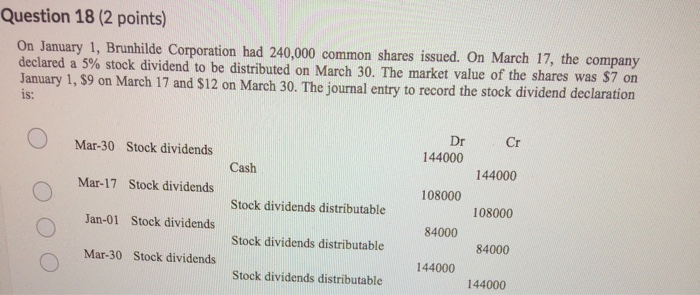

55

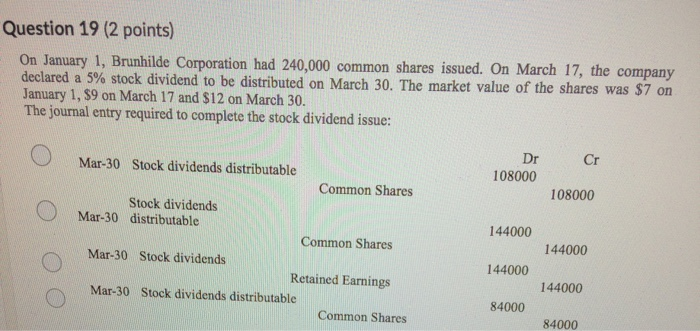

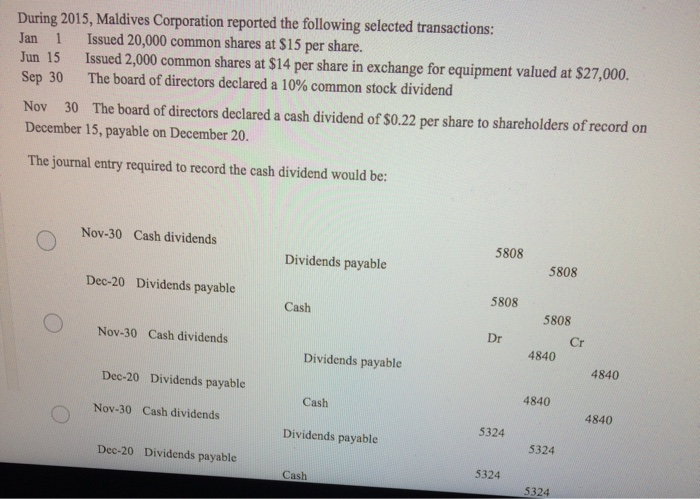

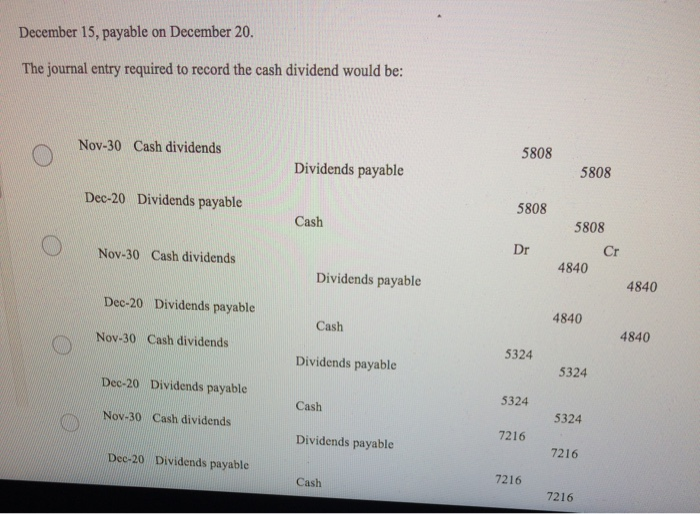

$ Employee's information Salaries expense CPP payable El payable Income tax payable Optional life insurance 10000 440 116 2100 85 Employer's information CPP payable 440 EI payable 232 Health insurance benefits payable 300 The journal entry to record the employer's payroll costs is Payroll Costs 672 Cash 672 Cr Payroll Costs Dr 672 440 232 Payroll Costs CPP payable El payable 972 CPP payable El payable Health insurance benefits payable 972 Cash 440 232 300 Payroll Costs 972 Question 18 (2 points) On January 1, Brunhilde Corporation had 240,000 common shares issued. On March 17, the company declared a 5% stock dividend to be distributed on March 30. The market value of the shares was $7 on January 1, $9 on March 17 and $12 on March 30. The journal entry to record the stock dividend declaration is: Mar-30 Stock dividends Cr Dr 144000 Cash Mar-17 Stock dividends 144000 108000 Stock dividends distributable 108000 Jan-01 Stock dividends 84000 Stock dividends distributable Mar-30 Stock dividends 84000 144000 Stock dividends distributable 144000 Question 19 (2 points) On January 1, Brunhilde Corporation had 240,000 common shares issued. On March 17, the company declared a 5% stock dividend to be distributed on March 30. The market value of the shares was $7 on January 1, $9 on March 17 and $12 on March 30. The journal entry required to complete the stock dividend issue: Cr Dr 108000 108000 Mar-30 Stock dividends distributable Common Shares Stock dividends Mar-30 distributable Common Shares Mar-30 Stock dividends Retained Earnings Mar-30 Stock dividends distributable Common Shares 144000 144000 144000 144000 84000 84000 During 2015, Maldives Corporation reported the following selected transactions: Jan 1 Issued 20,000 common shares at $15 per share. Jun 15 Issued 2,000 common shares at $14 per share in exchange for equipment valued at $27,000. The board of directors declared a 10% common stock dividend Sep 30 Nov 30 The board of directors declared a cash dividend of $0.22 per share to shareholders of record on December 15, payable on December 20. The journal entry required to record the cash dividend would be: Nov-30 Cash dividends Dividends payable 5808 5808 Dec-20 Dividends payable Cash 5808 5808 Nov-30 Cash dividends Dr Cr Dividends payable 4840 Dec-20 Dividends payable 4840 Cash 4840 Nov-30 Cash dividends 4840 Dividends payable 5324 Dec-20 Dividends payable 5324 Cash 5324 5324 December 15, payable on December 20. The journal entry required to record the cash dividend would be: Nov-30 Cash dividends 5808 Dividends payable 5808 Dec-20 Dividends payable 5808 Cash Nov-30 Cash dividends Dr 5808 Cr 4840 4840 Dividends payable Dec-20 Dividends payable 4840 Cash Nov-30 Cash dividends 4840 Dividends payable 5324 5324 Dec-20 Dividends payable 5324 Cash Nov-30 Cash dividends 5324 Dividends payable 7216 Dec-20 Dividends payable 7216 Cash 7216 7216

$ Employee's information Salaries expense CPP payable El payable Income tax payable Optional life insurance 10000 440 116 2100 85 Employer's information CPP payable 440 EI payable 232 Health insurance benefits payable 300 The journal entry to record the employer's payroll costs is Payroll Costs 672 Cash 672 Cr Payroll Costs Dr 672 440 232 Payroll Costs CPP payable El payable 972 CPP payable El payable Health insurance benefits payable 972 Cash 440 232 300 Payroll Costs 972 Question 18 (2 points) On January 1, Brunhilde Corporation had 240,000 common shares issued. On March 17, the company declared a 5% stock dividend to be distributed on March 30. The market value of the shares was $7 on January 1, $9 on March 17 and $12 on March 30. The journal entry to record the stock dividend declaration is: Mar-30 Stock dividends Cr Dr 144000 Cash Mar-17 Stock dividends 144000 108000 Stock dividends distributable 108000 Jan-01 Stock dividends 84000 Stock dividends distributable Mar-30 Stock dividends 84000 144000 Stock dividends distributable 144000 Question 19 (2 points) On January 1, Brunhilde Corporation had 240,000 common shares issued. On March 17, the company declared a 5% stock dividend to be distributed on March 30. The market value of the shares was $7 on January 1, $9 on March 17 and $12 on March 30. The journal entry required to complete the stock dividend issue: Cr Dr 108000 108000 Mar-30 Stock dividends distributable Common Shares Stock dividends Mar-30 distributable Common Shares Mar-30 Stock dividends Retained Earnings Mar-30 Stock dividends distributable Common Shares 144000 144000 144000 144000 84000 84000 During 2015, Maldives Corporation reported the following selected transactions: Jan 1 Issued 20,000 common shares at $15 per share. Jun 15 Issued 2,000 common shares at $14 per share in exchange for equipment valued at $27,000. The board of directors declared a 10% common stock dividend Sep 30 Nov 30 The board of directors declared a cash dividend of $0.22 per share to shareholders of record on December 15, payable on December 20. The journal entry required to record the cash dividend would be: Nov-30 Cash dividends Dividends payable 5808 5808 Dec-20 Dividends payable Cash 5808 5808 Nov-30 Cash dividends Dr Cr Dividends payable 4840 Dec-20 Dividends payable 4840 Cash 4840 Nov-30 Cash dividends 4840 Dividends payable 5324 Dec-20 Dividends payable 5324 Cash 5324 5324 December 15, payable on December 20. The journal entry required to record the cash dividend would be: Nov-30 Cash dividends 5808 Dividends payable 5808 Dec-20 Dividends payable 5808 Cash Nov-30 Cash dividends Dr 5808 Cr 4840 4840 Dividends payable Dec-20 Dividends payable 4840 Cash Nov-30 Cash dividends 4840 Dividends payable 5324 5324 Dec-20 Dividends payable 5324 Cash Nov-30 Cash dividends 5324 Dividends payable 7216 Dec-20 Dividends payable 7216 Cash 7216 7216

1

55

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started