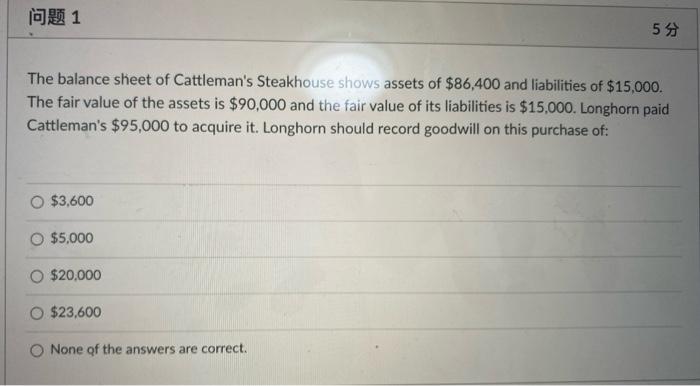

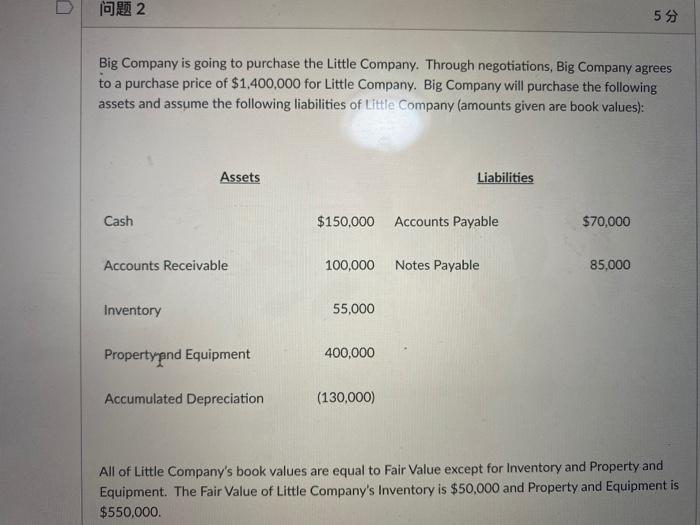

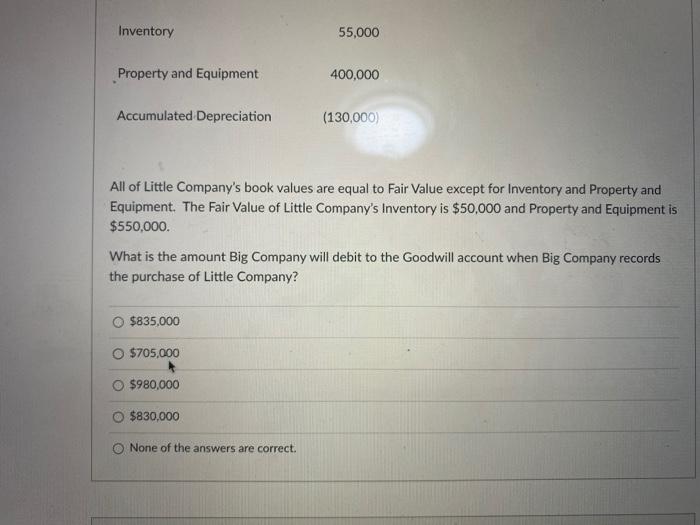

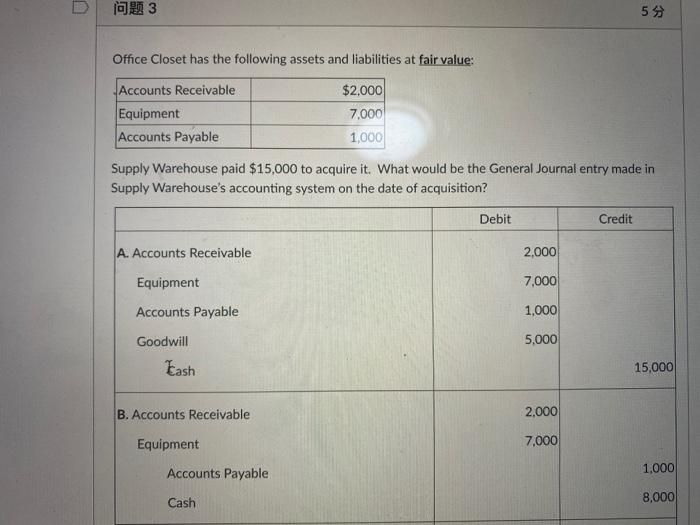

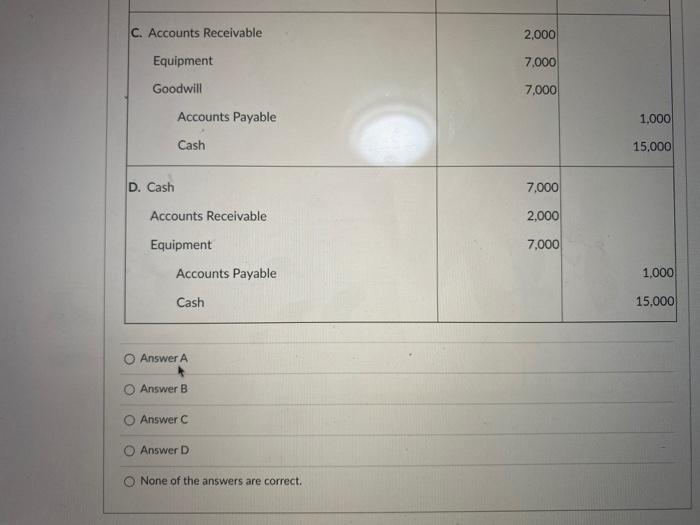

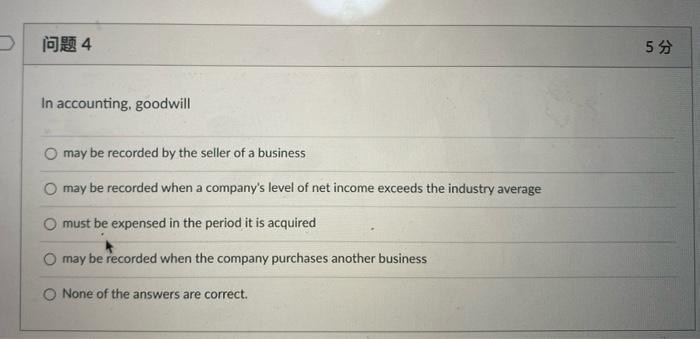

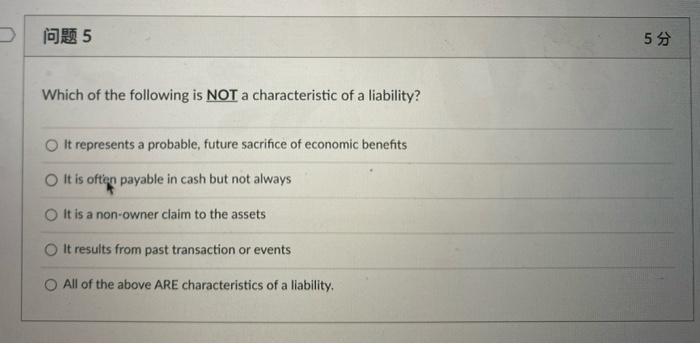

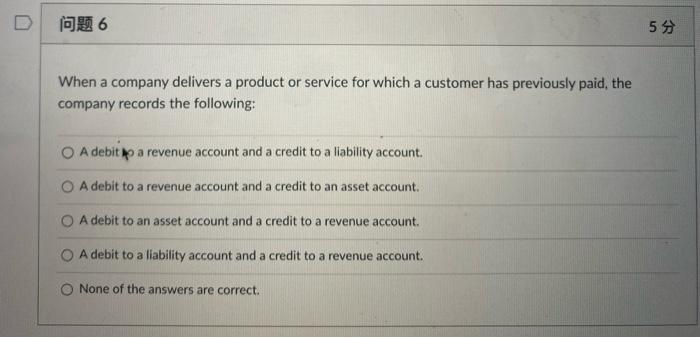

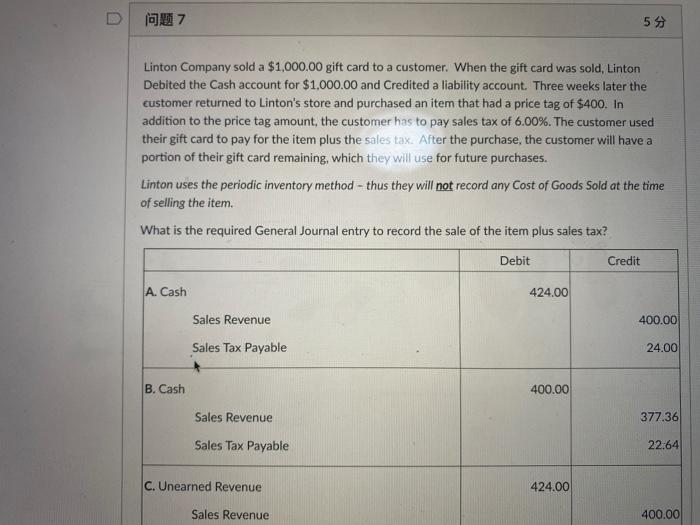

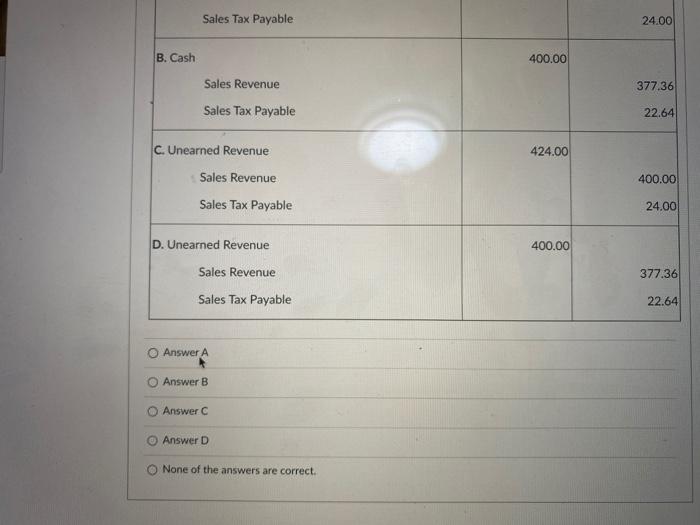

1 55 The balance sheet of Cattleman's Steakhouse shows assets of $86,400 and liabilities of $15,000. The fair value of the assets is $90,000 and the fair value of its liabilities is $15,000. Longhorn paid Cattleman's $95,000 to acquire it. Longhorn should record goodwill on this purchase of: $3,600 $5,000 O $20,000 $23,600 None of the answers are correct. 2 55 Big Company is going to purchase the Little Company. Through negotiations, Big Company agrees to a purchase price of $1,400,000 for Little Company. Big Company will purchase the following assets and assume the following liabilities of Little Company (amounts given are book values): Assets Liabilities Cash $150,000 Accounts Payable $70,000 Accounts Receivable 100,000 Notes Payable 85.000 Inventory 55,000 Property and Equipment 400,000 Accumulated Depreciation (130,000) All of Little Company's book values are equal to Fair Value except for Inventory and Property and Equipment. The Fair Value of Little Company's Inventory is $50,000 and Property and Equipment is $550,000. Inventory 55,000 Property and Equipment 400,000 Accumulated Depreciation (130,000) All of Little Company's book values are equal to Fair Value except for Inventory and Property and Equipment. The Fair Value of Little Company's Inventory is $50,000 and Property and Equipment is $550,000. What is the amount Big Company will debit to the Goodwill account when Big Company records the purchase of Little Company? $835,000 O $705,000 $980,000 O $830,000 None of the answers are correct. 103 55 Office Closet has the following assets and liabilities at fair value: Accounts Receivable Equipment Accounts Payable $2.000 7,000 1,000 Supply Warehouse paid $15,000 to acquire it. What would be the General Journal entry made in Supply Warehouse's accounting system on the date of acquisition? Debit Credit A. Accounts Receivable 2,000 Equipment 7,000 Accounts Payable 1,000 5,000 Goodwill Eash 15,000 B. Accounts Receivable 2.000 Equipment 7.000 Accounts Payable 1,000 Cash 8,000 2.000 C. Accounts Receivable Equipment Goodwill 7.000 7.000 Accounts Payable 1,000 Cash 15,000 D. Cash 7,000 2,000 Accounts Receivable Equipment 7,000 Accounts Payable 1.000 Cash 15,000 O Answer A Answer B Answer C Answer D None of the answers are correct. 4 55 In accounting, goodwill may be recorded by the seller of a business may be recorded when a company's level of net income exceeds the industry average must be expensed in the period it is acquired O may be recorded when the company purchases another business None of the answers are correct. 5 5 Which of the following is NOT a characteristic of a liability? It represents a probable, future sacrifice of economic benefits O it is often payable in cash but not always It is a non-owner claim to the assets It results from past transaction or events O All of the above ARE characteristics of a liability, 1996 55 When a company delivers a product or service for which a customer has previously paid, the company records the following: A debito a revenue account and a credit to a liability account. A debit to a revenue account and a credit to an asset account. A debit to an asset account and a credit to a revenue account. A debit to a liability account and a credit to a revenue account. None of the answers are correct. 07 5 Linton Company sold a $1,000.00 gift card to a customer. When the gift card was sold, Linton Debited the Cash account for $1,000.00 and Credited a liability account. Three weeks later the customer returned to Linton's store and purchased an item that had a price tag of $400. In addition to the price tag amount, the customer has to pay sales tax of 6.00%. The customer used their gift card to pay for the item plus the sales tax. After the purchase, the customer will have a portion of their gift card remaining, which they will use for future purchases. Linton uses the periodic inventory method - thus they will not record any Cost of Goods Sold at the time of selling the item. What is the required General Journal entry to record the sale of the item plus sales tax? Debit Credit A. Cash 424.00 Sales Revenue 400.00 Sales Tax Payable 24.00 B. Cash 400.00 Sales Revenue 377.36 Sales Tax Payable 22.64 C. Unearned Revenue 424.00 Sales Revenue 400.00 Sales Tax Payable 24.00 B. Cash 400.00 Sales Revenue 377.36 Sales Tax Payable 22.64 424.00 C. Unearned Revenue Sales Revenue Sales Tax Payable 400.00 24.00 D. Unearned Revenue 400.00 Sales Revenue 377.36 Sales Tax Payable 22.64 Answer A Answer B Answer C Answer D None of the answers are correct