Question

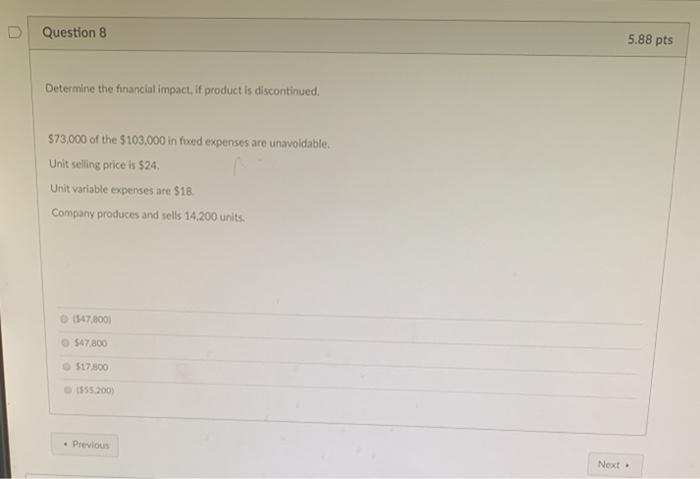

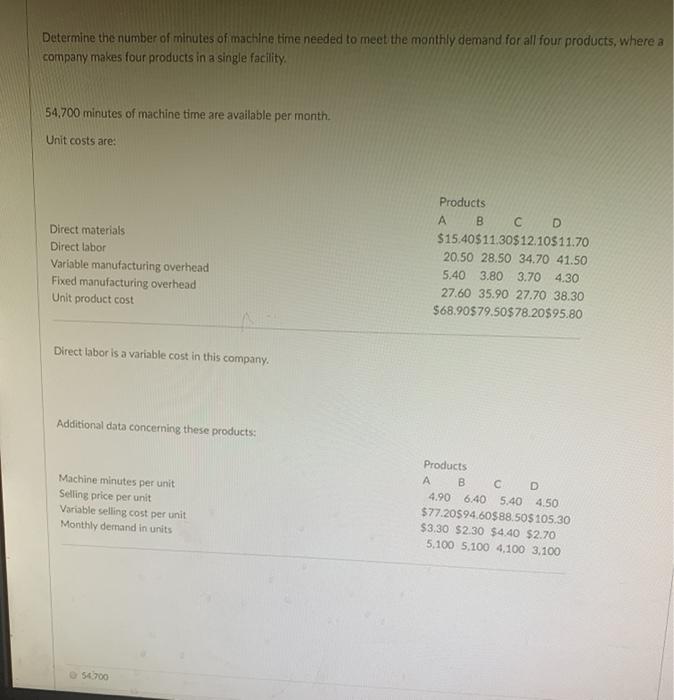

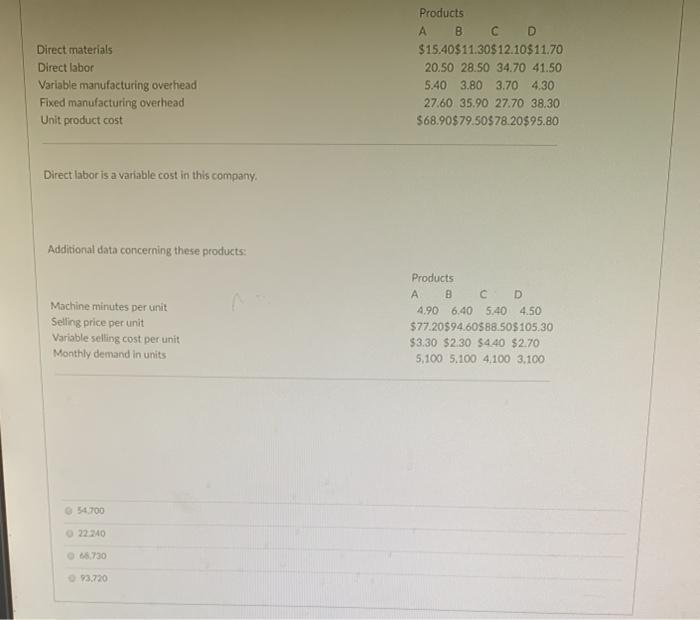

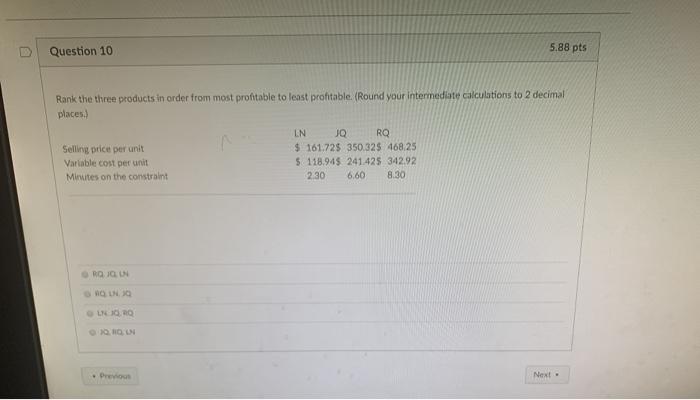

1 5.88 pts Two products emerge from a joint process. What would be the financial impact if a product is processed further and sold (instead

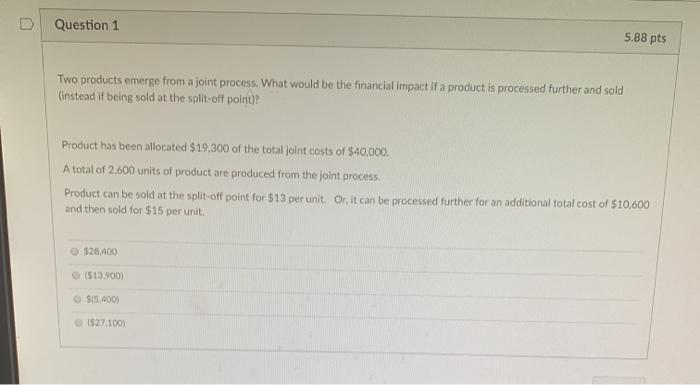

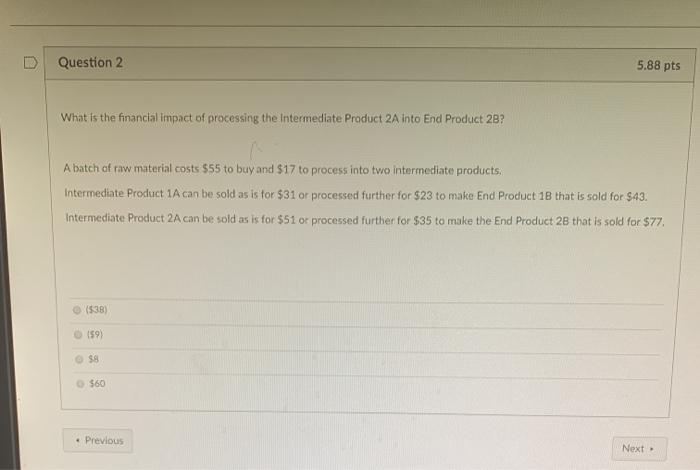

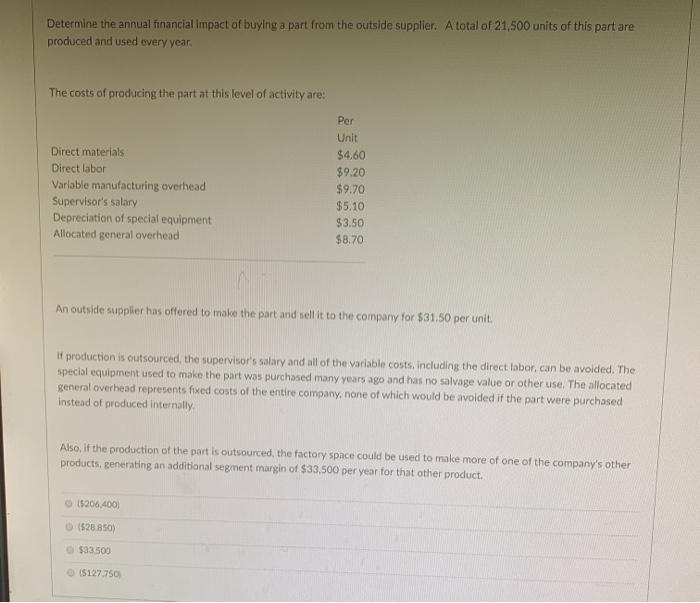

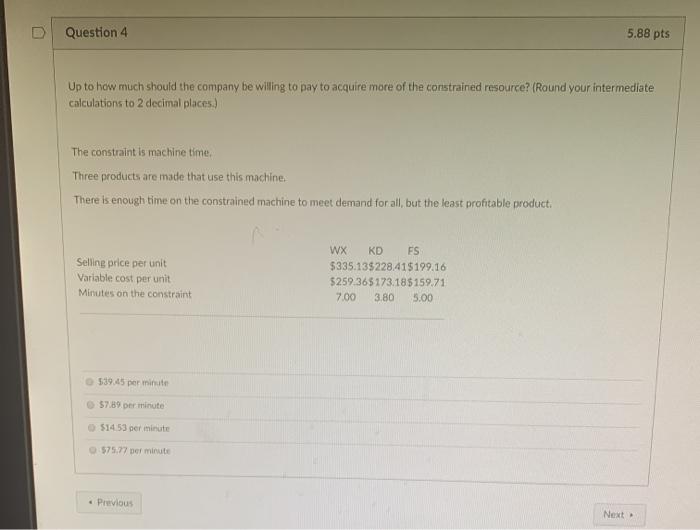

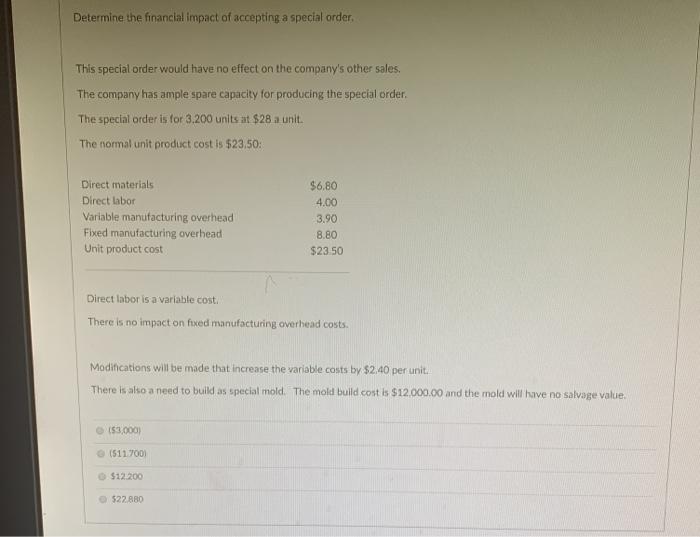

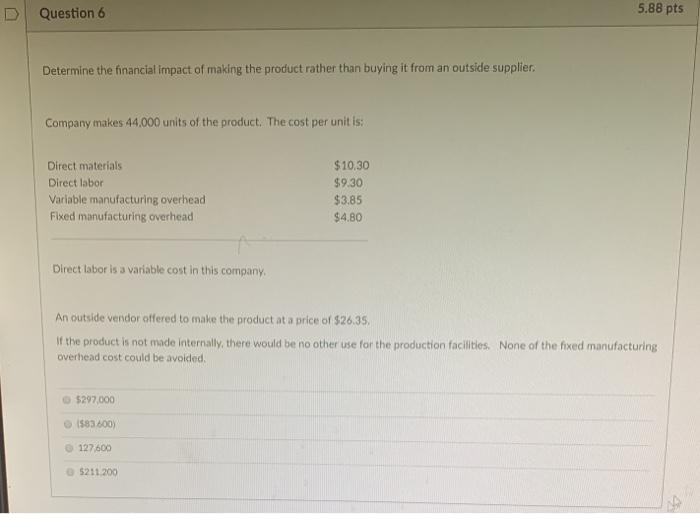

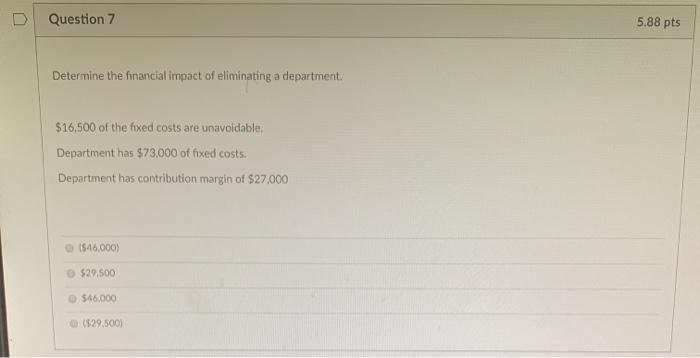

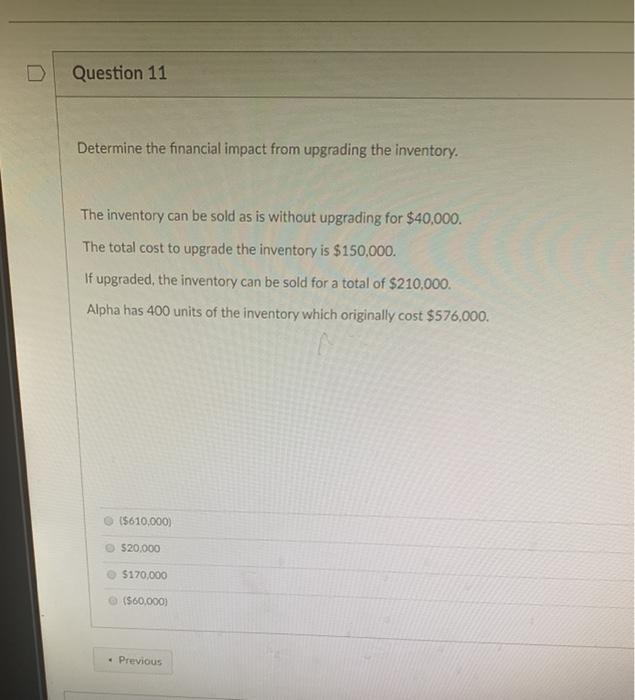

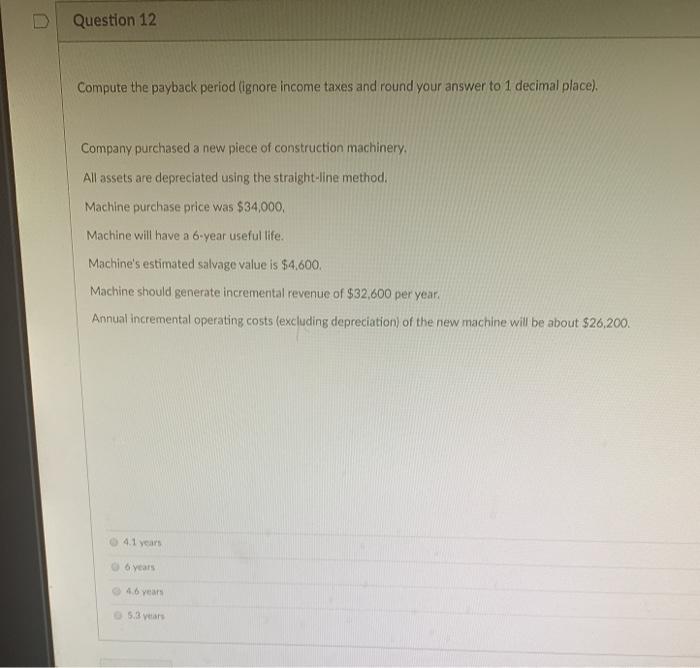

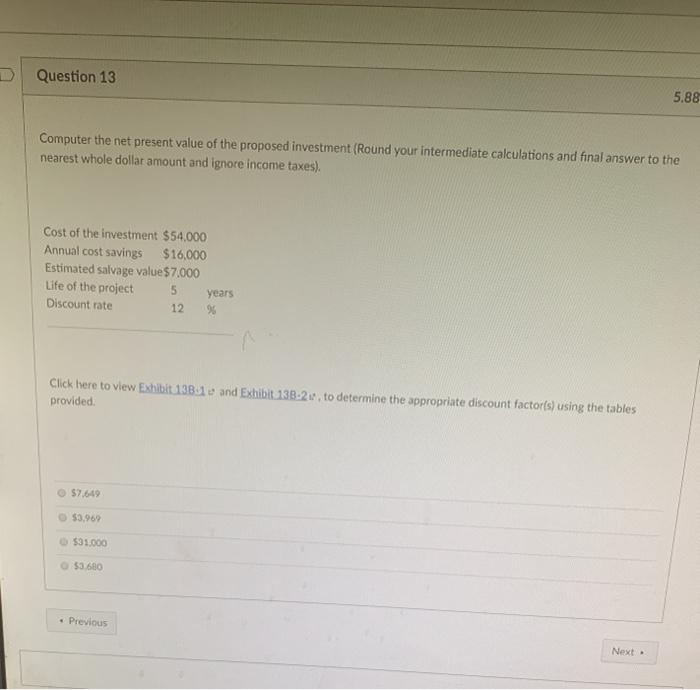

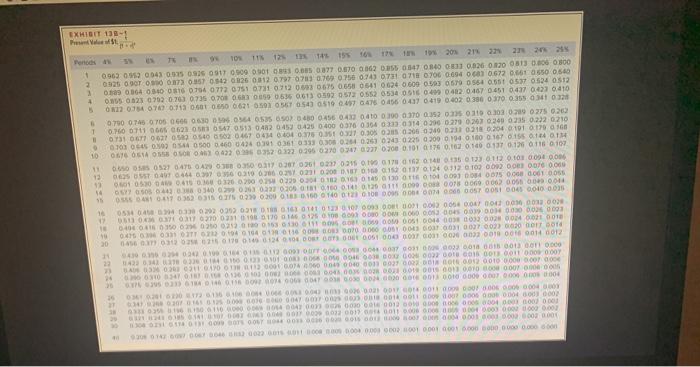

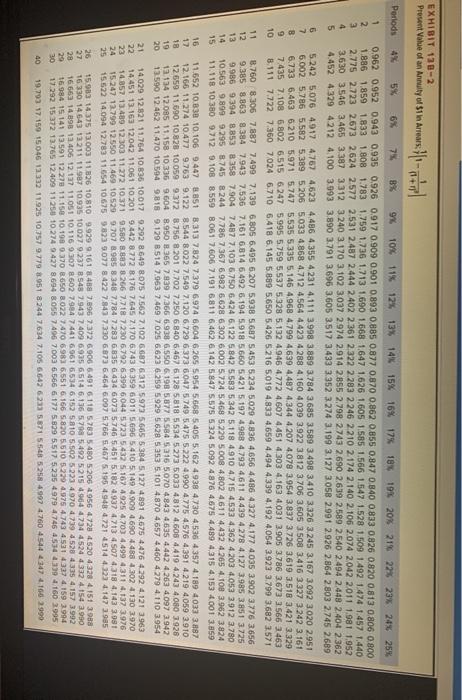

1 5.88 pts Two products emerge from a joint process. What would be the financial impact if a product is processed further and sold (instead if being sold at the split-off point)? Product has been allocated $19,300 of the total joint costs of $40,000. A total of 2,600 units of product are produced from the joint process. Product can be sold at the split-off point for $13 per unit. Or, it can be processed further for an additional total cost of $10,600 and then sold for $15 per unit. $28,400) ($13,900) $(5,400) ($27,100) Question 2 What is the financial impact of processing the Intermediate Product 2A into End Product 28? 5.88 pts A batch of raw material costs $55 to buy and $17 to process into two intermediate products. Intermediate Product 1A can be sold as is for $31 or processed further for $23 to make End Product 18 that is sold for $43. Intermediate Product 2A can be sold as is for $51 or processed further for $35 to make the End Product 28 that is sold for $77. ($38) (59) $8 $60 Previous Next Determine the annual financial impact of buying a part from the outside supplier. A total of 21,500 units of this part are produced and used every year. The costs of producing the part at this level of activity are: Per Unit Direct materials $4.60 Direct labor $9.20 Variable manufacturing overhead $9.70 Supervisor's salary $5.10 Depreciation of special equipment $3.50 Allocated general overhead $8.70 An outside supplier has offered to make the part and sell it to the company for $31.50 per unit. If production is outsourced, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. Also, if the production of the part is outsourced, the factory space could be used to make more of one of the company's other products, generating an additional segment margin of $33,500 per year for that other product. ($206,400) ($28.850) $33.500 ($127.750 Question 4 5.88 pts Up to how much should the company be willing to pay to acquire more of the constrained resource? (Round your intermediate calculations to 2 decimal places.) The constraint is machine time. Three products are made that use this machine. There is enough time on the constrained machine to meet demand for all, but the least profitable product. Selling price per unit Variable cost per unit Minutes on the constraint $39.45 per minute $7.89 per minute $14.53 per minute $75.77 per minute Previous WX KD FS $335.13$228.41$199.16 $259.36$173.18$159.71 7.00 3.80 5.00 Next Determine the financial impact of accepting a special order. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The special order is for 3.200 units at $28 a unit. The normal unit product cost is $23.50: Direct materials $6.80 Direct labor 4.00 Variable manufacturing overhead 3.90 Fixed manufacturing overhead 8.80 Unit product cost $23.50 Direct labor is a variable cost. There is no impact on fixed manufacturing overhead costs. Modifications will be made that increase the variable costs by $2.40 per unit. There is also a need to build as special mold. The mold build cost is $12,000.00 and the mold will have no salvage value. ($3,000) ($11.700) $12.200 $22.880 Question 6 Determine the financial impact of making the product rather than buying it from an outside supplier. Company makes 44,000 units of the product. The cost per unit is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead $10.30 $9.30 $3.85 $4.80 Direct labor is a variable cost in this company. An outside vendor offered to make the product at a price of $26.35. If the product is not made internally, there would be no other use for the production facilities. None of the fixed manufacturing overhead cost could be avoided. $297,000 ($83.600) 127,600 $211.200 5.88 pts 44 Question 7 Determine the financial impact of eliminating a department. $16,500 of the fixed costs are unavoidable, Department has $73,000 of fixed costs. Department has contribution margin of $27,000 ($46,000) $29.500 $46,000 ($29.500) 5.88 pts Question 8 Determine the financial impact, if product is discontinued. $73,000 of the $103,000 in fixed expenses are unavoidable. Unit selling price is $24. Unit variable expenses are $18. Company produces and sells 14.200 units. 1147,800) $47,800 $17.800 ($55.200) Previous Next 5.88 pts Determine the number of minutes of machine time needed to meet the monthly demand for all four products, where a company makes four products in a single facility. 54,700 minutes of machine time are available per month. Unit costs are: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost Direct labor is a variable cost in this company. Additional data concerning these products: Machine minutes per unit Selling price per unit Variable selling cost per unit Monthly demand in units 54.700 Products A B C D $15.40$11.30$12.10$11.70 20.50 28.50 34.70 41.50 5.40 3.80 3.70 4.30 27.60 35.90 27.70 38.30 $68.90$79.50$78.20$95.80 Products A B C D 4.90 6.40 5.40 4.50 $77.20$94.60$88.50$105.30 $3.30 $2.30 $4.40 $2.70 5,100 5,100 4,100 3,100 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost Direct labor is a variable cost in this company. Additional data concerning these products: Machine minutes per unit Selling price per unit Variable selling cost per unit Monthly demand in units 54,700 22.240 66.730 93.720 Products A B C D $15.40$11.30$12.10$11.70 20.50 28.50 34.70 41.50 5.40 3.80 3.70 4.30 27.60 35.90 27.70 38.30 $68.90$79.50$78.20$95.80 Products A B C D 4.90 6.40 5.40 4.50 $77.20$94.60$88.50$105.30 $3.30 $2.30 $4.40 $2.70 5,100 5,100 4,100 3,100 Question 10 5.88 pts Rank the three products in order from most profitable to least profitable. (Round your intermediate calculations to 2 decimal places.) Selling price per unit Variable cost per unit Minutes on the constraint LN JQ RQ $ 161.72$ 350.32$ 468.25 $ 118.945 241.425 342.92 8.30 2.30 6.60 RQ JQ IN ORQIN JQ LN JQ RO Previous Next Question 11 Determine the financial impact from upgrading the inventory. The inventory can be sold as is without upgrading for $40,000. The total cost to upgrade the inventory is $150,000. If upgraded, the inventory can be sold for a total of $210,000. Alpha has 400 units of the inventory which originally cost $576,000. ($610,000) $20,000 $170,000 ($60,000) Previous Question 12 Compute the payback period (ignore income taxes and round your answer to 1 decimal place). Company purchased a new piece of construction machinery. All assets are depreciated using the straight-line method. Machine purchase price was $34,000, Machine will have a 6-year useful life. Machine's estimated salvage value is $4,600. Machine should generate incremental revenue of $32,600 per year. Annual incremental operating costs (excluding depreciation) of the new machine will be about $26,200. 4.1 years 6 years 4.6 years 5.3 years Question 13 5.88 Computer the net present value of the proposed investment (Round your intermediate calculations and final answer to the nearest whole dollar amount and ignore income taxes). Cost of the investment $54,000 Annual cost savings $16,000 Estimated salvage value $7,000 Life of the project Discount rate 5 years 12 % Click here to view Exhibit 138-1 and Exhibit 138-2, to determine the appropriate discount factor(s) using the tables provided. $7,649 $3,969 $31.000 $3.680 Previous Next. EXHIBIT 138-1 Present Value of $1 Periods + B 10 " 12 12 14 15 16 17 18 55 7% es IN 98 10% 11% 12% 15% 16% 17% 12% 14% 1 19% 20% 21% 22% 27% 24% 25% 0962 0952 0043 0.935 0.925 0917 0909 0901 083 0.885 0877 0.870 0.062 0855 0847 0.840 0833 0826 0.820 0813 0.806 0.800 0925 0907 0.990 0873 0857 0842 0826 0812 0797 0783 0.769 0.756 0.743 0731 0718 0706 0694 0683 0.672 0.661 0650 0.540 0889 0.864 0040 0816 0794 0772 0751 0731 0712 0693 0675 0.658 0641 0624 0609 0.593 0579 0564 0.551 0537 0524 05121 0855 0823 0792 0.763 0735 0708 0683 0059 0.53 0.613 0592 0572 0552 0534 0516 0499 0482 0.467 0451 0437 0423 0.410 0822 0754 0767 0713 0601 0650 6621 0593 0567 0543 0519 0457 0476 0.456 0437 0419 0.402 0386 0370 0.355 0341 0328 0790 0745 0706 0666 0630 0596 0564 0535 0507 0480 0456 0432 0410 0.390 0.370 0352 0335 0319 0303 0289 0275 0.262 0.760 0711 0665 0623 0583 0547 0513 0482 0452 0425 0400 0.376 0.304 0332 0314 0296 0.279 0263 0.249 0235 0222 0210 0731 0677 0627 0582 0540 0502 0467 0434 0404 0.376 0.351 0.327 0.305 0285 0206 0240 0.233 0218 0.204 0191 0.179 0168 0703 0445 0.592 0544 0500 0.460 0424 0391 0361 0333 0.308 0.264 0.263 0243 0225 0200 0194 0.180 0.167 0.155 0.144 0.134 0676 0514 0558 050 0462 0422 036 0352 0322 0296 0270 0247 0227 0208 0.101 0176 0.162 0.140 0137 0.136 0116 0107 #2 R R R 25 0650 0585 0527 0475 0429 0388 0350 0317 0207 0261 0237 0215 0190 0178 0162 0148 0135 0123 0112 0.103.0094 0.006) 0625 0557 0497 0444 0397 0356 0319 0206 0.257 0231 0200 0187 0.16 0.152 0137 0124 0112 0102 0092 0083 0076 0.060 0601 0530 046 0415 0.368 0326 0200 0258 0229 0204 0182 0163 0145 0130 0116 0 104 0.093 0084 0075 0068 0061 0.055 0577 0508 0442 0388 0340 0299 0263 0222 0205 0181 0.160 0.141 0.120 0111 0099 0088 0078 0069 0062 0.055 0.09 0.044 0555 0481 0417 0362 0315 0275 0239 0209 0183 0.160 0140 0123 0.108 0.095 0.004 0.074 0.065 0.057 0051 0045 0040 0.035 0534 0458 0394 0330 0292 0252 0218 0.188 0.163 0141 0123 0107 0093 0.081 001 002 0054 0047 0042 0.036 0032 0028 0513 0436 0371 0317 0270 0231 0198 0170 0146 0125 0108 0093 0080 00 0000 0.053 0.045 0.039 0.034 0030 0026 0003 0494 0416 0350 0296 0250 0212 0180 0153 0130 0111 0095 008 069 0.050 0051 0044 0038 0032 0028 0024 0021 0018 0475 036 0331 0277 6212 0194 0164 0138 0116 009 0083 0070 0000 0051 0043 0037 0031 0027 0023 0020 0017 0014 20 0456 0377 0312 0258 0215 0170 0.149 0.124 0104 008 00S 0061 0051 0043 0037 0031 0026 0022 0019 0016 0014 0012 9439 0356 0254 0242 0.109 0164 0136 0112 0093 ourr 0064 003 0044 0037 0031 002 0022 0018 0015 0013 0011 0.000 22 422 0.342 0378 0336 0184 0150 0123 0301 0083 0068 0056 0046 0038 002 0028 0022 0010 0015 0013 0011 000 0007 " SADE 0326 026 0211 0470 013 112 0001 0.074 0.060 0045 0040 0033 0027 0022 0018 0015 0012 0010 000 0007 000 030 0310 0247 0.18 0.18 0.136 0 103 0082 nose 003 004 00% 0028 0023 0019 0015 0013 0010 000 0007 000 000s 0376 0295 0333 6184 0146 0116 0092 074 0069 0047 0038 0000 0024 0020 Gore 0013 0010 0000 0.007 0.000 000 0004 0361 0201 6230 172 0136 0106 004 0066 003 0042 033 0026 0021 0017 0014 0011 000 0007 0.006 0.006 0.004 0.009 0347 028 0207 0165 0125 0000 0076 060 0047 0037-0025 0005 0118 0014 0011 0009 000 0005 000 0004 6003 0002 0333 0356 0196 150 0110 0000 006 0054 0042 0023 06 0030 0018 0012 000 000 0006 0006 0004 0.003 0.002 0.002 63224630505410107 002 003 004 0017 0009 0022 0017 0014 0011 0006 000 000 0004 0003 0002 0.000 0.002 1308 0231 0114 0131 009 00rs 0067 044 00ss de 002 0015 0013 000 007 000 0004 0.003 0.003 0.002 0.002 0.001 9208 0142 607 0067 0046 2 0022 0015 0011 000 000 000 000 0002 0001 0001 0001 6000 0000 0000 0.000 0000 24 26 26 2 29 30 EXHIBIT 138-2 Present Value of an Annuity of $1 in Arrears; 6% 7% 8% 0.962 0.952 0.943 0.935 0.926 1.886 1.859 1.833 1.808 1.783 2.775 2.723 2.673 2.624 2.577 3.630 3.546 3.465 3.387 3.312 4.452 4.329 4.212 4.100 3.993 5.242 5.076 4.917 4.767 4.623 6.002 5.786 5.582 5.389 5.206 6.733 6.463 6.210 5.971 5.747 7.435 7.108 6.802 6.515 6.247 8.111 7.722 7.360 7.024 6.710 9% 10% 11% 12% 13% 14% 15% 16 % 17 % 18 % 19% 20% 21 % 22% 23% 24% 25% 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2011 1.981 1.952 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 Periods 4% 5% 1 2 3 4 5 6 7 B 9 10 11 12 13 14 15 16 17 18 19 20 11.652 10.838 10.106 9.447 12.166 11.274 10.477 9.763 9.122 12 659 11.690 10.828 10.059 9.372 13.134 12.085 11.158 10.336 9.604 13.590 12.462 11.470 10.594 9818 21 22 8.760 8.306 7.887 7.499 7.139 9.385 8.863 8.384 7.943 7.536 9.986 9.394 8.853 8358 7.904 10.563 9.899 9.295 8.745 8.244 11.118 10.380 9.712 9.108 8.559 8851 14.029 12.821 11.764 10.836 10.017 14.451 13.163 12.042 11.061 10.201 23 14.857 13.489 12.303 11.272 10.371 24 15.247 13.799 12.550 11.469 10.529 15.522 14.094 12.783 11.654 10.675 25 26 27 28 29 30 40 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3463 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 7.161 6.814 6.492 6.194 5.918 5660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4876 4.675 4.489 4.315 4.153 4.001 3.859 8.313 7.824 7.379 6.974 6,604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4536 4.357 4.189 4.033 3.887 8.544 8.022 7.549 7.120 6.729 6.373 6047 5.749 5475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910 8.756 8201 7.702 7.250 6.840 6.467 6.128 5.818 5534 5.273 5033 4.812 4.608 4.419 4.243 4.080 3.928 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5584 5316 5070 4843 4.635 4.442 4.263 4.097 3.942 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5929 5.628 5.353 5.101 4.870 4.657 4460 4.279 4.110 3.954 9.292 8.649 8.075 7.562 7.102 6687 6312 5.973 5.665 5.384 5,127 4891 4.675 4476 4.292 4.121 3.963 9.442 8.772 8.176 7.645 7.170 6.743 6.359 6011 5.696 5.410 5.149 4.909 4.690 4.488 4.302 4.130 3970 9.580 8.883 8.266 7.718 7.230 6.792 6.399 6,044 5723 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 9.707 8.985 8.348 7.784 7.283 6.835 6.434 6073 5746 5451 5.182 4.937 4.713 4.507 4.318 4.143 3.991 9823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4514 4.323 4.147 3.985 1 15.983 14.375 13.003 11.826 10.810 9929.9.161 8.488 7.896 7.372 6906 6.491 6118 5.783 5.480 5.206 4956 4.728 4.520 4.328 4.151 3.988 16 330 14 643 13211 11.987 10.935 10.027 9.237 8.548 7.943 7.409 6.935 6514 6.136 5.798 5.492 5215 4964 4,734 4524 4.332 4.154 3.990 16 663 14.898 13.406 12.137 11.051 10.116 9.307 8.602 7.984 7.441 6.961 6.534 6.152 5810 5.502 5.223 4.970 4739 4,528 4335 4.157 3.992 16.984 15 141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 7.470 6983 6551 6166 5.820 5.510 5.229 4.975 4.743 4.531 4337 4.159 3994 17.292 15372 13.765 12.409 11258 10 274 9427 8.694 8055 7.496 7.003 6.566 6.177 5.829 5.517 5235 4979 4.746 4.534 4.339 4.160 3995 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8951 8244 7.634 7.105 6642 6233 5871 5.548 5.258 4997 4760 4.544 4347 4.166 2.999

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started