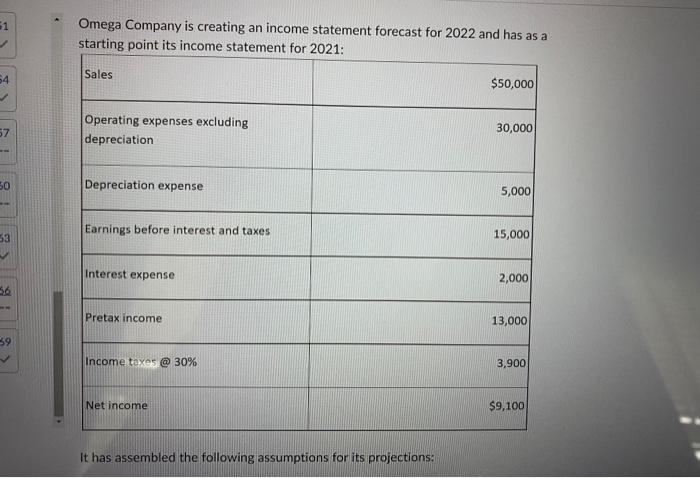

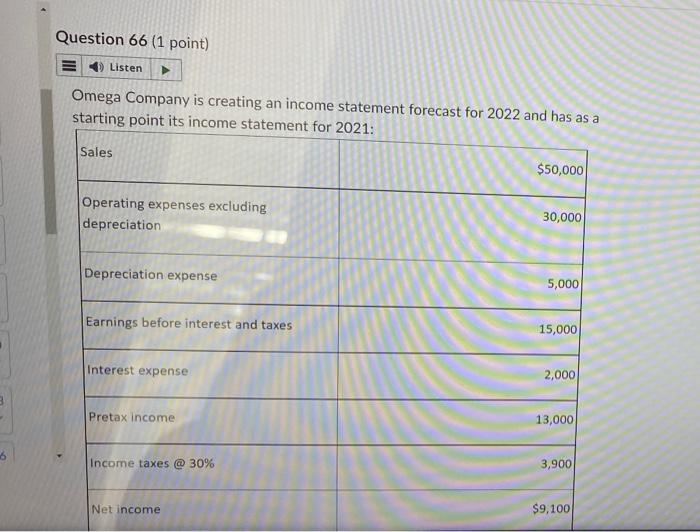

$1 64 57 50 53 5.6 ww 59 Omega Company is creating an income statement forecast for 2022 and has as a starting point its income statement for 2021: Sales Operating expenses excluding depreciation Depreciation expense Earnings before interest and taxes Interest expense Pretax income Income taxes @ 30% Net income It has assembled the following assumptions for its projections: $50,000 30,000 5,000 15,000 2,000 13,000 3,900 $9,100 Interest expense Pretax income Income taxes @ 30% Net income It has assembled the following assumptions for its projections: 2,000 13,000 3,900 $9,100 Question 66 (1 point) Listen Omega Company is creating an income statement forecast for 2022 and has as a starting point its income statement for 2021: Sales Operating expenses excluding depreciation Depreciation expense Earnings before interest and taxes Interest expense Pretax income Income taxes @ 30% Net income $50,000 30,000 5,000 15,000 2,000 13,000 3,900 $9,100 Pretax income Income taxes @ 30% Net income Attempt 1 It has assembled the following assumptions for its projections: 13,000 3,900 $9,100 $1 64 57 50 53 5.6 ww 59 Omega Company is creating an income statement forecast for 2022 and has as a starting point its income statement for 2021: Sales Operating expenses excluding depreciation Depreciation expense Earnings before interest and taxes Interest expense Pretax income Income taxes @ 30% Net income It has assembled the following assumptions for its projections: $50,000 30,000 5,000 15,000 2,000 13,000 3,900 $9,100 Interest expense Pretax income Income taxes @ 30% Net income It has assembled the following assumptions for its projections: 2,000 13,000 3,900 $9,100 Question 66 (1 point) Listen Omega Company is creating an income statement forecast for 2022 and has as a starting point its income statement for 2021: Sales Operating expenses excluding depreciation Depreciation expense Earnings before interest and taxes Interest expense Pretax income Income taxes @ 30% Net income $50,000 30,000 5,000 15,000 2,000 13,000 3,900 $9,100 Pretax income Income taxes @ 30% Net income Attempt 1 It has assembled the following assumptions for its projections: 13,000 3,900 $9,100