Answered step by step

Verified Expert Solution

Question

1 Approved Answer

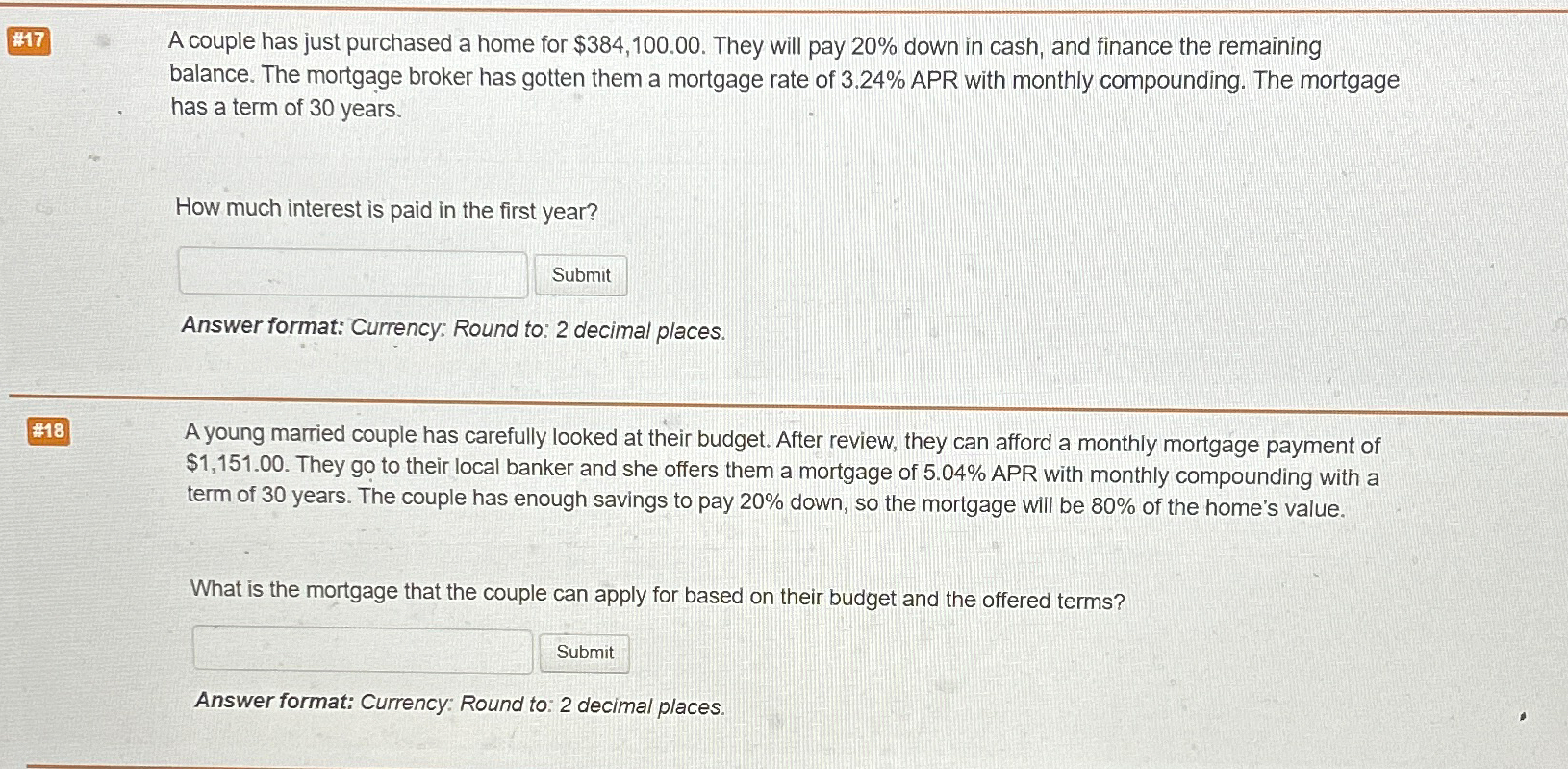

1 7 A couple has just purchased a home for $ 3 8 4 , 1 0 0 . 0 0 . They will pay

A couple has just purchased a home for $ They will pay down in cash, and finance the remaining balance. The mortgage broker has gotten them a mortgage rate of APR with monthly compounding. The mortgage has a term of years.

How much interest is paid in the first year?

Answer format: Currency: Round to: decimal places.

#

A young married couple has carefully looked at their budget. After review, they can afford a monthly mortgage payment of $ They go to their local banker and she offers them a mortgage of APR with monthly compounding with a term of years. The couple has enough savings to pay down, so the mortgage will be of the home's value.

What is the mortgage that the couple can apply for based on their budget and the offered terms?

Answer format: Currency: Round to: decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started