Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Big Corp is planning to fully acquire Small Corp. Big Corp currently has 10 million shares outstanding with a share price of $50 and

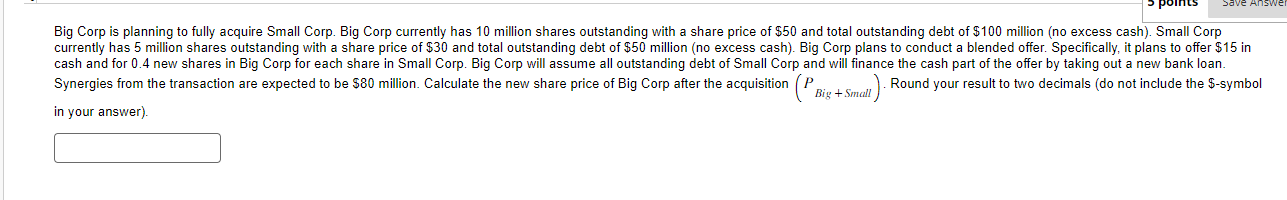

Big Corp is planning to fully acquire Small Corp. Big Corp currently has 10 million shares outstanding with a share price of $50 and total outstanding debt of $100 million (no excess cash). Small Corp currently has 5 million shares outstanding with a share price of $30 and total outstanding debt of $50 million (no excess cash). Big Corp plans to conduct a blended offer Specifically, it plans to offer SIS in cash and for 0.4 new shares in Big Corp for each share in Small Corp Big Corp will assume all outstanding debt of Small Corp and will finance the cash part of the offer by taking out a new bank loam Synergies from the transaction are expected to be S80 million. Calculate the new share price of Big Corp after the acquisition P Round your result to two decimals (do not include the S-symbol Big 4- Sm// in your answer).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started