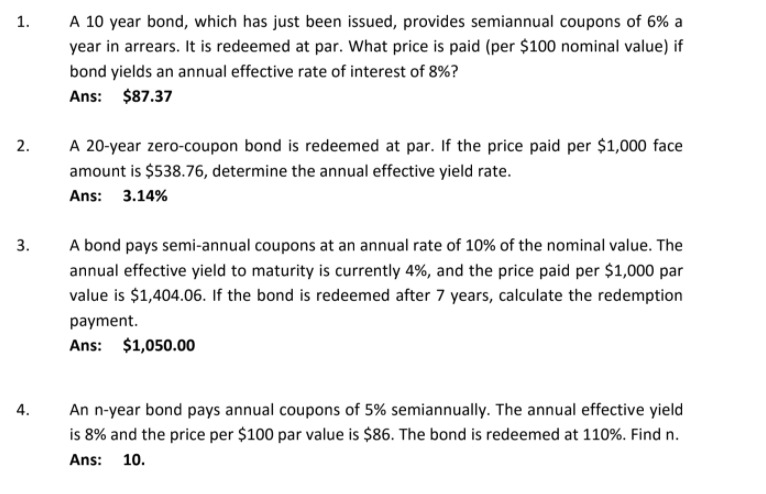

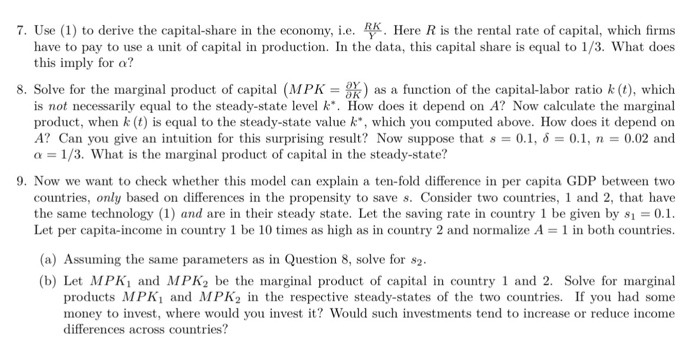

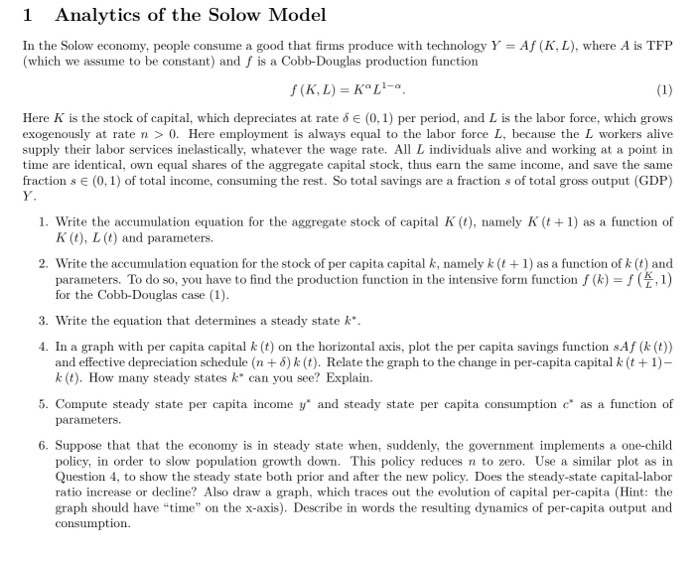

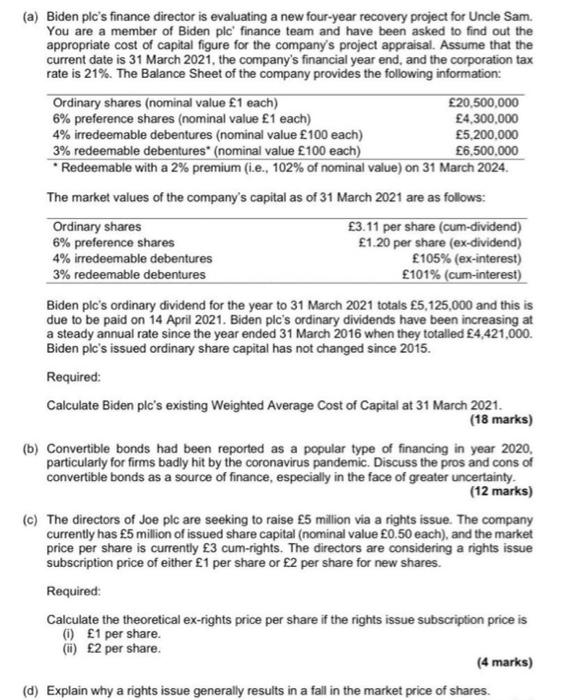

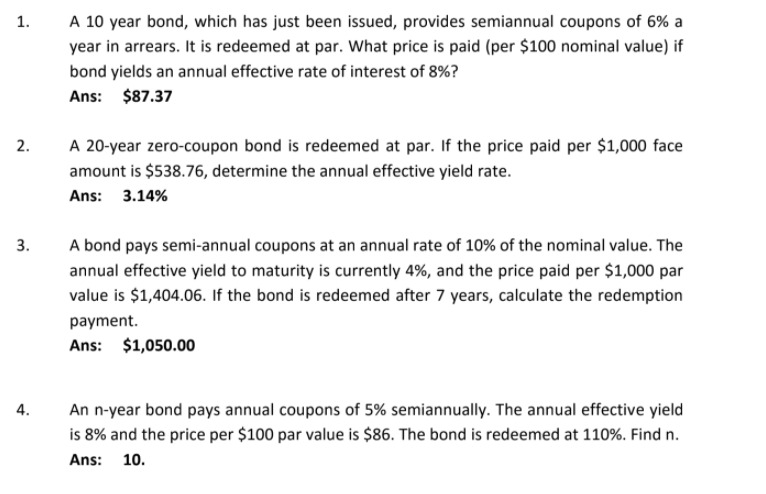

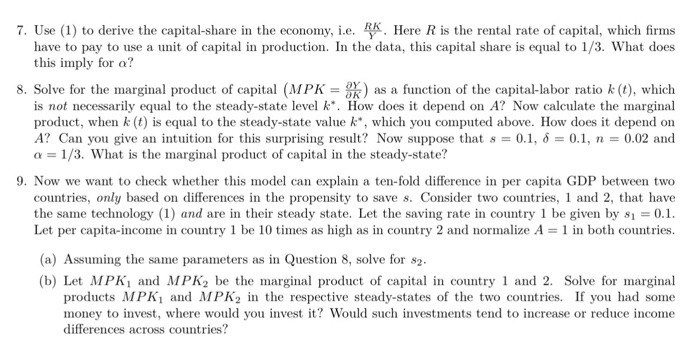

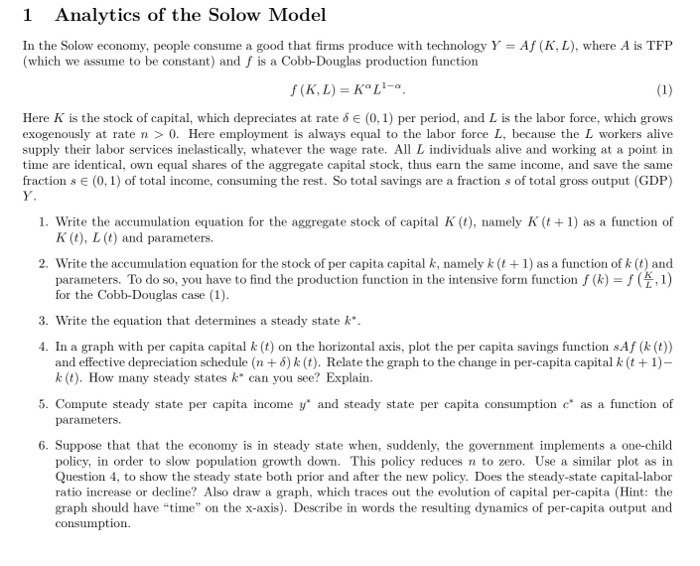

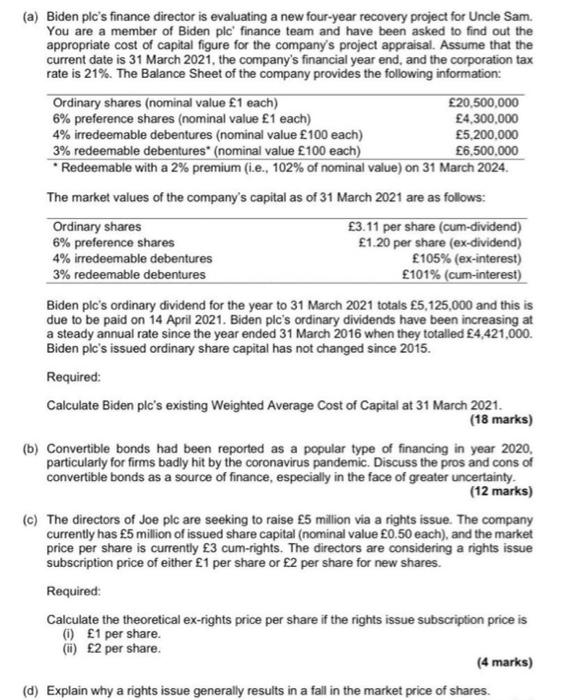

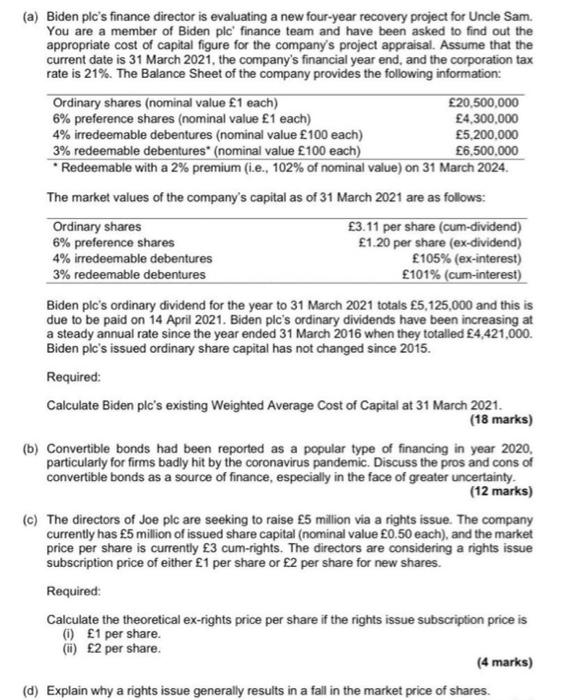

1. A 10 year bond, which has just been issued, provides semiannual coupons of 6% a year in arrears. It is redeemed at par. What price is paid (per $100 nominal value) if bond yields an annual effective rate of interest of 8%? Ans: $87.37 2. A 20-year zero-coupon bond is redeemed at par. If the price paid per $1,000 face amount is $538.76, determine the annual effective yield rate. Ans: 3.14% 3. A bond pays semi-annual coupons at an annual rate of 10% of the nominal value. The annual effective yield to maturity is currently 4%, and the price paid per $1,000 par value is $1,404.06. If the bond is redeemed after 7 years, calculate the redemption payment. Ans: $1,050.00 4. An n-year bond pays annual coupons of 5% semiannually. The annual effective yield is 8% and the price per $100 par value is $86. The bond is redeemed at 110%. Find n. Ans: 10.7. Use (1) to derive the capital-share in the economy, i.e. 44. Here R is the rental rate of capital, which firms have to pay to use a unit of capital in production. In the data, this capital share is equal to 1/3. What does this imply for o? 8. Solve for the marginal product of capital (MPK = ) ) as a function of the capital-labor ratio k (t), which is not necessarily equal to the steady-state level k*. How does it depend on A? Now calculate the marginal product, when k (t) is equal to the steady-state value k*, which you computed above. How does it depend on A? Can you give an intuition for this surprising result? Now suppose that s = 0.1, 6 = 0.1, n = 0.02 and o = 1/3. What is the marginal product of capital in the steady-state? 9. Now we want to check whether this model can explain a ten-fold difference in per capita GDP between two countries, only based on differences in the propensity to save s. Consider two countries, 1 and 2, that have the same technology (1) and are in their steady state. Let the saving rate in country 1 be given by $1 = 0.1. Let per capita-income in country 1 be 10 times as high as in country 2 and normalize A = 1 in both countries. (a) Assuming the same parameters as in Question 8, solve for $2. (b) Let MPK, and MPK2 be the marginal product of capital in country 1 and 2. Solve for marginal products MPK, and MPK2 in the respective steady-states of the two countries. If you had some money to invest, where would you invest it? Would such investments tend to increase or reduce income differences across countries?1 Analytics of the Solow Model In the Solow economy, people consume a good that firms produce with technology Y = Af (K, L), where A is TFP (which we assume to be constant) and f is a Cobb-Douglas production function f ( K, L) = KOL-a. (1) Here K is the stock of capital, which depreciates at rate o e (0, 1) per period, and L is the labor force, which grows exogenously at rate n > 0. Here employment is always equal to the labor force L, because the L workers alive supply their labor services inelastically, whatever the wage rate. All L individuals alive and working at a point in time are identical, own equal shares of the aggregate capital stock, thus earn the same income, and save the same fraction s E (0, 1) of total income, consuming the rest. So total savings are a fraction s of total gross output (GDP) Y. 1. Write the accumulation equation for the aggregate stock of capital K (), namely K (t + 1) as a function of K (t), L (t) and parameters. 2. Write the accumulation equation for the stock of per capita capital k, namely k (t + 1) as a function of k (t) and parameters. To do so, you have to find the production function in the intensive form function / (#) = f (7,1) for the Cobb-Douglas case (1). 3. Write the equation that determines a steady state &*. 4. In a graph with per capita capital & (t) on the horizontal axis, plot the per capita savings function sAf (k ()) and effective depreciation schedule (n + 6) k (). Relate the graph to the change in per-capita capital k (t + 1)- k (t). How many steady states k* can you see? Explain. 5. Compute steady state per capita income y" and steady state per capita consumption c* as a function of parameters. 6. Suppose that that the economy is in steady state when, suddenly, the government implements a one-child policy, in order to slow population growth down. This policy reduces n to zero. Use a similar plot as in Question 4, to show the steady state both prior and after the new policy. Does the steady-state capital-labor ratio increase or decline? Also draw a graph, which traces out the evolution of capital per-capita (Hint: the graph should have "time" on the x-axis). Describe in words the resulting dynamics of per-capita output and consumption.(a) Biden pic's finance director is evaluating a new four-year recovery project for Uncle Sam. You are a member of Biden pic' finance team and have been asked to find out the appropriate cost of capital figure for the company's project appraisal. Assume that the current date is 31 March 2021. the company's financial year end, and the corporation tax rate is 21%. The Balance Sheet of the company provides the following information: Ordinary shares (nominal value $1 each) E20,500,000 6% preference shares (nominal value $1 each) E4,300.000 4% irredeemable debentures (nominal value (100 each) $5,200,000 3% redeemable debentures" (nominal value [100 each) E6.500.000 *Redeemable with a 2% premium (i.e., 102% of nominal value) on 31 March 2024. The market values of the company's capital as of 31 March 2021 are as follows: Ordinary shares E3.11 per share (cum-dividend) 6% preference shares E1.20 per share (ex-dividend) 4% irredeemable debentures (105% (ex-interest) 3% redeemable debentures $101% (cum-interest) Biden pic's ordinary dividend for the year to 31 March 2021 totals $5,125,000 and this is due to be paid on 14 April 2021. Biden pic's ordinary dividends have been increasing at a steady annual rate since the year ended 31 March 2016 when they totalled $4,421,000. Biden pic's issued ordinary share capital has not changed since 2015. Required: Calculate Biden pic's existing Weighted Average Cost of Capital at 31 March 2021. (18 marks) (b) Convertible bonds had been reported as a popular type of financing in year 2020. particularly for firms badly hit by the coronavirus pandemic. Discuss the pros and cons of convertible bonds as a source of finance, especially in the face of greater uncertainty. (12 marks) (c) The directors of Joe pic are seeking to raise $5 million via a rights issue. The company currently has $5 million of issued share capital (nominal value $0.50 each), and the market price per share is currently $3 cum-rights. The directors are considering a rights issue subscription price of either $1 per share or $2 per share for new shares. Required: Calculate the theoretical ex-rights price per share if the rights issue subscription price is (i) 61 per share. (ii) E2 per share. (4 marks) (d) Explain why a rights issue generally results in a fall in the market price of shares