Answered step by step

Verified Expert Solution

Question

1 Approved Answer

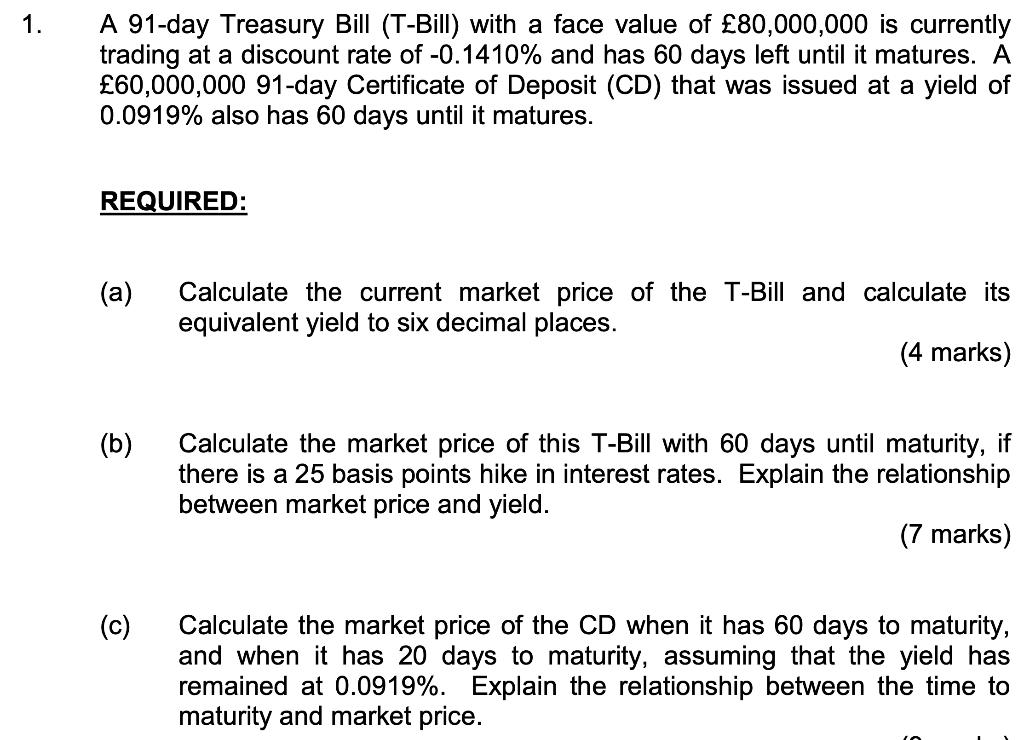

1. A 91-day Treasury Bill (T-Bill) with a face value of 80,000,000 is currently trading at a discount rate of -0.1410% and has 60

1. A 91-day Treasury Bill (T-Bill) with a face value of 80,000,000 is currently trading at a discount rate of -0.1410% and has 60 days left until it matures. A 60,000,000 91-day Certificate of Deposit (CD) that was issued at a yield of 0.0919% also has 60 days until it matures. REQUIRED: (a) (b) (c) Calculate the current market price of the T-Bill and calculate its equivalent yield to six decimal places. (4 marks) Calculate the market price of this T-Bill with 60 days until maturity, if there is a 25 basis points hike in interest rates. Explain the relationship between market price and yield. (7 marks) Calculate the market price of the CD when it has 60 days to maturity, and when it has 20 days to maturity, assuming that the yield has remained at 0.0919%. Explain the relationship between the time to maturity and market price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help with these calculations a To calculate the current market price of the TBill and its equivalent yield we can use the following formula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started