Answered step by step

Verified Expert Solution

Question

1 Approved Answer

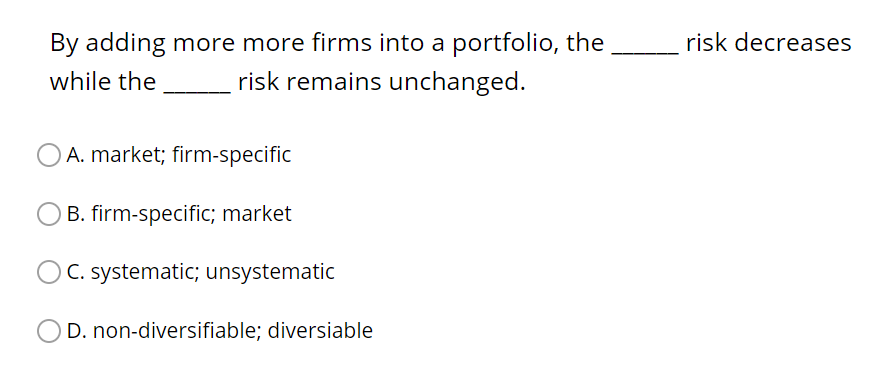

1. A: B: C. D. E. F. G. H. risk decreases By adding more more firms into a portfolio, the risk remains unchanged. while the

1.

A:

B:

C.

D.

E.

F.

G.

H.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started