Answered step by step

Verified Expert Solution

Question

1 Approved Answer

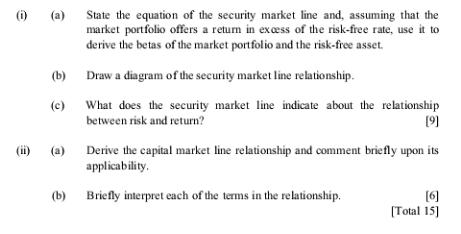

(1) (a) (b) (c) (ii) (a) State the equation of the security market line and, assuming that the market portfolio offers a return in

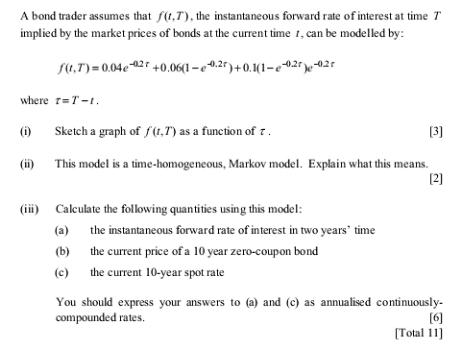

(1) (a) (b) (c) (ii) (a) State the equation of the security market line and, assuming that the market portfolio offers a return in excess of the risk-free rate, use it to derive the betas of the market portfolio and the risk-free asset. Draw a diagram of the security market line relationship. What does the security market line indicate about the relationship between risk and return? [9] Derive the capital market line relationship and comment briefly upon its applicability. (b) Briefly interpret each of the terms in the relationship. [6] [Total 15] A bond trader assumes that f(t.7), the instantaneous forward rate of interest at time T implied by the market prices of bonds at the current time 1, can be modelled by: f(1,7)=0.04-02 +0.06(1-2)+0.1(1-02-0.2 where r=T-1. (i) (ii) Sketch a graph of f(1.7) as a function of 7. This model is a time-homogeneous, Markov model. Explain what this means. [2] (iii) Calculate the following quantities using this model: (a) (b) (c) the current 10-year spot rate the instantaneous forward rate of interest in two years' time the current price of a 10 year zero-coupon bond m [3] You should express your answers to (a) and (c) as annualised continuously- compounded rates. [6] [Total 11]

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the solutions to the questions with workings 1 a The equation of the security market line is Ri Rf iRm Rf Where Ri is the expected return on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started