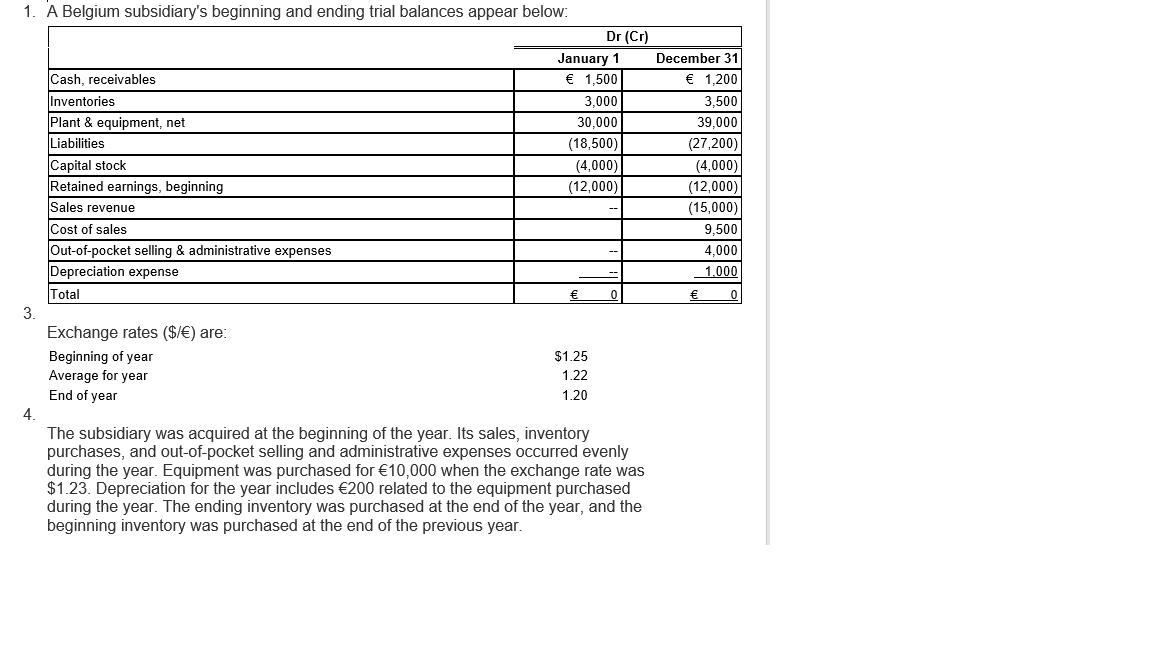

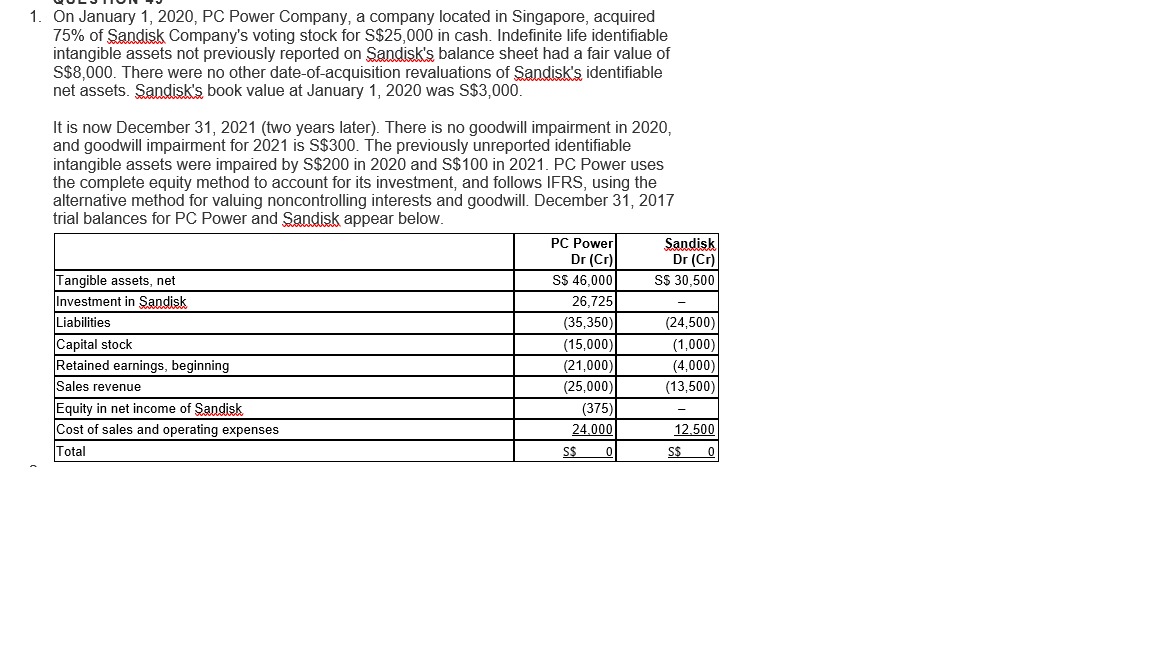

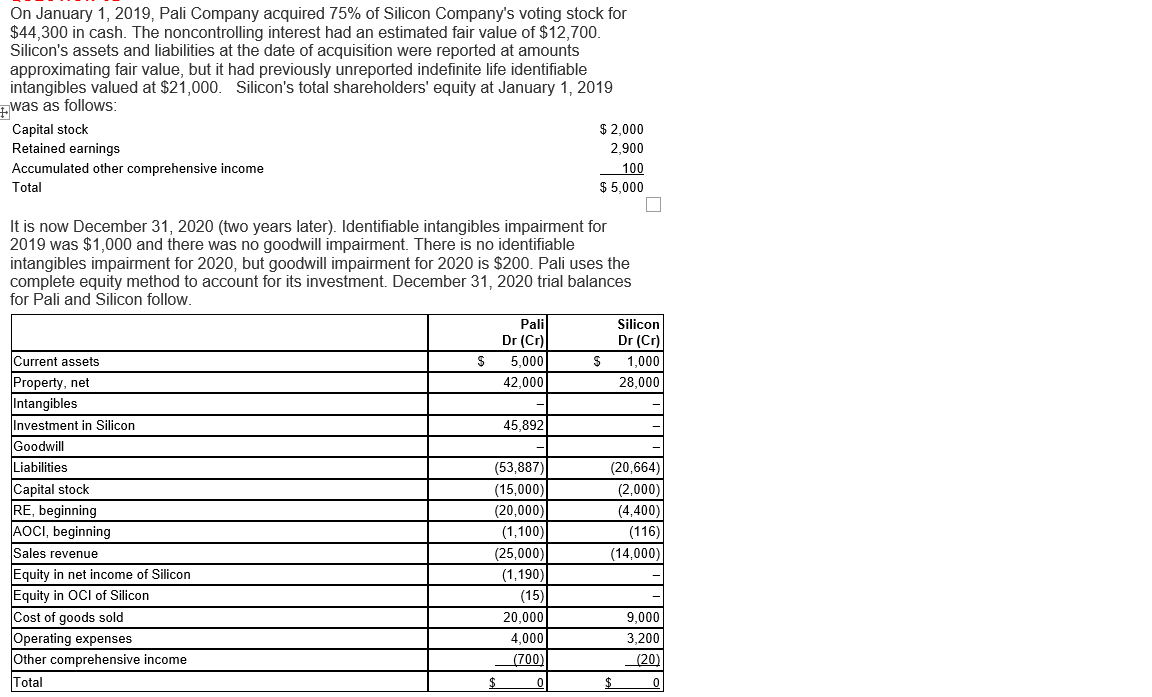

1. A Belgium subsidiary's beginning and ending trial balances appear below: Dr {Cr} January 1 December 31 Cash, receivables 1,200 Inventories 3,500 Plant & equipment, net 39,000 Liabilities (21200} Capital stock (4,000} Retained earnings, beginning (12000} Sales revenue _ (15000} Cost of sales 9,500 Outofpocket selling 8. administrative expenses _ 4,000 Depreciation expense 1 000 Total 0 0 3. Exchange rates ($t) are: Beginning of year $1.25 Average for year 1.22 End of year 1.20 4. The subsidiary was acquired at the beginning of the year. Its sales, inventory purchases, and outofpocket selling and administrative expenses occurred evenly during the year. Equipment was purchased for 10,000 when the exchange rate was $1.23. Depreciation for the year includes 200 related to the equipment purchased during the year. The ending inventory was purchased at the end of the year, and the beginning inventory was purchased at the end of the previous year. 1. On January 1, 2020, PC Power Company, a company located in Singapore, acquired 75% of Sandisk Company's voting stock for S$25,000 in cash. Indefinite life identifiable intangible assets not previously reported on Sandisk's balance sheet had a fair value of S$8,000. There were no other date-of-acquisition revaluations of Sandisk's identifiable net assets. Sandisk's book value at January 1, 2020 was S$3,000. It is now December 31, 2021 (two years later). There is no goodwill impairment in 2020, and goodwill impairment for 2021 is S$300. The previously unreported identifiable intangible assets were impaired by S$200 in 2020 and S$100 in 2021. PC Power uses the complete equity method to account for its investment, and follows IFRS, using the alternative method for valuing noncontrolling interests and goodwill. December 31, 2017 trial balances for PC Power and Sandisk appear below. PC Power Sandisk Dr (Cr) Dr (Cr) Tangible assets, net S$ 46,000 S$ 30,500 Investment in Sandisk 26,725 Liabilities (35,350) 24,500) Capital stock (15,000) 1,000) Retained earnings, beginning (21,000) (4,000) Sales revenue (25,000) (13,500) Equity in net income of Sandisk 375 Cost of sales and operating expenses 24.000 12.500 Total S$ 0 S$ 0On January 1, 2019, Pali Company acquired 75% of Silicon Company's voting stock for $44,300 in cash. The noncontrolling interest had an estimated fair value of $12,700. Silicon's assets and liabilities at the date of acquisition were reported at amounts approximating fair value, but it had previously unreported indenite life identiable intangibles valued at $21,000. Silicon's total shareholders' equity at January 1, 2010 was as follows: Capital stock Retained earnings I'i'l Accumulated other comprehensive income Total $ 2,000 2,900 100 $ 5,000 It is now December 31, 2020 (two years later). Identiable intangibles impairment for 2019 was $1 ,000 and there was no goodwill impairment. There is no identiable intangibles impairment for 2020, but goodwill impairment for 2020 is $200. Pali uses the complete equity method to account for its investment. December 31, 2020 trial balances for Pali and Silicon follow. Current assets Property, net Intangibles Investment in Silicon Goodwill Liabilities Capital stock RE, beginning AOCI, beginning Sales revenue Equity in net income of Silicon Equity in OCI of Silicon Cost of goods sold Operating expenses Other comprehensive income Total Pali 5 5,00 42,00 N 45,80 (53,08? (15,000 (20,000 (1,100 (25,000 (1,190 {15 20,00 \"4:. 9. D I: Q G G H H H H H H H G G u T00 I; Silicon Dr {Cr} 5 1,000 28,000 (20,664) (2,000) (4.400) (110) (14.000)