Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A bond matures in 5 years and pays a 4.25% coupon rate on a $1,000 par value. Assume the bond pays interest annually and

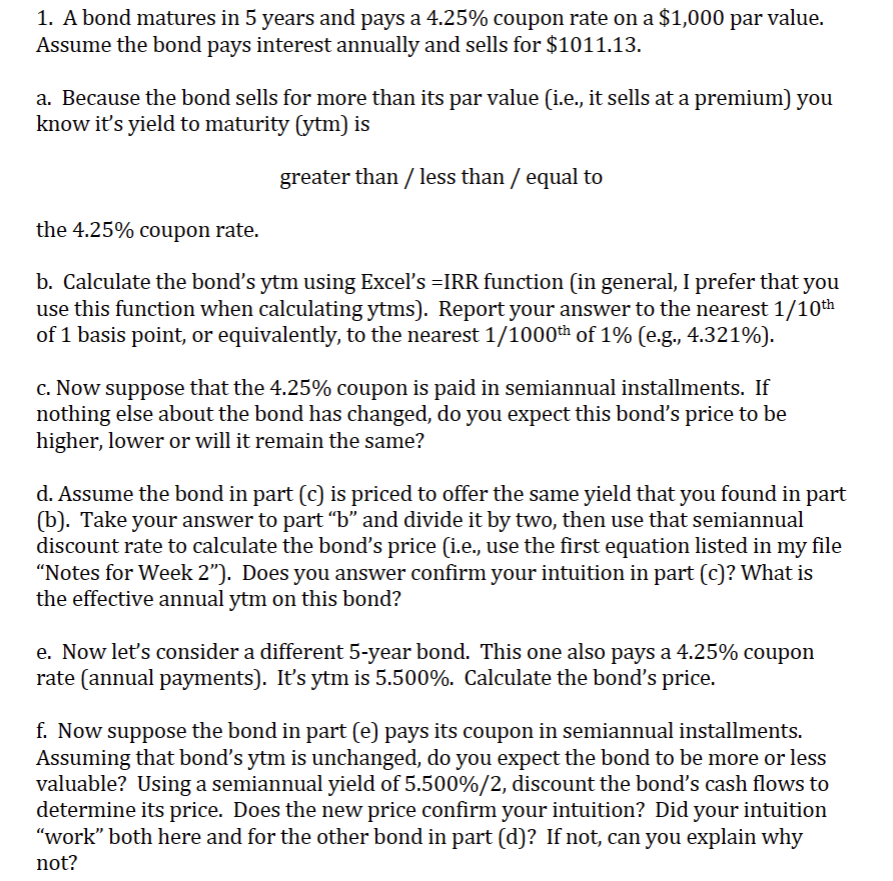

1. A bond matures in 5 years and pays a 4.25% coupon rate on a $1,000 par value. Assume the bond pays interest annually and sells for $1011.13. a. Because the bond sells for more than its par value (i.e., it sells at a premium) you know it's yield to maturity (ytm) is greater than / less than / equal to the 4.25% coupon rate. b. Calculate the bond's ytm using Excel's =IRR function (in general, I prefer that you use this function when calculating ytms). Report your answer to the nearest 1/10th of 1 basis point, or equivalently, to the nearest 1/1000th of 1% (e.g., 4.321%). c. Now suppose that the 4.25% coupon is paid in semiannual installments. If nothing else about the bond has changed, do you expect this bond's price to be higher, lower or will it remain the same? d. Assume the bond in part (c) is priced to offer the same yield that you found in part (b). Take your answer to part "b" and divide it by two, then use that semiannual discount rate to calculate the bond's price (i.e., use the first equation listed in my file "Notes for Week 2"). Does you answer confirm your intuition in part (c)? What is the effective annual ytm on this bond? e. Now let's consider a different 5-year bond. This one also pays a 4.25\% coupon rate (annual payments). It's ytm is 5.500%. Calculate the bond's price. f. Now suppose the bond in part (e) pays its coupon in semiannual installments. Assuming that bond's ytm is unchanged, do you expect the bond to be more or less valuable? Using a semiannual yield of 5.500%/2, discount the bond's cash flows to determine its price. Does the new price confirm your intuition? Did your intuition "work" both here and for the other bond in part (d)? If not, can you explain why not

1. A bond matures in 5 years and pays a 4.25% coupon rate on a $1,000 par value. Assume the bond pays interest annually and sells for $1011.13. a. Because the bond sells for more than its par value (i.e., it sells at a premium) you know it's yield to maturity (ytm) is greater than / less than / equal to the 4.25% coupon rate. b. Calculate the bond's ytm using Excel's =IRR function (in general, I prefer that you use this function when calculating ytms). Report your answer to the nearest 1/10th of 1 basis point, or equivalently, to the nearest 1/1000th of 1% (e.g., 4.321%). c. Now suppose that the 4.25% coupon is paid in semiannual installments. If nothing else about the bond has changed, do you expect this bond's price to be higher, lower or will it remain the same? d. Assume the bond in part (c) is priced to offer the same yield that you found in part (b). Take your answer to part "b" and divide it by two, then use that semiannual discount rate to calculate the bond's price (i.e., use the first equation listed in my file "Notes for Week 2"). Does you answer confirm your intuition in part (c)? What is the effective annual ytm on this bond? e. Now let's consider a different 5-year bond. This one also pays a 4.25\% coupon rate (annual payments). It's ytm is 5.500%. Calculate the bond's price. f. Now suppose the bond in part (e) pays its coupon in semiannual installments. Assuming that bond's ytm is unchanged, do you expect the bond to be more or less valuable? Using a semiannual yield of 5.500%/2, discount the bond's cash flows to determine its price. Does the new price confirm your intuition? Did your intuition "work" both here and for the other bond in part (d)? If not, can you explain why not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started